Binance Whales Cash Out as Bitcoin Drops—More Downside Ahead?

08 March 2025 - 2:30PM

NEWSBTC

Bitcoin’s price has once again turned bearish after briefly

recovering to $94,000 on Monday. Notably, the cryptocurrency had

shown signs of strength earlier this week following a period of

decline, but the recovery was short-lived. As of today, Bitcoin

slipped below $90,000, marking a 1.8% decrease in the past 24

hours. According to CryptoQuant analyst Crazzyblockk, one key

factor contributing to this downward movement appears to be

increased selling pressure from large Bitcoin holders. Related

Reading: Historic Bitcoin Buy Signal: DXY’s Collapse Signals A

Bigger Bull Run Whales and Large Holders Drive Selling Pressure on

Binance Crazzyblockk in his latest insight highlights how whales

and other large investors on Binance are actively offloading BTC as

prices rise. This trend suggests that experienced traders are

taking advantage of market optimism to exit their positions,

potentially limiting Bitcoin’s short-term upside potential. Whale

to Binance Flow Hits 3-Month High at $7.3B Over Last 30 Days “This

often happens alongside heavy changes in price and shows that large

holders choose Binance as their exchange. Watching whale deposits

is important, as their moves can drive the market.” – By

@JA_Maartun pic.twitter.com/psD3zuDXf3 — CryptoQuant.com

(@cryptoquant_com) March 6, 2025 The trend also comes at a time

when whale to Binance flow sees a consistent increase.

Crazzyblockk’s analysis of on-chain data from Binance particularly

indicates that large Bitcoin holders—categorized as fish, sharks,

and whales—are selling into market rallies. The data reveals that

the larger the holder, the more strategically they distribute their

Bitcoin holdings. These entities account for an increasing share of

daily sell-side activity on Binance, suggesting that they are

actively shaping Bitcoin’s price movements. As Bitcoin’s price

trends upward, whale activity on Binance has intensified, with more

BTC flowing into the exchange. The report highlights that while

retail investors—often referred to as shrimps—have remained

relatively inactive, whales and sharks are capitalizing on rising

prices to take profits. This consistent distribution from

high-value holders has created sustained downward pressure,

preventing Bitcoin from making a parabolic move higher. Bitcoin

Market Outlook: Can Accumulation Offset Whale Selling? With large

holders continuing to offload BTC, the risk remains that any

further upside could trigger even more selling pressure,

reinforcing resistance levels. This dynamic means that Bitcoin’s

price movement could remain constrained unless new accumulation

from long-term investors or institutional buyers offsets the

selling trend. Related Reading: Bitcoin Bullish Signal: $900

Million In BTC Leaves Exchanges Crazzyblockk emphasizes that

tracking Binance’s whale activity is crucial for understanding

market direction. Since these large holders are not just

participants but also price movers, their actions can provide

insight into short-term market trends. If whale selling slows and

new accumulation picks up, Bitcoin could find support and regain

momentum. However, if the current trend continues, further downside

pressure remains a possibility. Featured image created with DALL-E,

Chart from TradingView

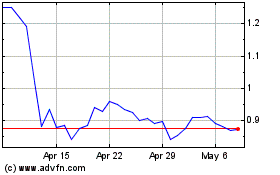

Flow (COIN:FLOWUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

Flow (COIN:FLOWUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025