By Art Patnaude and Nicolas Parasie

Global hotel companies are establishing new beachheads in Iran,

betting that lifted sanctions against the Middle East nation will

spark a jump in tourism and business travel after decades of

economic isolation.

Spanish operator Melia Hotels International is planning to open

a 319-room hotel next year on the Caspian Sea. French group Accor

Hotels, which opened two hotels near the Tehran airport last

autumn, is establishing a joint-stock company in Iran through which

it will partner with local groups to manage hotels. Abu Dhabi-based

Rotana Hotel Management Corp. PJSC has started developing

properties in the country as well.

Iran has largely been cut off from global commerce since 1979,

when a revolution sparked an exodus of Western firms, including

hotel groups like Hyatt Hotels Corp. and Hilton Hotels &

Resorts. The U.S., and later the United Nations, imposed rounds of

punishing economic sanctions over Tehran's nuclear program, making

it difficult for foreign companies to do business there.

A deal struck in January between Iran and global governments

cleared the path for cross-border commerce to restart. The parties

have until June 30 to agree on details, but all U.N. Security

Council resolutions against Iran would be lifted once Iran begins

implementing limits to its nuclear program.

"This is essentially the start of a new era," said Faisal

Durrani, head of research at real-estate broker Cluttons LLP. "What

you have is effectively the largest country in the Middle East open

for business."

Iran's case in many ways looks like Cuba, where thawing

relations with the U.S. have also sparked interest from Western

hotel operators. Both Starwood Hotels and Resorts and Marriott are

looking to take advantage of the growing commercial opportunities

there.

Major hurdles in Iran remain, from limited bank financing to

lingering sanctions, hotel chiefs and lawyers said.

The European Union has, for the most part, lifted sanctions

against dealing with Iranian companies and individuals. But most

U.S. sanctions remain in place, said Caroline Hobson, head of

competition at law firm CMS Cameron McKenna LLP.

"We just have to wait. That's the frustrating bit," said Peter

Norman, senior vice president for acquisitions and development at

Hyatt in Europe, the Mideast and Africa. "We're really keen to go

in there," he said. Hyatt and Germany-based Kempinski Hotels have

been exploring opportunities but said for the moment barriers

remain too high.

Still, with the Iranian government projecting foreign visitor

numbers to jump to 20 million by 2025 from five million currently,

"we believe there is huge potential," said Gabriel Escarrer, chief

executive of Melia Hotels, which operates more than 350 hotels in

35 countries.

Iran's economy is still reeling from years of sanctions. But the

International Monetary Fund expects economic growth in Iran to pick

up to about 4% this year once some sanctions are lifted and foreign

investment kicks in.

Hospitality could be one of the first sectors to benefit from

the influx of business and leisure travel. At the moment "there is

a lack of hotels, both in terms of quality and quantity, whatever

the segment," said Christophe Landais, chief operating officer at

Accor Hotels Iran, at a conference in Dubai last month.

Paris-based Accor Hotels has been operating two of its branded

hotels, a Novotel and an Ibis, near the Imam Khomeini airport since

last fall.

"Accor is on a mission to develop an extensive network of

property covering all market segments, from economy to business,"

Mr. Landais said.

Melia Hotels is aiming for the "premium segment," Mr. Escarrer

said. "That's where we think we can attract the international

traveler."

The Gran Melia Ghoo Hotel is scheduled to open in late 2017 on

the Caspian Sea, a popular vacation destination for Iranians,

Russians and Turks. It will include seven restaurants and bars, two

swimming pools and a spa.

Melia will operate the hotel, but it isn't investing its own

capital. Ahad Azimzadeh, an Iranian businessmen who owns Persian

carpet firm Azimzadeh Carpet, is funding the development, which

also includes apartments and shopping.

For companies already looking to develop hotels, the biggest

issue right now is funding, said Nicholas Gilani, chief investment

officer at CommoditEdge LLC.

The Dubai-based firm, an affiliate of a privately held Iranian

conglomerate, recently struck a deal with the Iran Touring and

Tourism Investment company, which owns 65 hotels across Iran in

tourism hot spots such as Shiraz, Mashhad, ski resorts near Tehran

and on the Caspian Sea coast. Under the deal, the two partners will

identify which properties to develop or renovate with the help of

foreign investors.

Mr. Escarrer of Melia said the potential is too great to pass

up.

"We're trying to be a pioneer in this market," he said. "We

started in Cuba 25 years ago. We're trying to do the same in

Iran."

Write to Art Patnaude at art.patnaude@wsj.com and Nicolas

Parasie at nicolas.parasie@wsj.com

(END) Dow Jones Newswires

May 17, 2016 09:31 ET (13:31 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

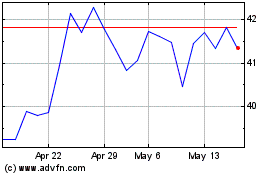

Accor (EU:AC)

Historical Stock Chart

From Nov 2024 to Dec 2024

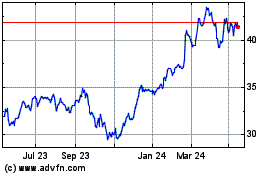

Accor (EU:AC)

Historical Stock Chart

From Dec 2023 to Dec 2024