Sell Bitcoin When This Happens, Warns Analyst—Here’s What to Watch For

13 December 2024 - 3:00PM

NEWSBTC

Bitcoin has shown a significant recovery, reclaiming the $100,000

milestone yesterday. It trades at $101,805, marking a 1.4% increase

over the past 24 hours. Amid this price performance, analysts have

closely examined various metrics to gauge potential market

movements, including identifying optimal cash-out moments.

Meanwhile, recent data reveals intriguing patterns that could guide

investor strategies. When Should You Cash Out Your Bitcoin? One key

insight shared by a CryptoQuant analyst, Onchain Edge, highlights a

critical signal for when investors should consider reducing their

Bitcoin holdings. Other metrics suggest a resurgence in buyer

activity, reinforcing optimism in Bitcoin’s ongoing rally. Onchain

Edge emphasizes the importance of the BTC supply loss percentage as

a marker for peak market phases. He notes that when this metric

drops below 4%, it could signify the culmination of a bull market

and the beginning of an overheated market phase. Currently,

the current supply loss percentage stands at 8.14%, providing room

for further price growth before a potential peak. The analyst

warns, however, that failing to act at the right time during such

peak phases could lead to substantial losses in a subsequent bear

market. Elaborating on his analysis, Onchain Edge encourages

investors to consider dollar-cost averaging (DCA) out of their

positions once the supply loss percentage breaches the 4%

threshold. It is worth noting that this strategy by Edge

could help mitigate the risk of holding through the transition into

a bear market. Historically, peak bull run phases are characterized

by significant profits among market participants, often followed by

sharp corrections. Investors can protect their gains by exiting

strategically while preparing for lower entry points during future

market downturns. BTC Buyer Activity Resurges Meanwhile, in a

separate analysis, another CryptoQuant analyst known as

Crazzyblockk sheds light on the behavior of takers on Binance, one

of the largest cryptocurrency exchanges. Data from the Taker

Buy/Sell Ratio shows a shift toward aggressive buying

activity. This metric, which compares the volume of buy

orders filled by takers to sell orders, had experienced a period of

negative monthly values, indicating a preference for selling among

market participants. However, the ratio has recently turned

positive, signifying renewed interest from buyers. This trend

suggests reduced selling pressure and growing optimism among

traders about Bitcoin’s potential price increase. According

to Crazzyblockk, sustaining this momentum is critical for

maintaining the bullish trajectory, particularly as Bitcoin

consolidates around the psychologically significant $100,000 level.

Featured image created with DALL-E, Chart from TradingView

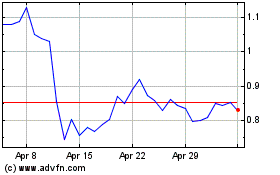

Mina (COIN:MINAUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

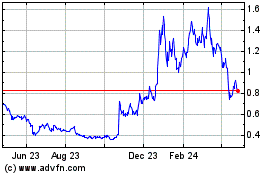

Mina (COIN:MINAUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025