Is Bitcoin’s $100K Just the Beginning? Key Insights from Supply Distribution Data

06 December 2024 - 6:00PM

NEWSBTC

Bitcoin has reached a landmark moment in its history earlier today,

crossing the $100,000 price mark for the first time and cementing

its position once again as the largest cryptocurrency by market

capitalization. As it stands, BTC all-time high is at roughly

$103,679. This significant achievement has prompted a detailed

analysis of its supply distribution, offering valuable insights

into the behavior of long-term and short-term holders and the

broader implications for the Bitcoin market. Related Reading:

Bitcoin’s Silent Whales: Rising Exchange Inflows Hint at Market’s

Next Big Move Supply Distribution and Market Behaviour Amid the

excitement of Bitcoin’s new all-time high, an analysis from

CryptoQuant’s analyst, Crazzyblockk, sheds light on how this

milestone impacts the cryptocurrency’s realized cap and the broader

market structure. While the milestone reflects growing global

adoption and investment confidence, it also raises questions about

the potential trajectory of the market. According to the analysis,

Bitcoin’s supply is currently divided between two key groups of

holders: long-term holders (LTHs) and short-term holders (STHs).

CryptoQuant data reveals that out of Bitcoin’s total supply, over

14.5 million BTC are held by LTHs, while nearly 5 million BTC are

in the hands of STHs. Despite the price surge, only 52% of

Bitcoin’s realized cap is attributed to STHs, a stark contrast to

previous market peaks where this figure typically exceeded 80%.

Historically, Bitcoin’s realized cap trends reveal distinct

behaviors during market cycles. During bear market phases, most

realized cap shifts towards LTHs as accumulation intensifies,

signaling the end of the bearish trend. Conversely, during bull

market peaks, the realized cap tends to be dominated by STHs,

driven by speculative trading and short-term profits. However, the

current distribution shows a higher concentration among LTHs,

indicating a deviation from traditional market patterns.

Implications for Bitcoin’s Market Momentum According to the

CryptoQuant analyst, the relatively low realized cap held by STHs

in the current market cycle suggests reduced selling pressure,

which may support sustained price growth. The analyst revealed that

with a significant proportion of Bitcoin held by LTHs, market

confidence appears strong, potentially providing a buffer against

abrupt price corrections. This stability is crucial as it reflects

long-term investor trust and reduces the likelihood of speculative

volatility. Related Reading: Bitcoin’s Next Move? Coinbase Premium

Suggests a Short-Term Rally May Be Brewing In addition, the

analysis also highlights that this supply distribution aligns with

a long-term bullish outlook for Bitcoin. The reduced participation

of STHs in the realized cap indicates room for further upward

movement as more capital may enter the market without triggering a

significant sell-off. The analyst wrote: In conclusion, Bitcoin

reaching $100,000 is a historic achievement, but the current supply

dynamics suggest the potential for further upward movement, given

the stability provided by LTHs and the relatively low participation

of STHs in the realized cap. Featured image created with DALL-E,

Chart from TradingView

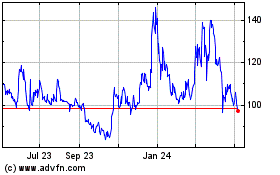

Quant (COIN:QNTUSD)

Historical Stock Chart

From Nov 2024 to Dec 2024

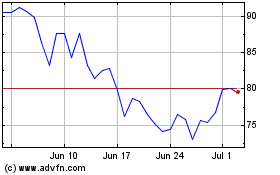

Quant (COIN:QNTUSD)

Historical Stock Chart

From Dec 2023 to Dec 2024