- Repayment of 2020 EIB loan to be rescheduled to October 2025

from April

- New €37.5 million 2025 EIB loan under appraisal, final

authorization stage

- New up to €10 million equity line completed with IRIS to enable

2025 EIB loan

- eyonis™ LCS RELIVE pivotal study data in Q1 2025

- eyonis™ LCS U.S. FDA 510(k) and EU CE mark filings on track for

Q2 2025

- US commercial launch on track for Q4 2025 in U.S.

- Active discussions ongoing with leading U.S. AI diagnostics

commercial organizations for potential eyonis™ LCS marketing

deal

- Operational improvements enhancing profitability of iCRO

business

Regulatory News:

Median Technologies (FR0011049824, ALMDT, PEA/SME eligible,

“Median” or “The Company”), a leading developer of eyonis™, a suite

of artificial intelligence (AI) powered Software as a Medical

Device (SaMD) for early cancer diagnostics, and a globally leading

provider of AI analyses and imaging services for oncology drug

developers, today announces the Company has agreed on a non-binding

term sheet with the European Investment Bank (EIB) for a new loan

facility for up to € 37.5 m€ and has signed an equity line for up

to €10 million with IRIS Capital Investment (IRIS). The funds will

be used to carry out eyonis™ Lung Cancer Screening (LCS) Software

as a Medical Device (SaMD) FDA regulatory approval and CE mark as

well as completing ongoing active commercialization partnership

discussions with leading U.S. providers of AI diagnostics in the

United States.

Fredrik Brag, CEO and Founder of Median Technologies,

said: “The imminent drawdown of the first €4 million tranche

from the IRIS equity line, the extension of the EIB’s 2020 loan

maturity from April to October 2025 combined with the

implementation of significant operational improvements to enhance

the profitability of the iCRO business and decrease our cash burn

rate, enable us to extend the Company’s cash runway into Q4, 2025

and achieve our upcoming 2025 key value inflection milestones.

Tranches of the new EIB loan would be made available upon

completion of certain undisclosed milestones. Successful completion

of these milestones would extend the cash runway beyond Q4 2025,

well into 2026.

In addition, we are in active discussions with several of the

leading U.S. AI diagnostics commercial organizations, who have

expressed their interest in marketing eyonis™ LCS, and we look

forward to announcing our choice of commercialization partner. I’d

like to thank EIB and IRIS for their confidence as the combination

of these financings enables us to bring eyonis™ LCS to

commercialization.

We are confident that eyonis™ LCS will offer medical

professionals increased efficiency and accuracy so that they can

scale up the currently painstaking lung cancer diagnostic process.

We believe more patients will cure their cancer through early

detection thanks to eyonis™ LCS SaMD; in turn, early detection will

reduce the overall costs of treating uncurable later stage lung

cancer. The future of eyonis™ AI diagnostics represents a win for

patients, doctors, payers and our shareholders.”

New financings based on imminent eyonis™ LCS regulatory

filings

Median is working with the European Investment Bank on

finalizing an agreement, based on a mutually agreed non-binding

term sheet, for financing of up to €37.5 million to enable the

regulatory and commercialization activities of eyonis™ LCS. In

addition, Median and the European Investment Bank (EIB) have agreed

to extend the maturity of the 2020 EIB loan by six months, from

April to October 2025, subject to signature of legal documentation.

The legal documentation for the 2025 loan and the 2020 loan

maturity extension are expected to be finalized in Q1 2025.

Under the expected terms, tranches of the new EIB loan would be

made available upon completion of certain undisclosed milestones.

Successful completion of these milestones would extend the cash

runway beyond Q4, well into 2026.

Concurrently, Median Technologies announces today that it has

signed a financing with IRIS that already partially fulfills the

EIB’s independent financing requirement. The IRIS financing

consists in bonds redeemable into ordinary shares of the Company

for a maximum amount of €10 million, with the first tranche of €4

million to be drawn immediately, extending cash for operations to

Q4 2025.

Median Technologies will be entitled to suspend and reactivate

at any time the withdrawal of any tranche without penalty. The main

terms and conditions of the IRIS equity line are further described

in the appendix of this press release.

This operation does not give rise to publication of a prospectus

requiring approval by the French regulator, the Autorité des

Marchés Financiers (AMF).

Strategic commercialization partnership

Considering the forthcoming eyonis™ LCS regulatory milestones

and the excellent pivotal results already achieved in the REALITY

study, Median is in active discussions with several leading U.S. AI

diagnostic commercial organizations for eyonis™ LCS sales. The

Company is working to conclude the best possible partnering

option(s) for the commercialization of eyonis™ LCS.

Median Technologies operational guidance

The Company reiterates that it is on track to communicate

eyonis™ LCS RELIVE (Clinicaltrials.gov identifier: NCT06751576)

pivotal study data in Q1 2025. The second eyonis™ LCS pivotal

study, RELIVE, is a Multi-Reader Multi-Case (MRMC) trial that will

offer clinical validation of eyonis™ LCS to complement the

analytical validation already achieved with the first pivotal

study, REALITY. The RELIVE study objective is to compare the

ability of radiologists to successfully diagnose lung cancer in

patients with or without the help of eyonis™ LCS. Median reported

in August that eyonis™ LCS, met all primary and secondary endpoints

with statistical significance in REALITY (Clinicaltrials.gov

identifier: NCT06576232). A recently held webinar on the REALITY

data featured two globally leading U.S. pulmonologists discussing

how eyonis™ LCS will be used to help people at risk of lung

cancer.

Regulatory filings, for U.S. FDA 510(k) clearance and for

European Economic Area (EEA) CE mark, will be submitted in Q2 for

eyonis™ LCS. Marketing authorizations are expected in Q3 2025 and

Q1 2026, for U.S. and EEA, respectively, assuming normal review

times.

About eyonis™ LCS: eyonis™ Lung Cancer Screening (LCS) is

an artificial intelligence (AI) powered diagnostic device that uses

machine learning to help analyze imaging data generated with low

dose computed tomography (LDCT) to diagnose lung cancer at the

earliest stages, when it can still be cured in many patients.

eyonis™ LCS has been classified by regulators as “Software as

Medical Device”, or SaMD, and is the subject of two pivotal studies

required for marketing approvals in the U.S. and Europe: REALITY

(successfully completed) and RELIVE (ongoing). Filing applications

including these pivotal data are scheduled to be submitted for FDA

510(k) premarket clearance and CE marking in 2025. Separately,

Median’s AI technology is being sold and deployed across cancer

indications, via Median’s iCRO business unit, to companies

performing clinical trials of experimental cancer therapeutics,

including many of the world’s leading pharmaceutical companies.

About Median Technologies: Pioneering innovative imaging

services and Software as a Medical Device (SaMD)., Median

Technologies harnesses cutting-edge AI to enhance the accuracy of

early cancer diagnoses and treatments. Median's offerings include

iCRO, which provides medical image analysis and management in

oncology trials, and eyonis™, an AI/ML tech-based suite of software

as a Medical Device. Median empowers biopharmaceutical entities and

clinicians to advance patient care and expedite the development of

novel therapies. The French-based company, with a presence in the

U.S. and China, trades on the Euronext Growth market (ISIN:

FR0011049824, ticker: ALMDT). Median is also eligible for the

French SME equity savings plan scheme (PEA-PME). For more

information, visit www.mediantechnologies.com.

Forward-Looking Statements - Disclaimer

This press release contains forward-looking statements. These

statements are not historical facts. They include projections and

estimates as well as the assumptions on which these are based,

statements concerning projects, objectives, intentions, and

expectations with respect to future financial results, events,

operations, services, product development and potential, or future

performance.

These forward-looking statements can often be identified by the

words "expects," "anticipates," "believes," "intends," "estimates"

or "plans" and any other similar expressions. Although Median's

management believes that these forward-looking statements are

reasonable, investors are cautioned that forward-looking statements

are subject to numerous risks and uncertainties, many of which are

difficult to predict and generally beyond the control of Median

Technologies, including the risks set forth in the annual financial

report of the Company published on April 25, 2024, which is

available on the Company's website

(https://mediantechnologies.com/). Readers' attention is drawn in

particular to the fact that the Company's current financing horizon

is limited to Q4 2025 (based on the assumptions provided for in the

second page of this press release) and that, given its financing

requirements and the dilutive instruments in circulation, the

shareholders of the Company are likely to suffer significant

dilution of their stake in the Company in the short term. The

occurrence of all or part of such risks could cause actual results

and events to differ materially from those expressed in, or implied

or projected by, the forward-looking information and

statements.

All forward-looking statements in this press release are based

on information available to Median Technologies as of the date of

the press release. Median Technologies does not undertake to update

any forward-looking information or statements, subject to

applicable regulations, in particular Articles 223-1 et seq. of the

General Regulation of the French Autorité des Marchés

Financiers.

This press release and the information contained herein do not

constitute an offer of sale, purchase or subscription or the

solicitation of a sale, purchase or subscription order for Median

Technologies ‘s shares in any country.

In addition to the above, on February 14, 2023, the Autorité des

Marchés Financiers (AMF) invited companies issuing equity

securities or securities giving access to capital over a period of

time to adopt a standard communication and warning on the

associated risks. This warning is shown below:

Warning

Median Technologies is launching an equity line in the form of

bonds redeemable in shares with the company IRIS, which, after

receiving the shares resulting from the redemption of these bonds,

does not intend to remain a shareholder in the Company. The shares

resulting from the redemption of the above-mentioned bonds will

generally be sold on the market at very short notice, which may

create strong downward pressure on the share price. Shareholders

may suffer a loss of their invested capital due to a significant

fall in the value of the Company's shares, as well as significant

dilution due to the large number of shares issued to Iris.

Investors are advised to exercise caution before deciding to invest

in Median Technologies securities. Investors are invited to

familiarize themselves with the risks associated with this

transaction, as mentioned in the above press release.

Main Terms of the

Equity Line with IRIS

The equity line has been implemented through the issuance to the

benefit of Iris of warrants giving rights to bonds redeemable into

ordinary shares of the Company (the “Warrants” and the

underlying redeemable bonds the “Bonds”).

No application for admission to trading on any market whatsoever

will be made for the Warrants and the Bonds, which will

consequently not be listed.

Main characteristics of the

Warrants:

Investor/Subscriber

IRIS, a French société à responsabilité

limitée unipersonnelle with a share capital of 400,000 euros, whose

head office is located at 5 Villa Houssay, 92200 Neuilly-sur-Seine,

registered with the Nanterre business register under number 753 471

853.

Number

A single tranche of 4,000 Warrants,

subscribed by the Investor on January 23, 2025.

Subscription price

Subscription free of charge.

Transfer

The Warrants may not be sold or

transferred without the Company’s prior consent, unless transferred

to an affiliate of the Investor.

Term

The unexercised Warrants will

automatically be cancelled on January 23, 2027 or at any time prior

such date at the request of the Company (provided that no Bonds

remain outstanding as at the date of such request).

Ratio

Each Warrant will carry a bond if

exercised at the Bond Subscription Price.

Legal basis of the Warrant issue

The Warrants have been issued by decision

of the Company's Board of Directors convened On January 23, 2025,

acting upon delegation of the combined general shareholders’

meeting convened on June 19, 2024 under the terms of its 18th

resolution, in accordance with articles L. 225-129-2, L. 22-10-49,

L. 225 135, L-225-138 and L. 228-91 et seq. of the French

Commercial Code.

Main characteristics of the

Bonds:

Tranches

The Investor has undertaken to subscribe

during a 24-month period (i.e. by January 23, 2027) to 4,000 Bonds

upon exercise of the Warrants in six (6) tranches (the first of

4,000,000 euros, the second of 2,500,000 euros, the third to fifth

of 1,000,000 euros each and the sixth and last of 500,000 euros).

Each Bond has a par value of 2,500 euros, representing a total

maximum amount of 10 million euros.

The exercise of each tranche by the

Investor is subject to certain conditions provided for in the issue

agreement granted to its benefit (no event of default, significant

unfavorable change or change to Company control, Company share

listing, closing share price above a certain threshold, etc.), as

well as a 30-trading-day waiting period between each tranche, it

being specified that such waiting period may be reduced (i) by

mutual agreement between the Company and the Investor or (ii) by

the Company alone, in the event that all of the Bonds of the

previous tranche have been redeemed.

Suspension and reactivation

The Company will be entitled to suspend

and reactivate the withdrawal of the tranches without penalty. The

24-month undertaking period will be extended to cover any

suspensions and reactivations requested by the Company.

Bond Subscription Price

100% of the face value of the Bonds, i.e.

2,500 euros per Bond.

Maturity

Thirty (30) months starting from the issue

date.

Interest rate

0%

Transfer

The Bonds may not be transferred to a

third party without the Company’s prior consent, unless transferred

to a person affiliated with the Investor.

Redemption

The Investor will have the right to

request at any time the redemption of all or part of its Bonds in

ordinary shares of the Company. The Investor has nevertheless

undertaken that the shares it sells on the trading day following

the publication by the Company of a press release will not exceed a

certain trading volume of Median Technologies shares on such day,

if the Company so requests.

Redemption at due date

If the Bonds have not been redeemed for

shares or repurchased by the due date, the Bond bearer must request

redemption in shares.

Early redemption

The Company will be entitled to redeem the

Bonds in circulation at 105% of their face value on its own

initiative.

Event of default

Default notably includes failure to meet

commitments on the part of the Company under the terms of the Bond

issue agreement, payment default on another of the Company’s

significant debts, Company share delisting, or a change of control,

etc. On the other hand, there are no financial covenants.

Bond Redemption Price

The Bond redemption price for new Company

shares is equal to 95% of the volume-weighted average prices over

the twenty-five (25) trading days immediately preceding the Bond

redemption date. Notwithstanding the above, the parties may agree

on a Bond redemption price in the event of the block sale of shares

resulting from redemption of said Bonds by the Investor.

It is also specified that the redemption

price of the Bonds may not under any circumstances be less than

either (i) the minimum price set by the Board of Directors of the

Company, i.e. the volume-weighted average prices over the trading

day immediately preceding the Bond redemption date or (ii)the

minimum price set by the Combined General Meeting of Shareholders

of the Company on June 19, 2024, i.e. the average closing price of

the Company's ordinary share over the twenty (20) trading days

preceding the redemption date of the Bonds, less a discount of 20%,

or (iii) the nominal value of the shares of the Company.

This discount allows the Investor – which

acts as a financial intermediary and is not intended to remain a

shareholder of the Company – to guarantee subscription of shares

despite the possible volatility of the financial markets.

New shares

New ordinary shares of the Company issued

on redemption of the Bonds will bear current dividend rights. They

will have the same rights as those attached to existing ordinary

shares and be admitted for trading on the Euronext Growth market on

Euronext Paris. The Company will publish the number of shares

issued in connection with this equity line on its website.

Potential dilution – Maximum share

number

Pursuant to the decision of the Company's

Board of Directors on January 23, 2025, the maximum number of

shares for issue on redemption of Bonds has been set at 10,000,000

shares.

By way of illustration, assuming issuance

of all the Bonds and the volume-weighted average prices over the

trading day immediately preceding the Bond redemption date

identical to those of the trading day immediately preceding the

Board of Directors’ meeting dated January 23, 2025, the number of

new Company shares for subscription by the Investor either pursuant

to the Reserved Issue (as such term is defined below) or on

redemption of the Bonds in new ordinary shares would be 3,081,362

shares, representing approximately 14% of the share capital* (on a

non-diluted basis). The stake of a shareholder with 1% of the

Company’s share capital not participating in the operation would

then decrease by 0.89%. To the Company's knowledge, on the basis of

the same assumptions, the distribution of its share capital before

and after redemption of all the Bonds in shares will be as

follows:

On January 23, 2025

After redemption of all

bonds

Shareholders

Shares

%

Shares

%

Furui Medical Science Company

Luxembourg

1,507,692

8.1%

1,507,692

7.0%

Celestial Successor Fund LP

1,288,958

7.0%

1,288,958

6.0%

Founders, Management,

Employees

1,249,548

6.7%

1,249,548

5.8%

Canon Inc

961,826

5.2%

961,826

4.5%

Abingworth Bioventures VI LP

956,819

5.2%

956,819

4.4%

Others

12,567,140

67.8%

15,648,502

72.4%

Total

18,531,983

100%

21,613,345

100%

* On the date of this press release, the Company has a share

capital of 926,599.15 euros divided into 18,531,983 shares,

including 18,508,782 ordinary shares.

General principles of the equity

line

Conflict of Interest

To the best of the Company's knowledge,

the implementation of the equity line does not create any conflicts

of interest with respect to its corporate officers and

directors.

Arrangement Fee – Reserved Issue

In consideration for its draw down

commitment, Iris will receive an arrangement fee equal to 5% of the

amount of the tranches actually drawn. The amount of the

arrangement fee, due before the 1st tranche is drawn down, will

initially be calculated on the basis of the maximum aggregate

amount of the equity line then, as the case may be, adjusted in

light of the number of tranches actually drawn down.

The arrangement fee will be paid by

offsetting against the subscription price of the 99,403 shares that

the Company has undertaken to issue to Iris, concomitantly to the

implementation of the equity line. The subscription price of these

shares is equal to 5.03 euros, equal to the volume-weighted average

share price on the trading day immediately preceding its setting,

without any discount (the “Reserved Issue”). This Reserved Issue

will be made on the same legal basis as the issue of the Warrants

(as described above).

Risks related to the equity line

Sale of the shares which are issued by the

Company in the context of the equity line and the Reserved Issue on

the market by Iris, which does not intend to remain a shareholder

of the Company, is liable to impact the volatility and liquidity of

the share and exert downward pressure on the Company’s share price.

The shareholders of the Company may also suffer significant

dilution as a result of the use of the equity line and of the

Reserve Issue. The total amount of the Bonds issue is not

guaranteed, as it is dependent in particular on the fulfillment of

the above-mentioned conditions.

The public’s attention is also drawn to

the risk factors relative to the Company and its business,

presented in its annual financial report published on April 25,

2024, which is available free of charge on the Company website and,

in particular, the Company's short- to medium-term financing

requirements in view of its current financing horizon limited to Q4

2025 (based on the assumptions provided for in the second page of

this press release). The occurrence of all or some of these risks

is liable to have an unfavorable effect on the Company's business,

financial situation, results, development or prospects.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250123654213/en/

MEDIAN TECHNOLOGIES Emmanuelle Leygues Head of Corporate

Marketing & Financial Communications +33 6 10 93 58 88

emmanuelle.leygues@mediantechnologies.com

Investors Ghislaine Gasparetto SEITOSEI ACTIFIN

+33 6 21 10 49 24 ghislaine.gasparetto@seitosei-actifin.com

U.S. media & investors Chris Maggos COHESION

BUREAU +41 79 367 6254 chris.maggos@cohesionbureau.com

Press Caroline Carmagnol ALIZE RP +33 6 64 18 99

59 median@alizerp.com

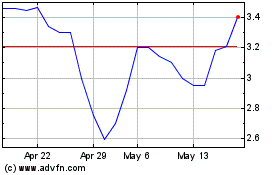

Median Technologies (EU:ALMDT)

Historical Stock Chart

From Feb 2025 to Mar 2025

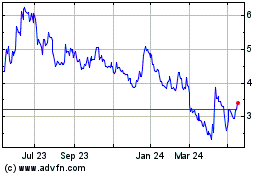

Median Technologies (EU:ALMDT)

Historical Stock Chart

From Mar 2024 to Mar 2025