Signs Of A New Crypto Winter? Warren Buffett’s $1 Billion Stock Sales Spark Market Crash Fears

29 August 2024 - 11:00AM

NEWSBTC

Amid growing global economic uncertainties looming over financial

markets, including crypto, Warren Buffett has made a significant

move by selling an additional $982 million worth of Bank of America

stock. Buffett’s Sale Of Bank Of America Shares According to

Bloomberg, this sale marks the continuation of his conglomerate’s

reduction of investments in the second-largest US bank. Berkshire

Hathaway has trimmed its stake by nearly 13% through sales since

mid-July, generating $5.4 billion in proceeds. These sales

mark Buffett’s most substantial retreat from an investment that has

historically signaled an endorsement of Bank of America’s

leadership under CEO Brian Moynihan, a figure the 93-year-old

investing figure has praised in public. Related Reading: MakerDAO

Rebrands As ‘Sky’: Two New Tokens To Be Launched On Sept 18 Adding

to the narrative, technical analyst Jamil has underscored the

significance of Buffett’s latest sales by questioning the rationale

behind his decision to dump nearly $1 billion worth of Bank of

America stock. Citing previous breaches and the near

completion of “backtesting” on the Bank of America stock chart,

Jamil hints at an impending market shift, suggesting the potential

for a significant downturn that could drive the bank’s share price

toward the $14 mark. Crypto Market Rattles While these developments

may not directly pertain to the crypto market, they raise pertinent

questions about the broader financial landscape. They could signal

preparedness from large investors for a potential global economic

downturn that could reverberate across various sectors, including

the digital asset industry. Recent events, such as the

turbulence in the Japanese stock market on August 5, resulted in a

notable over 20% correction in leading cryptocurrencies like

Bitcoin (BTC) and Ethereum (ETH, further showcasing the fragility

of the current financial climate. Related Reading: XRP Remains

Strong Despite Market Pullback: Analyst Forecasts $500 By 2025

Interestingly, Buffett’s actions come in the wake of the Federal

Reserve’s (Fed) recent dovish stance, with Chair Jerome Powell

hinting at the likelihood of further rate cuts in September amidst

a cooling labor market. While Bitcoin initially welcomed such

a stance, which surged to a one-month high of $65,000 last weekend,

the broader implications of Buffett’s strategic moves and the Fed’s

monetary policy signals point to a potentially turbulent economic

landscape in the months ahead, with no clear certainties.

This is further evidenced by the recent 6% price correction

experienced by Bitcoin in the last 24 hours, which is currently

trading at $58,500 and has been unable to consolidate above the key

$60,000 level for over a week. On the other hand, Ethereum

has seen a 4% decline in the 24-hour time frame, falling back to

the $2,480 level on Wednesday, along with the broader market

correction led by BTC. It remains to be seen what signs the

Fed gives in the expected September meetings, as well as the

industry’s reactions and experts’ further analysis of these

developments to gauge the crypto market’s next

movements. Featured image from DALL-E, chart from

TradingView.com

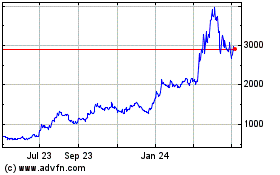

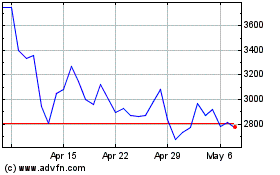

Maker (COIN:MKRUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Maker (COIN:MKRUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024