- Buy-back by CARMAT of 2 million shares from Airbus for a

symbolic sum of 1 euro.

- The shares so bought-back will be allocated to the repayment

of the Company's financial debt, via their use in the ongoing

equitization of the loan contracted with the European Investment

Bank, thus reducing the dilution associated with this

equitization.

Regulatory News:

CARMAT (FR0010907956, ALCAR), designer and developer of the

world’s most advanced total artificial heart, aiming to provide a

therapeutic alternative for people suffering from advanced

biventricular heart failure (the “Company” or

“CARMAT”), announced today that it has bought-back 2 million

shares from Matra-Défense (Airbus group) (“Airbus”), for a

symbolic sum of one euro, which will be used to repay the Company's

financial debt, via their use in the ongoing equitization of the

first tranche of its loan contracted with the European Investment

Bank (EIB).

Airbus to reduce its stake in CARMAT

A founder of CARMAT in 2008, alongside Professor Alain

Carpentier, Airbus has since supported the Company, particularly

from a technical point of view, throughout the research and

development process, and then the industrialization of the Aeson®

artificial heart.

As CARMAT is now well engaged in the commercialization of

Aeson®, and Airbus has no expertise in medical devices, the two

companies agreed for Airbus to reduce its stake in CARMAT, in which

Airbus was still holding about 6.1%1 of the shares.

In order to support CARMAT's development through this

transaction, Airbus has proposed to sell the vast majority of its

CARMAT shares (i.e. 2 million out of a total of 2.67 million

shares) to the Company for a symbolic sum of 1 euro, so that these

shares could then be used as part of the ongoing equitization of

the loan contracted with the European Investment Bank2, and thus

contribute directly to the Company's debt reduction.

CARMAT buys back 2 million Airbus shares for a symbolic sum

of 1 euro

On December 20, 2024, Airbus sold to CARMAT, by way of an

off-market block sale, the full ownership of 2 million CARMAT

shares, valued at €1.998 million3, for a symbolic sum of one

euro.

At the same time, Matra Défense resigned from CARMAT’s board of

directors.

Shares bought-back by CARMAT to be used in the on-going

equitization of the loan contracted with the EIB, thus enabling

partial repayment of such loan

As a reminder, in order to reduce the repayment in cash, due

under the loan contracted by CARMAT with the EIB, CARMAT and the

EIB, on June 13, 2024, launched an equitization of the first

tranche of this loan, consisting in its gradual conversion into

CARMAT shares, via a management trust4.

As part of this operation, the trustee regularly exercises share

subscription warrants (the “Warrants”) issued to it free of charge

by CARMAT, by way of offsetting receivables. The trustee then

gradually sells on the market, the new shares issued as a result of

these exercises, and the net proceeds of these sales are then

transferred to the EIB in repayment of its loan.

The management trust agreement regulating this equitization, and

the terms of the Warrants were amended on December 20, 2024, in

order to allow CARMAT to deliver to the trustee either newly issued

shares or existing shares.

In practice, CARMAT now intends to deliver in priority the

existing shares bought-back from Airbus upon exercise of the

Warrants, until these existing shares are exhausted.

The use of the shares bought-back from Airbus will therefore

enable CARMAT to partially repay the loan contracted with the EIB

as part of the on-going equitization, while significantly limiting

the dilution associated to it.

Company's shareholding structure

To the best of CARMAT's knowledge, the Company's shareholding

structure before and after the share buy-back is as follows:

Before Buyback

After Buyback

(Based on the share capital as of

November 30, 2024)

Number of Shares

% of Capital

Number of Shares

% of Capital

Lohas SARL (Pierre Bastid)

4,854,143

11.0%

4,854,143

11.0%

Les Bastidons (Pierre Bastid)

1,343,333

3.0%

1,343,333

3.0%

Sante Holdings SRL (Dr Antonino

Ligresti)

6,143,866

13.9%

6,143,866

13.9%

Matra Défense SAS (Airbus Group)

2,670,640

6.1%

670,640

1.5%

Corely Belgium SPRL (Gaspard Family)

880,000

2.0%

880,000

2.0%

Therabel Invest

741,706

1.7%

741,706

1.7%

Prof. Alain Carpentier & Family

491,583

1.1%

491,583

1.1%

Alain Carpentier Scientific Research

Foundation

115,000

0.3%

115,000

0.3%

Stéphane Piat (Chief Executive

Officer)

553,402

1.3%

553,402

1.3%

Cornovum

458,715

1.0%

458,715

1.0%

Treasury Shares (liquidity contract)

20,731

0.0%

20,731

0.0%

Treasury Shares (shares bought-back from

Airbus)

-

-

2,000,000

4.5%

Free Float

25,777,194

58.5%

25,777,194

58.5%

Total

44,050,313

100.0%

44,050,313

100.0%

Stéphane Piat, CEO of CARMAT, declares: “This friendly

reduction in stake by AIRBUS, one of CARMAT's founders and an

industrial partner closely linked to our company's identity, is an

important and very natural step. It is indeed thanks to Airbus’

technological know-how that the Aeson® artificial heart imagined by

Professor Alain Carpentier could turn into reality and gradually

become a therapy that now saves the life of patients suffering from

advanced heart failure. It is also thanks to Airbus group’s

financial support that we have been able to go through pivotal

periods of our project, and thus become an industrial and

commercial company, now well set on a growth trajectory. Actually,

the reduction in Airbus’ stake testifies to our ability to now

“stand on our own two feet”, and to carry-on with the support of

our other key shareholders, particularly LOHAS (Pierre Bastid) and

Sante Holdings, who are very much involved in the strategic

management of CARMAT.

I would like to reiterate my gratitude to Airbus group for its

invaluable contribution to the creation and development of CARMAT

over the last 20 years; and to thank them for enabling us, through

the very favorable terms of the reduction of their stake in our

capital, to repay part of our financial debt, while avoiding any

cashout, and with no dilutive effect for our existing shareholders.

All this fully reflects our long-standing relationship based on

support, respect and trust.”

Marie-Pierre Merle-Beral, Director representing Airbus Group

on CARMAT Board of Directors, comments: “Airbus is proud to

have been able to contribute, through its know-how and financial

support, to the CARMAT adventure since its inception, thus enabling

the emergence of a world leader in artificial heart technologies.

We wish CARMAT and its management team every success in addressing

challenges ahead, and in bringing this innovation to patients

worldwide.”

●●●

About CARMAT

CARMAT is a French MedTech that designs, manufactures and

markets the Aeson® artificial heart. The Company’s ambition is to

make Aeson® the first alternative to a heart transplant, and thus

provide a therapeutic solution to people suffering from end-stage

biventricular heart failure, who are facing a well-known shortfall

in available human grafts. The world’s first physiological

artificial heart that is highly hemocompatible, pulsatile and

self-regulated, Aeson® could save, every year, the lives of

thousands of patients waiting for a heart transplant. The device

offers patients quality of life and mobility thanks to its

ergonomic and portable external power supply system that is

continuously connected to the implanted prosthesis. Aeson® is

commercially available as a bridge to transplant in the European

Union and other countries that recognize CE marking. Aeson® is also

currently being assessed within the framework of an Early

Feasibility Study (EFS) in the United States. Founded in 2008,

CARMAT is based in the Paris region, with its head offices located

in Vélizy-Villacoublay and its production site in Bois-d’Arcy. The

Company can rely on the talent and expertise of a multidisciplinary

team of circa 200 highly specialized people. CARMAT is listed on

the Euronext Growth market in Paris (Ticker: ALCAR / ISIN code:

FR0010907956).

For more information, please go to www.carmatsa.com and follow

us on LinkedIn.

●●●

Name: CARMAT ISIN code:

FR0010907956 Ticker: ALCAR

●●●

Disclaimer

This press release and the information it contains do not

constitute an offer to sell or subscribe, or the solicitation of an

order to buy or subscribe, CARMAT shares in any country.

This press release may contain forward-looking statements about

the Company's objectives and prospects. These forward-looking

statements are based on the current estimates and expectations of

the Company's management and are subject to risk factors and

uncertainties, including those described in its universal

registration document filed with the Autorité des Marchés

Financiers (AMF) under number D.24-0374, as updated by an amendment

to the 2023 universal registration document filed with the AMF on

17 September 2024 under number D. 24-0374-A01 (together the ‘2023

Universal Registration Document’), and available on CARMAT's

website.

Readers' attention is particularly drawn to the fact that the

Company's current financing horizon is limited to the beginning of

2025 and that, given its financing requirements and the dilutive

instruments in circulation, the Company's shareholders are likely

to experience significant dilution of their stake in the Company in

the short term. The Company is also subject to other risks and

uncertainties, such as the Company's ability to implement its

strategy, the pace of development of CARMAT's production and sales,

the pace and results of ongoing or planned clinical trials,

technological developments, changes in the competitive environment,

regulatory developments, industrial risks and all risks associated

with managing the Company's growth. The forward-looking statements

contained in this press release may not be achieved as a result of

these factors or other unknown risks and uncertainties or factors

that the Company does not currently consider material and

specific.

Aeson® is an active implantable medical device commercially

available in the European Union and other countries recognising the

CE mark. The Aeson® total artificial heart is intended to replace

the ventricles of the native heart and is indicated as a bridge to

transplant in patients with end-stage biventricular heart failure

(Intermacs classes 1-4) who cannot benefit from maximal medical

therapy or a left ventricular assist device (LVAD) and who are

likely to benefit from a heart transplant within 180 days of

implantation. The decision to implant and the surgical procedure

must be carried out by healthcare professionals trained by the

manufacturer. The documentation (clinician's manual, patient's

manual and alarm booklet) must be read carefully to learn about the

characteristics of Aeson® and the information required for patient

selection and proper use (contraindications, precautions, side

effects) of Aeson®. In the United States, Aeson® is currently only

available as part of a feasibility clinical trial approved by the

Food & Drug Administration (FDA).

1Based on CARMAT's share capital as of November 30, 2024.

2Loan of a total principal amount of €30 million, divided into

three tranches of €10 million each. The first tranche is repayable

(principal and interest) on July 31, 2026, the second one on August

4, 2027 and the third one on October 27, 2028.

3Based on CARMAT's closing share price on December 19, 2024.

4For more details about the equitization, please refer to the

press release published by the Company on March 22, 2024, as well

as the press release published when the equitization effectively

began on June 13, 2024 (press release published by the Company on

June 13, 2024). On June 13, 2024, the Company issued, free of

charge, 6 million share subscription warrants (‘BSA’) to the trust,

which may only be exercised by offsetting receivables.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241222687650/en/

CARMAT Stéphane Piat Chief Executive Officer

Pascale d’Arbonneau Chief Financial Officer Tel.: +33 1 39

45 64 50 contact@carmatsas.com Alize RP Press Relations

Caroline Carmagnol Tel.: +33 6 64 18 99 59

carmat@alizerp.com NewCap Financial Communication &

Investor Relations Dusan Oresansky Jérémy Digel Tel.:

+33 1 44 71 94 92 carmat@newcap.eu

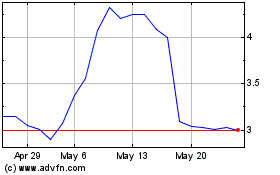

Carmat (EU:ALCAR)

Historical Stock Chart

From Dec 2024 to Jan 2025

Carmat (EU:ALCAR)

Historical Stock Chart

From Jan 2024 to Jan 2025