XRP Binance Inflows Spike: What It Means For Price

22 November 2024 - 1:00AM

NEWSBTC

On-chain data shows the XRP Binance Netflow has spiked to positive

levels recently. Here’s what this could mean for the asset’s price.

XRP Investors Have Been Depositing To Binance Recently As explained

by an analyst in a CryptoQuant Quicktake post, a large amount of

XRP deposit transactions have headed to Binance recently. The

on-chain metric of relevance here is the “Exchange Netflow,” which

keeps track of the net transfers going in or out of a given

centralized exchange. The traditional form of this metric measures

the difference between the inflow and outflow volume for the

platform, but in the context of the current topic, a different

version of the indicator is of interest: one that counts the net

number of deposit/withdrawal transactions. When the value of the

metric is positive, it means there are more inflow transfers

happening for the exchange than outflow ones. As one of the main

reasons why investors deposit to these platforms is for

selling-related purposes, this kind of trend can be bearish for

XRP. Related Reading: Cardano Outperforms Market With 50% Surge:

Here’s Why On the other hand, the indicator being negative implies

withdrawals are dominant on the exchange. Such a trend can be a

sign that holders are interested in HODLing into the long

term, which can naturally have bullish effects on the price. Now,

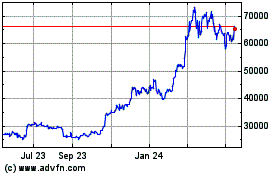

here is a chart that shows the trend in the 30-day moving average

(MA) of the XRP Exchange Netflow for Binance over the last couple

of years: As is visible in the above graph, the XRP Exchange

Netflow for Binance has mostly stayed inside the positive territory

during the last two years, which suggests investors have constantly

been making withdrawal transactions. Recently, however, the metric

appears to have diverged from the norm, as its value has registered

a sharp positive spike. The asset has seen a sharp rally of over

54% in the past week, so it’s possible that the traders making the

deposits are looking to sell and realize their profits. Now, the

main question is, is this selling a potential threat to XRP’s

value? The indicator is sitting at 470 right now, which suggests

significantly more inflows than outflows. Considering that this is

also just the 30-day MA, the peak value is bound to be even higher.

Related Reading: Bitcoin Is About To See A Historically-Profitable

Crossover In This Metric While this high number of inflow

transactions may look like a danger at first glance, it may

actually not be so, since it corresponds to activity that’s mostly

from the retail investors. Whales don’t tend to leave behind too

many transactions, as they prefer to move large amounts with a

single transaction. Thus, whenever this version of the Exchange

Netflow spikes, it’s a sign that the small holders are depositing.

Naturally, there could still be a few whale transfers among these

inflows, which can indeed end up having a negative effect on the

XRP price. It only remains to be seen, though, which of the

scenarios holds true. XRP Price XRP has pulled ahead of the rest of

the market with a sharp rally during the past week, which has taken

its price to $1.09. Featured image from Dall-E, CryptoQuant.com,

chart from TradingView.com

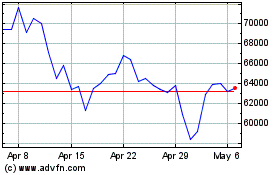

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024