Bitcoin Price Holds Above $96,000 — Analyst Explains This Level’s Significance

10 February 2025 - 12:00AM

NEWSBTC

The Bitcoin price appears to have settled within the $92,000 –

$102,000 consolidation range, sparking discussions about the coin’s

future trajectory. While it remains unclear whether the premier

cryptocurrency has enough momentum to forge new all-time highs

soon, it would take significant bearish pressure to pull down the

BTC price. Nevertheless, the latest on-chain data shows a specific

level that could be crucial to the Bitcoin price in the short term.

Here’s How $96,000 Could Be Critical To BTC Price In a Quicktake

post on the CryptoQuant platform, an analyst with the pseudonym

ShayanBTC explained how the realized price of a certain investor

class could influence the Bitcoin price trajectory in the

short-to-mid term. This analysis revolves around the Realized Price

of Unspent Transaction Output (UTXO) age bands, which evaluate the

holding pattern of different investor cohorts through different

realized prices. The UTXO age bands metric measures the

average price at which Bitcoin holders purchased their coins

compared to how long they’ve held the assets. The relevant age band

in ShayanBTC’s analysis is the 1-month to 3-month group, which

offers insight into “short-term holders’ behavior and overall

market sentiment.” Related Reading: Dogecoin Whales Desert Market:

Number Of $100,000 Transactions Nosedives 70% According to the

Quicktake analyst, the realized price of Bitcoin holders in this

short-term investor cohort has historically served as critical

support levels. Historically, the Bitcoin price has often found a

cushion above this realized price, suggesting that investors are

doubling down on their positions. Recent data from CryptoQuant

shows that the Bitcoin price is currently holding above the

realized price of the 1-3 month cohort. As of this writing, this

UTXO age band’s average purchase price is around the $96,000 mark.

ShayanBTC highlighted the importance of the Bitcoin price holding

above $96,000 in maintaining the current bullish narrative.

“Holding above this key level reinforces a bullish market

sentiment, increasing the likelihood of an extended upward trend,”

the Quicktake analyst noted. On the flip side, a breach beneath the

crucial $96,000 support could trigger a shift in investor sentiment

from confidence to fear. Ultimately, the failure of this crucial

level could force some investors to distribute their coins,

threatening the upward trajectory of the BTC price. Bitcoin Price

Stays Above $96k As of this writing, Bitcoin is valued at around

$96,500, reflecting no significant move in the past 24 hours. After

starting the week above $100,000, the flagship cryptocurrency

quickly fell toward $92,000 due to bearish pressure triggered by

new US trade policies. According to CoinGecko data, the price of

BTC is down by nearly 4% in the past week. Related Reading: 49,700

Dormant Bitcoin Just Moved—What’s Next For BTC’s Price? Featured

image from iStock, chart from TradingView

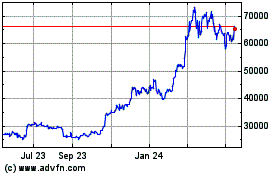

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

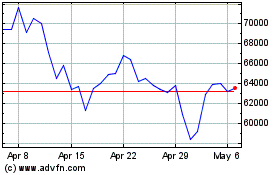

Bitcoin (COIN:BTCUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025