Ethereum Price Guns For A Mid-High Timeframe Reversal Against Bitcoin In Bullish Q1 2025

30 December 2024 - 11:30PM

NEWSBTC

As the crypto market prepares to close the year, the Ethereum price

is showing strength against Bitcoin (BTC) as it aims for a mid-high

timeframe reversal. A breakout above a critical resistance level

could signal a potential shift in price action, paving the way for

Ethereum’s dominance and potential rally in Q1 2025. Ethereum

Price Poised For Breakout Against Bitcoin A crypto analyst, known

as ‘Daan Crypto Trades,’ shared a price chart

representing the ETH/BTC trading pair, providing a detailed

analysis of the probability of a reversal and its impact on

the strength of the altcoin market. According to the

analyst’s X (formerly Twitter) post, the Ethereum price is

attempting to form a higher low near the 0.786 Fibonacci

retracement level at 0.0337, signaling the start of a potential

trend reversal against Bitcoin. Related Reading: El Salvador

Bitcoin Buying Spree Continues, BTC Holdings Now At 6,000 The 0.786

Fibonacci level appears to act as a strong support zone, indicating

a possible shift from bearish to bullish. Daan also disclosed that

the 0.04 BTC level has emerged as a key resistance level that needs

to be broken for further bullish momentum to occur. The

analyst emphasized that a breakout above the 0.04 BTC level would

confirm the mid-high timeframe trend reversal. If this happens, it

could significantly weaken Bitcoin’s dominance and indicate an

increased strength in altcoins, especially Ethereum. In the context

of the ETH/BTC analysis, a mid-high timeframe reversal suggests

that Ethereum could establish a bullish trend over the next few

weeks to months. This timeframe is also used to assess broader

trends rather than short-term price movements. Moving

forward, Daan revealed that historically, the ETH/BTC trading pair

have performed well during the first quarter of the year, aligning

with seasonal trends that typically favor altcoins. If this

historical pattern holds, the analyst believes that a breakout

above the 0.04 Bitcoin level could lead to a significant rally for

Ethereum and the altcoin market. Additionally, this projected

rally is expected to occur in Q1 2025, resulting in a significant

surge from the 0.040 BTC level to the 0.046 mark, as indicated by

the analyst’s chart. Implications On The Altcoin Season If Ethereum

breaks out of the 0.04 BTC level, it could mark the beginning of a

bullish phase not just for the second-largest cryptocurrency but

for the broader altcoin market. Historically, Ethereum’s market

performance has acted as a measure of altcoin strength. Related

Reading: XRP Price Prediction: Fibonacci And Elliott Wave Analysis

Suggests $15 By May 2025 If Bitcoin’s dominance declines, it could

trigger a surge of interest and demand from investors to altcoins.

Currently, Bitcoin’s dominance is standing at 57.8%, still

relatively high despite price declines and market volatility. For

the altcoin season to fully kickstart, the market’s attention will

need to shift from Bitcoin to alternative cryptocurrencies. A

crypto analyst, identified as the ‘Crypto Rover’, disclosed in a

recent post that Bitcoin’s dominance is experiencing a bearish

retest and could potentially decline to 42%. If this occurs, the

analyst asserts that it would be incredibly bullish for altcoins,

potentially marking the start of the anticipated altcoin

season. Featured image created with Dall.E, chart from

Tradingview.com

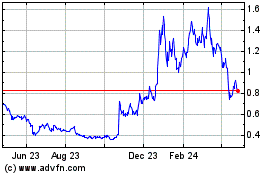

Mina (COIN:MINAUSD)

Historical Stock Chart

From Dec 2024 to Jan 2025

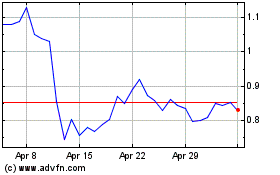

Mina (COIN:MINAUSD)

Historical Stock Chart

From Jan 2024 to Jan 2025