Bitcoin Stalls: Weak Momentum Puts $85,211 Recovery In Doubt

09 March 2025 - 7:00AM

NEWSBTC

Bitcoin is making an effort to stage a comeback after dipping to

$85,211, but a lack of strong momentum is casting doubt on the

recovery. While buyers are attempting to regain control, technical

indicators suggest that bullish strength remains fragile, raising

concerns about whether BTC can sustain its rebound or face another

pullback. With key resistance levels ahead and market sentiment

still uncertain, Bitcoin’s next move remains unpredictable. If

buyers fail to build enough momentum, BTC could struggle to push

higher, leaving it vulnerable to renewed selling pressure.

Bitcoin Tries To Bounce Back BTC’s current price action indicates

that bulls are making an effort to stage a rebound from the $85,211

support level after a sharp decline. This attempt follows a period

of strong bearish pressure, which intensified when Bitcoin faced

heavy resistance at $93,257 and failed to move upward.

Related Reading: Bitcoin Price Attempts a Comeback—Is a Recovery

Rally on the Horizon? Despite some signs of stabilization,

technical indicators suggest that bullish momentum remains weak.

The lack of strong buying pressure raises concerns about whether

BTC can maintain its current attempt at a rebound or if another

downturn is imminent. Additionally, the price remains below the

100-day Simple Moving Average (SMA), signaling that bears still

dominate the market. Furthermore, the MACD line and the signal line

are edging lower, hinting at a possible decline in bullish

momentum. If both lines continue downward and cross into negative

territory, it could signal a shift in trend favoring the bears.

This weakening performance suggests that buying pressure is not

strong enough to sustain a meaningful recovery, increasing the risk

of further downside. A confirmed bearish crossover might

reinforce selling dominance, making it difficult for BTC to regain

an uptrend. For the bulls to regain control, a surge in buying

activity is needed to push the MACD indicators back into a positive

trend. Traders should watch key support and resistance levels

closely for confirmation of the next trend direction Potential

Scenarios: Rebound Or Another Leg Down? If bulls successfully

defend the $85,211 support level, Bitcoin could stage a relief

rally, driving prices toward the immediate resistance at $93,257. A

decisive break above this critical level could open the door for a

stronger bullish push, propelling BTC toward $100,000. Such a move

would restore market confidence and attract more buyers, increasing

the likelihood of continued upside expansion. Related Reading:

Bitcoin Reclaims $90K But This Indicator Signals Possible

Consolidation Phase However, once Bitcoin fails to gain momentum, a

drop below $85,211 may accelerate losses. In this case, BTC might

test lower support levels, possibly around $73,919 or even $65,082,

before finding stability. Featured image from Unsplash, chart from

Tradingview.com

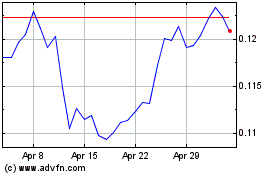

TRON (COIN:TRXUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025