Ethereum Whales Have Bought Over 600,000 ETH In The Past Week – Time For A Price Upswing?

13 February 2025 - 3:00PM

NEWSBTC

Ethereum has been struggling to regain momentum, trading below the

critical $2,800 mark since last Thursday. Bulls are in trouble as

the price remains trapped under key supply levels, leaving

investors concerned about Ethereum’s short-term future. Many who

expected a bullish year for the second-largest cryptocurrency are

now questioning their outlook after last week’s massive selling

pressure took ETH from $3,150 to $2,150 in less than two days.

Related Reading: Can Bitcoin Hold $97K? – 1-3 Month Holders’ Data

Reveals Crucial BTC Demand The recent price action has amplified

fear and uncertainty among retail investors, with many continuing

to sell amid the market turbulence. However, on-chain metrics tell

a different story, signaling growing confidence from larger

players. Key data shared by top crypto analyst Ali Martinez reveals

that whales have accumulated over 600,000 Ethereum in the past

week, even as retail investors remain cautious. This divergence

highlights a critical trend in the market—retail investors appear

scared and reactive, while big players are quietly buying up ETH at

discounted prices. As the market grapples with indecision and

volatility, this accumulation by whales could set the stage for a

significant shift in momentum. If bulls manage to reclaim the

$2,800 and $3,000 levels, Ethereum may begin a recovery rally. For

now, all eyes are on whether the divergence will lead to a turning

point in ETH’s price action. Ethereum Investors Are Divided: Retail

Fears Vs. Whales Trust Ethereum remains in a challenging position

after last week’s dramatic sell-off, which saw the price drop from

$3,150 to $2,150 in less than 48 hours. Despite a strong recovery

back into the $2,700 range, ETH has struggled to reclaim key supply

levels, leaving many investors cautious. The price remains trapped

below crucial resistance at $2,800, with bulls needing to push

above the $3,000 mark to shift the bearish trend and regain market

confidence. Key metrics shared by crypto analyst Ali Martinez

reveal a promising trend amidst the uncertainty. Whales have

accumulated over 600,000 Ethereum in the past week, signaling

strong buying activity from big players. This accumulation

trend is a stark contrast to the cautious behavior of retail

investors, many of whom continue to sell amid fear and uncertainty.

The divergence between whale accumulation and retail selling

suggests that large investors remain optimistic about Ethereum’s

long-term prospects, even as short-term price action remains shaky.

Related Reading: Litecoin Approaches Daily Range Peak – Can LTC

Break Multi-Year Highs? This whale activity gives hope to investors

who believe Ethereum still has the potential to surge this year. A

breakout above $3,000, which aligns with the 200-day moving

average, could mark a significant turning point for ETH, sparking a

rally toward higher price levels. Until then, ETH remains in a

critical phase as it navigates between bearish pressure and the

potential for recovery. ETH Price Action: Key Levels To Reclaim

Ethereum is currently trading at $2,620, attempting to reclaim the

$2,700 mark as it battles against key supply levels. Bulls are

under pressure to break through resistance at $2,800 and $3,000, as

reclaiming these levels would signify a reversal of the daily

downtrend that has persisted since late December. The $3,000 mark

holds particular significance, as it aligns with the 200-day moving

average, a widely watched indicator that signals long-term strength

when prices hold above it. A successful push above the $3,000 level

could ignite a strong rally, with Ethereum targeting higher price

levels quickly. Such a move would restore confidence in the market

and signal a potential bullish trend for ETH, which has struggled

to regain its footing following last week’s dramatic sell-off.

Related Reading: Cardano Is Showing Signs Of A Potential Rebound As

Key Indicator Flashes A Buy Signal – Analyst However, if Ethereum

fails to hold above the $2,600 mark, the outlook becomes bearish. A

breakdown below this level could open the door to further declines,

with ETH potentially testing lower demand zones in the coming days.

The market remains at a critical juncture, and Ethereum’s ability

to reclaim and hold key levels will determine its short-term

direction as investors closely monitor the next moves. Featured

image from Dall-E, chart from TradingView

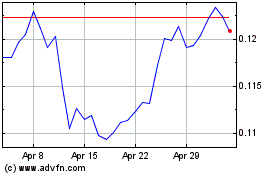

TRON (COIN:TRXUSD)

Historical Stock Chart

From Jan 2025 to Feb 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Feb 2024 to Feb 2025