This Bitcoin Range The Next Key Resistance, Analytics Firm Says

04 March 2025 - 8:30PM

NEWSBTC

The market intelligence platform IntoTheBlock has revealed where

the next major obstacle for Bitcoin could lie, according to

on-chain data. Bitcoin Has A Major Supply Wall Between $95,400

& $98,200 In a new post on X, IntoTheBlock has discussed about

how the various BTC price ranges are looking in terms of on-chain

resistance and support. In on-chain analysis, the strength of any

support or resistance range is assumed to lie in the amount of

supply that was last purchased/transacted by investors at price

levels falling in said range. Related Reading: Crypto Liquidations

Near $1 Billion As Bitcoin & Altcoins Bounce Back That is,

strong support/resistance ranges carry the cost basis of a large

number of addresses. The reason behind this is that to any

investor, their break-even level is naturally a special level, so

when retests of it happen, they are probable to make some kind of

move. Holders who were in loss prior to such a retest may be

tempted to sell, as they would at least recoup all of their

investment. Investors who were in profit, however, may decide to

buy more instead, as they could believe the same acquisition level

would end up paying off again in the future. Naturally, just a few

investors showing this buying/selling would have no effects on the

cryptocurrency’s price, so the range would need to contain the cost

basis of a significant amount of addresses if it has to act as a

resistance or support boundary. Now, here is the chart shared by

the analytics firm, that shows how the Bitcoin supply is

distributed at ranges around the current spot price: In the graph,

the size of the dot correlates to the amount of coins that the

investors purchased inside the corresponding range. It would appear

that one range ahead of the current price particularly stands out

in terms of the size of its dot: $95,400 to $98,200. At these price

levels, around 2.29 million addresses purchased a total of 1.66

million tokens. Given that the range is above the asset’s price at

the moment, all of these investors would be in the red. Related

Reading: Bitcoin Is Enough—Coinbase CEO Rejects Altcoins For US

Reserves Bitcoin has recently gone through a rollercoaster where it

plunged below $80,000 and recovered back above $90,000, all within

the matter of a few days. As such, these underwater holders may be

especially eager for the price to get back to their cost basis.

“Fearful sentiment can trigger these holders to sell at break-even

prices, thus providing resistance,” explains IntoTheBlock. It now

remains to be seen whether demand would be enough to outpace these

potential sellers, if BTC can rally far enough to retest this

range. BTC Price Bitcoin neared the $95,000 level during the latest

price rally, but it seems its price has since faced a retrace as

it’s now back to $90,700. Featured image from Dall-E,

IntoTheBlock.com, chart from TradingView.com

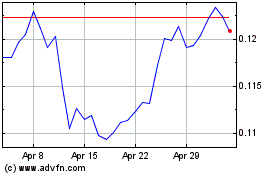

TRON (COIN:TRXUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025