Is The Bitcoin Top In For This Cycle? On-Chain Signals You Need To Know

21 December 2024 - 1:00AM

NEWSBTC

Bitcoin’s price retracement from its new all-time high of $108,353

on Tuesday to around $96,000 (a -11.5% pullback) has ignited

intense speculation about whether the current bull cycle is nearing

its peak. To address growing uncertainty, Rafael Schultze-Kraft,

co-founder of on-chain analytics provider Glassnode, released a

thread on X detailing 18 on-chain metrics and models. “Where is the

Bitcoin TOP?” Schultze-Kraft asked, before laying out his detailed

analysis. Has Bitcoin Reached Its Cycle Top? 1/ MVRV Ratio: A

longstanding measure of unrealized profitability, the MVRV ratio

compares market value to realized value. Historically, readings

above 7 signaled overheated conditions. “Currently hovering around

3 – room to grow,” Schultze-Kraft noted. This suggests that, in

terms of aggregate unrealized profit, the market is not yet at

levels that have previously coincided with macro tops. 2/ MVRV

Pricing Bands: These bands are derived from the number of days MVRV

has spent at extreme levels. The top band (3.2) has been exceeded

for only about 6% of trading days historically. Today, this top

band corresponds to a price of $127,000. Given that Bitcoin sits at

around $98,000, the market has not yet reached a zone that

historically marked top formations. 3/ Long-Term Holder

Profitability (Relative Unrealized Profit & LTH-NUPL):

Long-term holders (LTHs) are considered more stable market

participants. Their Net Unrealized Profit/Loss (NUPL) metric is

currently at 0.75, entering what Schultze-Kraft terms the “euphoria

zone.” He remarked that in the 2021 cycle, Bitcoin ran another ~3x

after hitting similar levels (though he clarified he is not

necessarily expecting a repetition). Historical top formations

often saw LTH-NUPL readings above 0.9. Thus, while the metric is

elevated, it has not yet reached previous cycle extremes. Notably,

Schultze-Kraft admitted his observations may be conservative

because the 2021 cycle peaked at somewhat lower profitability

values than prior cycles. “I would’ve expected these profitability

metrics to reach slightly higher levels,” he explained. This may

signal diminishing peaks over successive cycles. Investors should

be aware that historical extremes may become less pronounced over

time. 4/ Yearly Realized Profit/Loss Ratio: This metric measures

the total realized profits relative to realized losses over the

past year. Previous cycle tops have seen values above 700%.

Currently at around 580%, it still shows “room to grow” before

reaching levels historically associated with market tops. Related

Reading: Bitcoin Crashes: Here’s Where The Nearest On-Chain Support

Is 5/ Market Cap To Thermocap Ratio: An early on-chain metric, it

compares Bitcoin’s total market capitalization to the cumulative

mining cost (Thermocap). In prior bull runs, the ratio’s extremes

aligned with market tops. Schultze-Kraft advises caution with

specific target ranges but notes that current levels are not close

to previous extremes. The market remains below historical thermocap

multiples that indicated overheated conditions in the past. 6/

Thermocap Multiples (32-64x): Historically, Bitcoin has topped at

roughly 32-64 times the Thermocap. “We’re at the bottom of this

range,” said Schultze-Kraft. Hitting the top band in today’s

environment would imply a Bitcoin market cap just above $4

trillion. Given that current market capitalization ($1.924

trillion) is significantly lower, this suggests the possibility of

substantial upside if historical patterns were to hold. 7/ The

Investor Tool (2-Year SMA x5): The Investor Tool applies a 2-year

Simple Moving Average (SMA) of price and a 5x multiple of that SMA

to signal potential top zones. “Which currently denotes $230,000,”

Schultze-Kraft noted. Since Bitcoin’s current price is well beneath

this level, the indicator has not yet flashed an unequivocal top

signal. 8/ Bitcoin Price Temperature (BPT6): This model uses

deviations from a 4-year moving average to capture cyclical price

extremes. Historically, BPT6 was reached in previous bull markets,

and that band now sits at $151,000. With Bitcoin at $98,000, the

market is still short of levels previously associated with peak

overheating. 9/ The True Market Mean & AVIV: The True Market

Mean is an alternative cost basis model. Its MVRV-equivalent, known

as AVIV, measures how far the market strays from this mean.

Historically, tops have seen more than 3 standard deviations.

Today’s equivalent “amounts to values above ~2.3,” while the

current reading is 1.7. “Room to grow,” Schultze-Kraft said,

implying that by this metric, the market is not yet stretched to

its historical extremes. Related Reading: US Strategic Bitcoin

Reserve Could Push Price To $500,000: Expert 10/ Low/Mid/Top Cap

Models (Delta Cap Derivatives): These models, based on the Delta

Cap metric, historically showed diminished values during the 2021

cycle, never reaching the ‘Top Cap.’ Schultze-Kraft urges caution

in interpreting these due to evolving market structures. Currently,

the mid cap level sits at about $4 trillion, roughly a 2x from

current levels. If the market followed previous patterns, this

would allow for considerable growth before hitting levels

characteristic of earlier tops. 11/ Value Days Destroyed Multiple

(VDDM): This metric gauges the spending behavior of long-held coins

relative to the annual average. Historically, extreme values above

2.9 indicated that older coins were heavily hitting the market,

often during late-stage bull markets. Presently, it’s at 2.2, not

yet at extreme levels. “Room to grow,” Schultze-Kraft noted,

suggesting not all long-term holders have fully capitulated to

profit-taking. 12/ The Mayer Multiple: The Mayer Multiple compares

price to the 200-day SMA. Overbought conditions in previous cycles

aligned with values above 2.4. Currently, a Mayer Multiple above

2.4 would correspond to a price of approximately $167,000. With

Bitcoin under $100,000, this threshold remains distant. 13/ The

Cycle Extremes Oscillator Chart: This composite uses multiple

binary indicators (MVRV, aSOPR, Puell Multiple, Reserve Risk) to

signal cycle extremes. “Currently 2/4 are on,” meaning only half of

the tracked conditions for an overheated market are met. Previous

tops aligned with a full suite of triggered signals. As such, the

chart suggests the cycle has not yet reached the intensity of a

full-blown peak. 14/ Pi Cycle Top Indicator: A price-based signal

that has historically identified cycle peaks by comparing the

short-term and long-term moving averages. “Currently the short

moving average sits well below the larger ($74k vs. $129k),”

Schultze-Kraft said, indicating no crossover and thus no classic

top signal. 15/ Sell-Side Risk Ratio (LTH Version): This ratio

compares total realized profits and losses to the realized market

capitalization. High values correlate with volatile, late-stage

bull markets. “The interesting zone is at 0.8% and above, while

we’re currently at 0.46% – room to grow,” Schultze-Kraft explained.

This implies that, despite recent profit-taking, the market has not

yet entered the intense sell pressure zone often seen near tops.

16/ LTH Inflation Rate: Schultze-Kraft highlighted the Long-Term

Holder Inflation Rate as “the most bearish chart I’ve come across

so far.” While he did not provide specific target values or

thresholds in this excerpt, he stated it “screams caution.”

Investors should monitor this closely as it may signal increasing

distribution from long-term holders or other structural headwinds.

17/ STH-SOPR (Short-Term Holder Spent Output Profit Ratio): This

metric measures the profit-taking behavior of short-term holders.

“Currently elevated, but not sustained,” Schultze-Kraft noted. In

other words, while short-term participants are taking profits, the

data does not yet show the kind of persistent, aggressive

profit-taking typical of a market top. 18/ SLRV Ribbons: These

ribbons track trends in short- and long-term realized value.

Historically, when both moving averages top out and cross over, it

indicates a market turning point. “Both moving averages still

trending up, only becomes bearish at rounded tops and crossover. No

indication of a top at this time,” Schultze-Kraft stated. Overall,

Schultze-Kraft emphasized that these metrics should not be used in

isolation. “Never rely on single data points – confluence is your

friend,” he advised. He acknowledged that this is a

non-comprehensive list and that Bitcoin’s evolving ecosystem—now

with ETFs, regulatory clarity, institutional adoption, and

geopolitical factors—may render historical comparisons less

reliable. “This cycle can look vastly different, yet (historical)

data is all we have,” he concluded. While numerous metrics show

that Bitcoin’s market is moving into more euphoric and profitable

territory, few have reached the historical extremes that marked

previous cycle tops. Indicators like MVRV, profitability ratios,

thermal metrics, and various price-based models generally suggest

“room to grow,” although at least one—LTH Inflation Rate—raises a

note of caution. Some composites are only partially triggered,

while classic top signals such as Pi Cycle Top remain inactive. At

press time, BTC traded at $96,037. Featured image created with

DALL.E, chart from TradingView.com

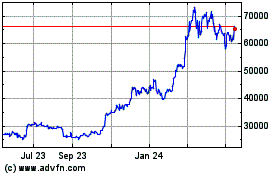

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

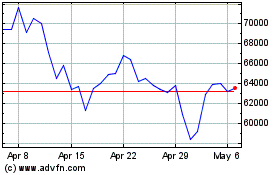

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024