QCP Capital Forecasts ETH’s Dominance Over Bitcoin To Persist, Ethereum ETFs In Focus

18 January 2024 - 5:00AM

NEWSBTC

Over the past 30 days, Ethereum (ETH), the second-largest

cryptocurrency, has experienced a notable surge of 17%,

outperforming Bitcoin (BTC), which has recorded a surge of 2.5%

over the same period. This comes as the initial excitement

surrounding the approval of the exchange-traded funds (ETFs) by the

US Securities and Exchange Commission (SEC) appears to have waned,

with BTC witnessing a 5% drop in the past seven days.

Interestingly, according to crypto trading firm QCP Capital,

following the approval of Bitcoin ETFs, the focus has shifted to

the potential launch of an ETH spot ETF, which could be one of the

factors for Ethereum outperforming BTC. Ethereum Gains

Ground Against BTC According to QCP Capital, the total

volumes transacted across all 11 ETFs in the past week have reached

$9.8 billion. The Grayscale Bitcoin Trust (GBTC) alone accounted

for $4.6 billion. Since converting from a Trust to an ETF,

GBTC has experienced outflows of $1.17 billion. This is

“unsurprising” for the firm, considering GBTC had been trading at a

discount since 2020, offering investors an opportunity to exit at

par value. Related Reading: Chiliz (CHZ) Jumps Over 40%:

Reasons Behind The Hot Streak BTC initially surged to a high of

$49,100 upon ETF approval but has since seen a decline,

consolidating above the $40,000 support level. Volumes have slowed

since the initial launch, and market attention is focused on GBTC

outflows. Meanwhile, ETHBTC, which traded below 0.05, has

seen an upward trend to 0.06. According to QCP Capital, Ethereum is

anticipated to continue to outperform Bitcoin in the medium term as

the narrative shifts towards potential ETH Spot ETF approvals.

Bitcoin Forward Contract Yields Decrease Following the launch of

the BTC spot ETF, BTC forward contracts have experienced a greater

decline compared to ETH forward contracts. BTC 1-month forward fell

from 32% annualized to 9% (-23%), while ETH 1-month forward

decreased from 28% to 12% (-16%). According to QCP Capital,

despite declining yields, ETH forwards still appear attractive,

offering 11-13% annualized returns. Additionally, selling ETH

1-month 2200 Puts presents a viable option with yields above 21%

annually, and it could be a suitable level to buy in the event of a

dip upon potential ETH spot ETF approvals. Related Reading:

Shibarium Shatters Records: 2 Million Transactions In A Day –

Details Ultimately, the crypto firm suggests that the forthcoming

BTC halving in mid-April and the potential approval of ETH Spot

ETFs from May are anticipated to be significant events for the

crypto market. In the interim, market movements may also be

influenced by macroeconomic events. The January Federal Open Market

Committee (FOMC) meeting, as well as the February Non-Farm Payrolls

(NFP) and Consumer Price Index (CPI) reports, are being closely

monitored for insights. The pace of the balance sheet runoff,

discussed briefly in December 2023, is expected to provide further

clarity during the January FOMC meeting. The market consensus

suggests a slowdown in quantitative tightening (QT), but the timing

and extent of these changes remain uncertain. Overall, the

potential launch of an Ethereum spot ETF has sparked speculation

and could have a transformative impact on the Ethereum ecosystem.

As the market grapples with changing dynamics, attention remains on

key events, such as the BTC halving and potential ETH Spot ETF

approvals. Featured image from Shutterstock, chart from

TradingView.com

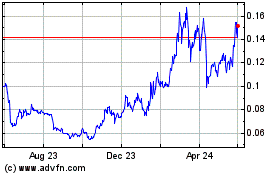

chiliZ (COIN:CHZUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

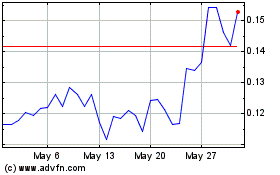

chiliZ (COIN:CHZUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024