Michael Saylor’s Strategy Unveils $21 Billion Stock Issuance For Bitcoin Investment

11 March 2025 - 3:30PM

NEWSBTC

Michael Saylor, co-founder and chairman of Strategy (formerly

Microstrategy), is intensifying efforts to acquire Bitcoin (BTC) by

tapping into capital markets, announcing plans to issue up to $21

billion in preferred stock. Strategy Plans Major Sale Of

Preferred Shares According to Bloomberg, the new offering will

consist of 8% series A perpetual-strike preferred shares, which are

convertible into class A common stock. The company plans to sell

these shares through an “at the market offering” program, allowing

for flexibility in timing and pricing. This approach builds

on a previous successful effort in January, when Strategy raised

$563 million by issuing preferred shares priced at $80 each, which

were offered at a discount to their market value. Related Reading:

Dogecoin Crash? Analyst Predicts Drop To $0.12 Before Rebound

Preferred stocks are unique hybrid securities that combine features

of both equity and debt, offering investors a fixed dividend while

providing a claim on company assets. The favorable terms of the

January deal reportedly attracted significant investor interest,

contributing to a strong performance of the newly issued shares.

Since late October, Strategy has been actively acquiring Bitcoin,

and the latest capital raise is part of a broader strategy to

secure $42 billion over the next few years through various

securities offerings. This includes a focus on selling

fixed-income securities while managing common stock sales to fund

additional BTC purchases. Currently, the firm holds approximately

499,096 Bitcoin, valued at around $42 billion. Shares Drop 10% Amid

Bitcoin Crash Despite this purchase plan, Strategy reported that it

did not purchase any Bitcoin between March 3 and March 9, according

to a filing with the US Securities and Exchange Commission.

This pause comes amid a fluctuating cryptocurrency market, where

the market’s leading crypto, BTC, recently trades at $79,000 down

4.5% for the day and approximately 18% on the monthly time frame.

The preferred stock market has seen varied performance; while the

shares climbed 18% from their initial pricing, they faced a decline

of over 6% in a recent trading session as the supply

increased. Related Reading: Cardano Bulls Eye $10 Target –

Analyst Reveals Key Levels To Break Despite this fluctuation, the

preferred shares have outperformed common stock and Bitcoin over

the same period, suggesting a robust demand from investors. As seen

in the daily chart below, shares of Strategy (MSTR), also

experienced a drop of around 15% to $238 on Monday, reflecting

broader market trends that have seen the company’s stock down

approximately 10% this year. In contrast, shares have surged

over 2,200% since Saylor began investing in Bitcoin as an inflation

hedge in 2020, while Bitcoin itself has risen over 600%. The

announcement of Strategy’s plans coincided with recent developments

from the US government. President Donald Trump signed an executive

order to create a strategic US Bitcoin reserve, which will be

funded through cryptocurrencies forfeited in legal

proceedings. Featured image from DALL-E, chart from

TradingView.com

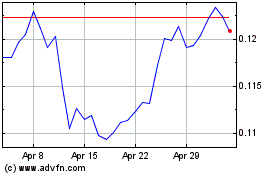

TRON (COIN:TRXUSD)

Historical Stock Chart

From Feb 2025 to Mar 2025

TRON (COIN:TRXUSD)

Historical Stock Chart

From Mar 2024 to Mar 2025