Ripple CTO Addresses Curious Price Link Between XRP And XLM

27 May 2024 - 10:00PM

NEWSBTC

In an exchange on X, Ripple‘s Chief Technology Officer (CTO), David

Schwartz, also known as JoelKatz, responded to queries about the

strikingly similar price movements of XRP and Stellar (XLM). This

discussion has brought to light not just the intertwined market

dynamics of these two major cryptocurrencies but also the complex

factors influencing their valuation. Curious Correlation Between

XRP And XLM Schwartz candidly addressed a post by Good Morning

Crypto, who highlighted a long-term price chart comparison between

XRP and XLM since 2014, questioning the “unnatural price symmetry”

and the potential for both to “breakout together during this bull

run.” Schwartz replied, “I genuinely don’t know. The thing that I

think is most likely is that both prices are driven primarily by

factors completely outside their ecosystems.” Related Reading:

Ready For Liftoff: XRP Price Primed To Skyrocket Before November

However, Schwartz also acknowledged conflicting evidence to his

theory. When pressed for specifics regarding the unusual

correlation, he pointed to the significant event of Stellar burning

half of their token supply, which surprisingly did not impact their

price or disrupt the price correlation pattern with XRP. “The one

bit that’s the most convincing to me is that Stellar burned half

their supply and there wasn’t so much as a blip on their price

chart or any real deviation from XRP’s price correlation,” Schwartz

explained. This dialogue underscores a broader narrative within the

cryptocurrency sector, where XRP and XLM share not only a founder

in Jed McCaleb but also similar technological frameworks aimed at

streamlining cross-border payments. Despite these overlaps, the

absence of a price impact post-Stellar’s token burn has been a

particularly puzzling aspect for analysts and the crypto community

alike. Both XRP and XLM have historically mirrored each other’s

price movements, potentially due to overlapping use cases, investor

behaviors, and market perceptions. As financial tools facilitating

quick, cross-border transactions with minimal fees, both have

attracted similar investor bases looking for alternatives to

traditional banking hurdles. Related Reading: XRP Price

Consolidates, Gearing Up for Its Next Major Breakout Market

sentiment plays a significant role. News impacting one of the

cryptos can quickly spill over to the other due to their perceived

substitutability. Additionally, regulatory shifts in one can

inadvertently sway investor sentiment towards the other. Popular

pro-XRP lawyer Bill Morgan commented on this, “I don’t know what

causes it but it shows how useless Ripple burning the escrow would

be. Stellar burned XLM and Ripple did not burn XRP and it had no

impact on the symmetry. Same for the lawsuit. No impact overall.

Stellar was not sued. Factors external to either blockchain and not

specific to either Ripple or Stellar must be the explanation.” The

ongoing debate includes speculation about whether XRP and XLM will

jointly make significant gains in an anticipated bull run.

Historical price patterns suggest a high level of correlation, but

as Schwartz indicates, external factors such as global market

conditions and macroeconomic factors are likely at play. At press

time, XRP price stood at $0.5282. Featured image created with

DALL·E, chart from TradingView.com

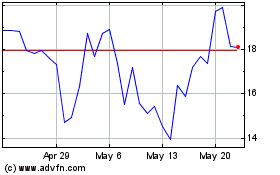

Prime (COIN:PRIMEUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Prime (COIN:PRIMEUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024