Aramis Group - 2024 first-quarter activity

PRESS RELEASE

Arcueil, January 24, 2024

2024 first-quarter activity

Strong revenue

growth,driven by solid growth in sales of

refurbished vehiclesand a continued rebound in

pre-registered vehicles

Revenues at December 31, 2023, first quarter of

the fiscal year ending September 30, 2024

- First quarter 2024

revenues of 527.0 million euros, up +20.0%

- Total sales of

vehicles to private customers increased by +31.9% compared to the

first quarter of 2023, reaching 26,442 units, which represents an

outperformance of +31 points relative to the market1

- Increase of +18.0%

to 20,817 units in the volumes of refurbished vehicles sold and a

growth of +134.2% to 5,625 units in the volumes of pre-registered

vehicles sold

- Performance driven

by all countries, with double-digit growth, except for Spain which

continues its transition

- Customer

satisfaction remains very high, with an NPS2 of 70 at the end of

December, the result of a unique business model driven by the

strong commitment of the teams and dedicated to a distinctive

offering tailored to customer needs. Through its extensive network

of suppliers, experienced teams, and data and technological

solutions, Aramis Group is able to quickly identify the most

competitive sourcing opportunities in a market that is moving

towards normalization

- 2024 objectives

confirmed: at constant scope, the volumes of B2C vehicles sold by

Aramis Group will exceed the milestone of 100,000 units, and the

Group will generate an adjusted EBITDA at least twice that achieved

in 2023

Nicolas Chartier and Guillaume Paoli,

co-founders3 of Aramis

Group: “Aramis Group continues its growth

trajectory in 2024 and consolidates its European leadership,

despite a market that remains somewhat uncertain. Thanks to the

strong commitment of its teams and the antifragile business model

developed since the Group's inception 22 years ago, it has once

again been able to react quickly to market changes and benefit from

shifts in its environment.In the first quarter of 2024, Aramis

Group achieved double-digit growth in almost all its geographies, a

performance much higher than the market overall. Besides the

continued rebound of the pre-registered vehicle segment, the good

management of our competitive advantages in the refurbished vehicle

segment is generating market share gains. In particular, we have

capitalized on our significant multichannel supply network and our

on-the-ground proximity to seize opportunities with professionals

and satisfy an ever-increasing number of customers through our

offering of quality vehicles at the right price.In the coming

months, we will maintain our commercial efforts, control of our

margins, costs, and inventory, in order to fuel our market share

conquest in a responsible and sustainable manner. We also note

encouraging signs in recent market dynamics. We confirm our annual

objectives.”

2024

FIRST-QUARTER ACTIVITY

Overview of volumes and

revenues

2024 first-quarter B2C

volumes

|

In units |

Reported basis |

|

|

Q1 2024 |

Q1 2023 |

Change (%) |

|

Refurbished cars |

20,817 |

17,639 |

+18.0% |

|

Pre-registered cars |

5,625 |

2,402 |

+134.2% |

|

Total B2C volumes |

26,442 |

20,041 |

+31.9% |

2024 first-quarter revenues

By segment

|

In million of euros |

Reported basis |

|

|

Q1 2024 |

Q1 2023 |

Change (%) |

|

Refurbished cars |

360.5 |

314.2 |

+14.7% |

|

Pre-registered cars |

100.0 |

48.2 |

+107.4% |

|

Total B2C |

460.5 |

362.4 |

+27.1% |

|

Total B2B |

39.6 |

52.6 |

-24.7% |

|

Total services |

26.9 |

24.2 |

+10.9% |

|

Revenues |

527.0 |

439.2 |

+20.0% |

By country

|

In million of euros |

Reported basis |

|

|

Q1 2024 |

Q1 2023 |

Change (%) |

|

France |

231.1 |

186.3 |

+24.0% |

|

Belgium |

63.3 |

53.0 |

+19.4% |

|

Spain |

74.5 |

92.8 |

-19.7% |

|

United Kingdom |

101.7 |

74.3 |

+36.9% |

|

Austria |

49.8 |

32.0 |

+55.7% |

|

Italy |

6.6 |

0.9 |

+644.7% |

|

Revenues |

527.0 |

439.2 |

+20.0% |

Analysis of revenues by

segment

B2C – sales of cars to private customers (87% of

revenues)

Revenues for the B2C segment –

corresponding to sales of refurbished and pre-registered cars to

private customers – reached €460.5 million in the first quarter of

2024, an increase of +27.1% compared to the first quarter of 2023.

Aramis Group sold 26,442 B2C vehicles during the period, a growth

of +31.9% compared to last year, and an outperformance of 31

points4 compared to the market for used vehicles less than 8 years

old, which is the Group's core target.

In detail, revenues for the refurbished

car segment amounts to €360.5 million, growing by +14.7%

compared to the first quarter of 2023. 20,817 vehicles were

delivered, marking a progression of +18.0%.

Volumes are positively oriented across all

geographies, except in Spain. This performance is undoubtedly the

result of our ability to identify and seize market opportunities,

through a unique business model, committed teams, and technology

dedicated to satisfying our customers.

However, activity in Spain remains behind.

Clicars, the Spanish subsidiary of the Group, after 6 years of

exponential growth, continues its transition. Since last summer,

the company has been particularly focused on establishing a

reasoned territorial presence in Spain, shifting its mix towards

more accessible vehicles, and improving the refurbishing processes

at its Villaverde center. A return to a growth trajectory is

expected for the second half of

2024 As for the

average selling price of refurbished vehicles, it is slightly down

(c. -3%), reflecting both mix effects and the impact of the erosion

of selling prices in the used vehicle market in general. The

decline of the latter has notably accelerated in the United Kingdom

since September.

Revenues for the pre-registered car

segment amount to €100.0 million, more than doubling

(+107.4%) compared to the first quarter of 2023. 5,625 vehicles

were delivered, representing a significant increase of +134.2%. The

French (Aramisauto) and Belgian (Cardoen) subsidiaries of the Group

have been particularly agile in fully benefiting from the recovery

of this market segment.

The evolution of the average selling price of

pre-registered vehicles is mainly due to mix effects.

B2B – sales of cars to professional customers (8% of

revenues)

The B2B segment revenues amount to €39.6

million, a decrease of -24.7% compared to the first quarter of

2023, mainly due to a change in the supply mix. The sourcing of

used vehicles from private individuals - a portion of which is

resold to professionals, mostly vehicles over 8 years old or more

than 150,000 km - was less frequent during the period. Conversely,

sourcing of used vehicles from Stellantis doubled compared to the

first quarter of 2023, returning to levels close to those reached

pre-crisis. Moreover, the return to a more usual functioning of the

automotive market, particularly through the improvement in the

availability of recent used vehicles via professional channels, has

led Aramis Group to evolve its sourcing mix to ensure an ever more

attractive offer of quality vehicles at competitive prices for its

customers.

Services (5% of revenues)

Services, finally, generated revenues of 26.9

million euros, an increase of +10.9% compared to the first quarter

of 2023. The contribution from financing solutions tends to erode

in a context of higher interest rates.

OUTLOOK

Aramis Group is observing encouraging signs in

market dynamics.

Although still well below pre-crisis levels (c.

-19%5 compared to the first quarter of 2019), the used car market

has regained a positive orientation in the period between October

and December 2023 (first fiscal quarter of 2024 for Aramis Group),

showing a +1% increase compared to the same period in 2022.

Furthermore, its way of operating is tending to return to a more

usual pattern, with new car production exceeding demand leading to

pre-registrations, and increased availability of recent used

cars.

Moreover, the selling prices of used vehicles

have been trending downwards for several quarters now, with an

acceleration noted in the United Kingdom in recent months. Although

household budgets remain exposed to macroeconomic uncertainties,

the downward price trend is likely to support future demand.

In this context, Aramis Group is approaching

2024 with confidence. The Group reiterates its objectives for the

current fiscal year, namely to generate:

- at constant scope, B2C vehicle

sales volumes of at least 100,000 units;

- an adjusted EBITDA at least twice

that achieved in 2023

***

Next financial information:

2024 first-half results: May 27, 2024 (after

market close)

About Aramis Group –

www.aramis.group

Aramis Group is the European leader for B2C

online used car sales and operates in six countries. A growing

group, an e-commerce expert and a vehicle refurbishing pioneer,

Aramis Group acts each day for more sustainable mobility with an

offering that is part of the circular economy. Founded in 2001, it

has been revolutionizing its market for over 20 years, focused on

ensuring the satisfaction of its customers and capitalizing on

digital technology and employee engagement to create value for all

its stakeholders. With full-year revenues of nearly €2 billion,

Aramis Group sells more than 90,000 vehicles B2C and welcomes more

than 70 million visitors across all its digital platforms each

year. The Group employs more than 2,500 people and has eight

industrial-scale refurbishing sites throughout Europe. Aramis Group

is listed on Euronext Paris Compartment B (Ticker: ARAMI – ISIN:

FR0014003U94).

Disclaimer

Certain information included in this press

release is not historical data but forward-looking statements.

These forward-looking statements are based on current beliefs and

assumptions, including, but not limited to, assumptions about

current and future business strategies and the environment in which

Aramis Group operates, and involve known and unknown risks,

uncertainties and other factors, which may cause actual results or

performance, or the results or other events, to be materially

different from those expressed or implied in such forward-looking

statements. These risks and uncertainties include those discussed

or identified in Chapter 4 “Risk Factors and Control Environment”

of the Universal Registration Document dated December 19, 2023,

approved by the AMF under number D. 23-0864 and available on the

Group’s website (www.aramis.group) and on the AMF website

(www.amf-france.org). These forward-looking statements and

information are not guarantees of future performance.

Forward-looking statements speak only as of the date of this press

release. This press release does not contain or constitute an offer

of securities or an invitation or inducement to invest in

securities in France, the United States or any other

jurisdiction.

Investors contact

Alexandre LeroyHead of Investor Relations, Financing and Cash

Managementalexandre.leroy@aramis.group

+33 (0)6 58 80 50 24

Press contacts

BrunswickHugues Boëton Tristan Roquet

Montegon

aramisgroup@brunswickgroup.com+33 (0)6 79 99 27

15

1 Market for used vehicles less than 8 years

old, on average across the 6 geographies of the Group, source

S&P Global and Aramis Group2 Net Promoter Score3 Guillaume

Paoli is Chairman and Chief Executive Officer of the Company, and

Nicolas Chartier is Deputy Chief Executive Officer, based on a

two-year rotation4 On average across the 6 geographies of the

Group, source S&P Global and Aramis Group5 Market for used

vehicles less than 8 years old, on average across the 6 geographies

of the Group, source S&P Global and Aramis Group

- Press release - ARAMIS GROUP - 2024 first-quarter activity

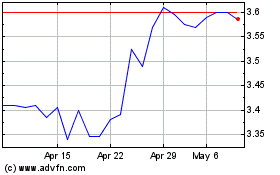

Aramis (EU:ARAMI)

Historical Stock Chart

From Jan 2025 to Feb 2025

Aramis (EU:ARAMI)

Historical Stock Chart

From Feb 2024 to Feb 2025