What’s Behind The Recent Bitcoin Drop? Here’s What On-Chain Data Says

24 April 2023 - 9:40PM

NEWSBTC

Bitcoin on-chain data hints that selling from the miners may have

been behind the latest plunge in the asset’s price below the

$28,000 mark. Bitcoin Miners Have Shown Signs Of Selling Recently

As pointed out by an analyst in a CryptoQuant post, miners had been

putting on some selling pressure on Bitcoin while the decline had

happened. A relevant indicator here is the “miner netflow,” which

measures the net amount of Bitcoin entering into or exiting the

wallets of all miners. When this metric has a positive value, it

means a net number of coins is being transferred into the wallets

of miners right now. Such a trend implies that these chain

validators are accumulating currently, which is naturally something

that could be bullish for the price. On the other hand, negative

values suggest miners are transferring some BTC out of their

holdings at the moment. Usually, miners transfer out their coins

whenever they want to sell them. Hence, negative netflow values can

have bearish consequences for the asset. Now, here is a chart that

shows the trend in the 30-day simple moving average (SMA) Bitcoin

miner netflow over the past week or so: The 30-day SMA value of the

metric seems to have been quite negative in recent days | Source:

CryptoQuant As displayed in the above graph, the 30-day SMA Bitcoin

miner netflow registered a very sharp red spike when the

cryptocurrency’s price was in the middle of its decline a few days

ago. BTC was just above $28,000 when this spike came, but the asset

rapidly plummeted to the low $27,000 level following it. The timing

of these large net outflows taking place from the miners may be a

sign that it was this cohort’s selling that at least partially

contributed to the coin’s drawdown. Related Reading: Bitcoin Market

Update: Is $27,000 The Local Bottom? The chart for the 30-day

exponential moving average (EMA) Bitcoin miner reserve, a metric

that measures the total amount of BTC all miners are holding right

now, also shows this spike: Looks like the value of the indicator

has plunged recently | Source: CryptoQuant This plummet in the

Bitcoin miner reserve from a few days ago naturally makes sense, as

the netflow is nothing but a measure of the changes taking place in

this metric. From the chart, it’s visible that while the outflows

may have been sizeable, they still haven’t significantly affected

this cohort’s total holdings, meaning that many miners are still

sitting still on their wallets. Related Reading: China Is Fast

Losing Money: Their Bitcoin Stash Just Fell By $388 Million

Nonetheless, compared to the average during the last 365 days, the

current outflows are very large, as the data for the 14-day EMA

Miners’ Position Index (MPI) below displays. The metric has shot up

| Source: CryptoQuant It looks like the rate at which Bitcoin

miners are selling right now (proportional to the past year) is

greater than what even the FTX crash back in November 2022 saw. All

these indicators suggest that this extraordinary selling pressure

from these holders could be why BTC plunged to low $27,000 levels a

couple of days ago, something that the coin is yet to recover. BTC

Price At the time of writing, Bitcoin is trading around $27,300,

down 8% in the last week. BTC has plunged | Source: BTCUSD on

TradingView Featured image from Becca on Unsplash.com, charts from

TradingView.com, CryptoQuant.com

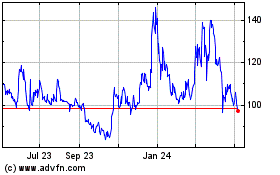

Quant (COIN:QNTUSD)

Historical Stock Chart

From Dec 2024 to Dec 2024

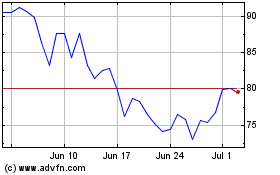

Quant (COIN:QNTUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024