Brunel continues strong upward trend

Amsterdam, 28 October 2022 – Brunel International N.V. (Brunel;

BRNL), a global provider of flexible workforce solutions and

expertise, today announced its third quarter 2022 results.

Key points Q3 2022

- EBIT up 28% to EUR 17.4 million, 27%

like-for-like, driven by high operating leverage;

- Revenue up 33% to EUR 302 million,

20% like-for-like with growth in all regions;

- Financial position further improved

with net cash at EUR 73.6 million;

- Continued to extend capabilities

through M&A with acquisition of ICE in Singapore, a small

technical services company.

Key points YTD 2022

- EBIT up 35% to EUR 43.1 million, 32%

growth like-for-like;

- Revenue up 32% to EUR 866 million,

19% like-for-like;

- Gross profit increase of 23%

compared to YTD 2021.

Jilko Andringa, CEO of Brunel

International N.V.:“Our strong performance and high growth

continues, as we are well positioned to take advantage of the

megatrends towards a more sustainable world. Energy, energy

transition and renewables in particular remain big themes and are

expected to continue to drive demand for engineering specialists

and subsequently our recruiting and contracting solutions.

We are ahead of our long-term plan and see plenty of

opportunities to continue on that path. Our organization shows

great speed, agility and delivers high quality services to more and

more clients on many pioneering projects, while continuing to

realize attractive margins.

We manage to navigate the increasing uncertainty in the world

well. We closely monitor the potential impact of the situation in

the Ukraine, the development of inflation and interest rates and

the consequences of a next COVID outbreak.

Energy markets and commodity prices result in a significant

increase in investments in these markets, both in conventional as

well as in renewable energy. Especially in our regions outside

Europe we continue to grow very fast. Supported by the acquisition

of Taylor Hopkinson, our revenue in renewable energy alone

increased by almost 300% year on year, creating a world leading

proposition in renewable recruitment and contracting solutions.

We recently acquired ICE, a technical service company based in

Singapore, to better support our clients in their capacity need and

project management through all phases of their CAPEX investments.

ICE is specialized in commissioning services and forms a great

addition to our skillset and portfolio of services. The outlook for

the market for commissioning is very bright and we look forward to

increase our footprint in that market.

This quarter we organized a global training for our organization

on diversity, inclusion and belonging. I’m proud to see how firmly

this focus is embedded in our culture.

All in all, our outlook remains positive as the current upward

trend is expected to continue.”

ESG strategyOur diversification strategy with a

primary focus on the renewables sector is testament to our

commitment to contribute to our clients’ energy transition.

Consistent with our commitments we pursue our efforts to reduce our

CO2 emission, whilst we continue to offset the remainder. The

Brunel Foundation, which will see its 10th anniversary in Q4

2022, has continuously inspired us to positively impact the

environment and contribute to a better society. Numerous people

with autism were touched through the Foundation’s initiatives to

positively influence the labor market; over 360,000 pieces of

litter were picked in the Global Trash ‘n Trace challenge and over

16,000 trees planted in the Brunel Foundation Global

Forest.

|

Brunel International (unaudited) |

| P&L

amounts in EUR million |

|

|

|

|

|

|

|

|

|

|

Q3 2022 |

Q3 2021 |

Δ% |

|

|

YTD 2022 |

YTD 2021 |

Δ% |

|

| Revenue |

301.8 |

227.2 |

33% |

a |

|

865.5 |

654.3 |

32% |

d |

| Gross Profit |

65.6 |

54.3 |

21% |

|

|

186.4 |

151.1 |

23% |

|

| Gross margin |

21.7% |

23.9% |

|

|

|

21.5% |

23.1% |

|

|

| Operating costs |

47.2 |

40.7 |

16% |

b |

|

140.1 |

119.2 |

18% |

e |

| Operating result |

18.4 |

13.6 |

35% |

|

|

46.3 |

31.9 |

45% |

|

| Earn out related share based

payments* |

1.0 |

- |

|

|

|

3.2 |

- |

|

|

| EBIT |

17.4 |

13.6 |

28% |

c |

|

43.1 |

31.9 |

35% |

f |

| EBIT % |

5.8% |

6.0% |

|

|

|

5.0% |

4.9% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average directs |

11,008 |

9,994 |

10% |

|

|

11,199 |

9,636 |

16% |

|

| Average indirects |

1,450 |

1,299 |

12% |

|

|

1,444 |

1,303 |

11% |

|

| Ratio direct / Indirect |

7.6 |

7.7 |

|

|

|

7.8 |

7.4 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a 20 % at like-for-like |

d 19 % at

like-for-like |

|

|

|

|

|

| b 5 % at like-for-like |

e 7 % at

like-for-like |

|

|

|

|

|

| c 27 % at like-for-like |

f 32 % at

like-for-like |

|

|

|

|

|

| Like-for-like is

measured excluding the impact of currencies, acquisitions &

divestments |

|

|

|

|

|

| *Relates to the

acquisition related expenses for Taylor Hopkinson |

|

|

|

|

|

Q3 2022 results by divisionP&L amounts in

EUR million

Summary:

|

Revenue |

Q3 2022 |

Q3 2021 |

Δ% |

|

YTD 2022 |

YTD 2021 |

Δ% |

| |

|

|

|

|

|

|

|

| DACH region |

58.7 |

55.6 |

6% |

|

172.2 |

164.7 |

5% |

| The Netherlands |

45.1 |

44.4 |

2% |

|

140.0 |

136.6 |

2% |

| Australasia |

43.2 |

27.7 |

56% |

|

116.8 |

77.6 |

50% |

| Middle East & India |

37.7 |

25.7 |

47% |

|

103.4 |

75.9 |

36% |

| Americas |

38.4 |

25.4 |

51% |

|

106.2 |

69.2 |

53% |

| Rest of world |

78.6 |

48.4 |

62% |

|

227.0 |

130.3 |

74% |

| |

|

|

|

|

|

|

|

| Total |

301.8 |

227.2 |

33% |

|

865.5 |

654.3 |

32% |

|

EBIT |

Q3 2022 |

Q3 2021 |

Δ% |

|

YTD 2022 |

YTD 2021 |

Δ% |

| |

|

|

|

|

|

|

|

| DACH region |

8.1 |

7.4 |

10% |

|

18.8 |

16.8 |

12% |

| The Netherlands |

3.9 |

4.4 |

-12% |

|

11.8 |

11.6 |

1% |

| Australasia |

1.1 |

0.3 |

269% |

|

2.0 |

0.5 |

310% |

| Middle East & India |

3.5 |

2.2 |

58% |

|

9.6 |

6.7 |

44% |

| Americas |

0.7 |

0.2 |

224% |

|

1.6 |

0.3 |

491% |

| Rest of world |

3.0 |

2.2 |

37% |

|

8.0 |

5.1 |

59% |

| Unallocated |

-2.8 |

-3.1 |

8% |

|

-8.8 |

-9.0 |

3% |

| |

|

|

|

|

|

|

|

| Total |

17.4 |

13.6 |

28% |

|

43.1 |

31.9 |

35% |

Overall, we continue our strong growth trajectory. In Q3 2022,

group revenue increased by 33% or EUR 75 million year-on-year, and

20% like-for-like. Especially, business activities the energy

markets remain at a high level. We see a slight acceleration in the

DACH region, while performance in the Netherlands is flat.

The decrease in gross margin from 23.9% to 21.7% is mainly the

result of a change in the mix between Europe and the other regions.

EBIT increased by 28% or EUR 3.8 million to EUR 17.4 million.

PERFORMANCE BY REGION

|

DACH region (unaudited) |

|

| P&L

amounts in EUR million |

|

|

|

|

|

|

|

|

|

|

Q3 2022 |

Q3 2021 |

Δ% |

|

|

YTD 2022 |

YTD 2021 |

Δ% |

|

| Revenue |

58.7 |

55.6 |

6% |

|

|

172.2 |

164.7 |

5% |

|

| Gross Profit |

22.3 |

21.0 |

6% |

|

|

61.8 |

58.2 |

6% |

|

| Gross margin |

38.0% |

37.8% |

|

|

|

35.9% |

35.3% |

|

|

| Operating costs |

14.2 |

13.6 |

4% |

|

|

43.0 |

41.4 |

4% |

|

| EBIT |

8.1 |

7.4 |

10% |

|

|

18.8 |

16.8 |

12% |

|

| EBIT % |

13.8% |

13.3% |

|

|

|

10.9% |

10.2% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average directs |

2,055 |

1,972 |

4% |

|

|

2,018 |

1,936 |

4% |

|

| Average indirects |

417 |

371 |

12% |

|

|

402 |

378 |

7% |

|

| Ratio direct / Indirect |

4.9 |

5.3 |

|

|

|

5.0 |

5.1 |

|

|

The DACH region includes

Germany, Switzerland, Austria and Czech Republic. The revenue

increase in Q3 2022 is the result of the increase in headcount and

rates, partly offset by a lower productivity. Higher illness

continued, and was at 5% (Q3 2021: 4%).

Gross margin was slightly higher due to

increased rates, at a slightly lower productivity. EBIT was up 10%

at EUR 8.1 million.

Headcount as of September 30th was 2,074

(2021:1,991)

Working days Germany:

|

|

Q1 |

Q2 |

Q3 |

Q4 |

FY |

|

2022 |

64 |

60 |

66 |

62 |

252 |

|

2021 |

63 |

60 |

66 |

65 |

254 |

|

Brunel Netherlands (unaudited) |

|

| P&L

amounts in EUR million |

|

|

|

|

|

|

|

|

|

|

Q3 2022 |

Q3 2021 |

Δ% |

|

|

YTD 2022 |

YTD 2021 |

Δ% |

|

| Revenue |

45.1 |

44.4 |

2% |

|

|

140.0 |

136.6 |

2% |

|

| Gross Profit |

13.4 |

14.3 |

-6% |

|

|

41.0 |

40.3 |

2% |

|

| Gross margin |

29.7% |

32.1% |

|

|

|

29.3% |

29.5% |

|

|

| Operating costs |

9.5 |

9.9 |

-4% |

|

|

29.2 |

28.7 |

2% |

|

| EBIT |

3.9 |

4.4 |

-12% |

|

|

11.8 |

11.6 |

1% |

|

| EBIT % |

8.6% |

9.9% |

|

|

|

8.4% |

8.5% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average directs |

1,633 |

1,687 |

-3% |

|

|

1,660 |

1,713 |

-3% |

|

| Average indirects |

280 |

269 |

4% |

|

|

278 |

282 |

-2% |

|

| Ratio direct / Indirect |

5.8 |

6.3 |

|

|

|

6.0 |

6.1 |

|

|

In The Netherlands revenue

increased with 2% in Q3 2022 despite a slightly lower headcount.

The increase is attributable to higher rates, partly offset by a

lower productivity. The business lines Legal and Finance & Risk

continue to grow, while IT experienced a decline.

The lower productivity also resulted in a

decrease in gross margin of 2.4 ppt, while EBIT was down 12% at EUR

3.9 million.

We believe the market potential in The Netherlands allows us for

further growth, and the team is working very hard to return to

levels in line with market growth.

Headcount as of September 30th was 1,643 (2021:

1,680)

Working days Netherlands:

|

|

Q1 |

Q2 |

Q3 |

Q4 |

FY |

|

2022 |

64 |

61 |

66 |

64 |

255 |

|

2021 |

63 |

61 |

66 |

66 |

256 |

|

Australasia (unaudited) |

|

| P&L

amounts in EUR million |

|

|

|

|

|

|

|

|

|

|

Q3 2022 |

Q3 2021 |

Δ% |

|

|

YTD 2022 |

YTD 2021 |

Δ% |

|

| Revenue |

43.2 |

27.7 |

56% |

a |

|

116.8 |

77.6 |

50% |

d |

| Gross Profit |

4.4 |

2.9 |

52% |

|

|

11.5 |

7.9 |

45% |

|

| Gross margin |

10.2% |

10.5% |

|

|

|

9.8% |

10.2% |

|

|

| Operating costs |

3.3 |

2.6 |

27% |

b |

|

9.5 |

7.4 |

28% |

e |

| EBIT |

1.1 |

0.3 |

269% |

c |

|

2.0 |

0.5 |

310% |

f |

| EBIT % |

2.5% |

1.1% |

|

|

|

1.8% |

0.6% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average directs |

1,413 |

981 |

44% |

|

|

1,340 |

948 |

41% |

|

| Average indirects |

112 |

95 |

18% |

|

|

106 |

88 |

20% |

|

| Ratio direct / Indirect |

12.7 |

10.3 |

|

|

|

12.7 |

10.7 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a 41 % like-for-like |

d 41 % at

like-for-like |

|

|

|

|

|

| b 18 % like-for-like |

e 21 % at

like-for-like |

|

|

|

|

|

| c 209 % like-for-like |

f 255 % at

like-for-like |

|

|

|

|

|

| Like-for-like is

measured excluding the impact of currencies, acquisitions

& divestments |

|

|

|

|

|

| |

|

Australasia includes Australia

and Papua New Guinea. The strong revenue growth continued in Q3

2022 and was visible across all markets: Energy, Mining and IT,

supported by a favourable currency effect. EBIT% increased by 1.4

ppt, again reflecting strong operational leverage.

|

Middle East & India (unaudited) |

|

| P&L

amounts in EUR million |

|

|

|

|

|

|

|

|

|

|

Q3 2022 |

Q3 2021 |

Δ% |

|

|

YTD 2022 |

YTD 2021 |

Δ% |

|

| Revenue |

37.7 |

25.7 |

47% |

a |

|

103.4 |

75.9 |

36% |

b |

| Gross Profit |

6.0 |

4.2 |

44% |

|

|

16.7 |

12.3 |

37% |

|

| Gross margin |

16.0% |

16.3% |

|

|

|

16.2% |

16.2% |

|

|

| Operating costs |

2.5 |

2.0 |

25% |

b |

|

7.1 |

5.6 |

27% |

d |

| EBIT |

3.5 |

2.2 |

58% |

c |

|

9.6 |

6.7 |

44% |

f |

| EBIT % |

9.2% |

8.6% |

|

|

|

9.3% |

8.9% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average directs |

2,275 |

2,068 |

10% |

|

|

2,220 |

2,056 |

8% |

|

| Average indirects |

142 |

125 |

13% |

|

|

135 |

125 |

8% |

|

| Ratio direct / Indirect |

16.1 |

16.5 |

|

|

|

16.5 |

16.5 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a 27 % like-for-like |

d 22 % at

like-for-like |

|

|

|

|

|

| b 13 % like-for-like |

e 17 % at

like-for-like |

|

|

|

|

|

| c 35 % like-for-like |

f 27 % at

like-for-like |

|

|

|

|

|

| Like-for-like is

measured excluding the impact of currencies, acquisitions &

divestments |

|

|

|

|

|

| |

|

Middle East & India

includes Qatar, Kuwait, UAE, Iraq and India. In addition to the

high business activity levels in Qatar, we also see the yard

activity in Dubai increasing.

|

Americas (unaudited) |

|

| P&L

amounts in EUR million |

|

|

|

|

|

|

|

|

|

|

Q3 2022 |

Q3 2021 |

Δ% |

|

|

YTD 2022 |

YTD 2021 |

Δ% |

|

| Revenue |

38.4 |

25.4 |

51% |

a |

|

106.2 |

69.2 |

53% |

b |

| Gross Profit |

5.3 |

3.4 |

56% |

|

|

14.4 |

9.1 |

58% |

|

| Gross margin |

13.9% |

13.5% |

|

|

|

13.5% |

13.1% |

|

|

| Operating costs |

4.6 |

3.2 |

44% |

b |

|

12.8 |

8.8 |

45% |

d |

| EBIT |

0.7 |

0.2 |

224% |

c |

|

1.6 |

0.3 |

491% |

f |

| EBIT % |

1.8% |

0.8% |

|

|

|

1.5% |

0.4% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average directs |

938 |

816 |

15% |

|

|

901 |

801 |

13% |

|

| Average indirects |

128 |

104 |

23% |

|

|

121 |

102 |

19% |

|

| Ratio direct / Indirect |

7.3 |

7.8 |

|

|

|

7.4 |

7.8 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a 31 % like-for-like |

d 36 % at

like-for-like |

|

|

|

|

|

| b 27 % like-for-like |

e 30 % at

like-for-like |

|

|

|

|

|

| c 163 % like-for-like |

f 382 % at

like-for-like |

|

|

|

|

|

| Like-for-like is

measured excluding the impact of currencies, acquisitions &

divestments |

|

|

|

|

|

The Americas includes

Canada, USA, Brazil, Guyana and Suriname. The strong revenue growth

in Q3 2022 was visible in almost all countries with only Brazil

trailing slightly. The growth is mainly driven by the start of new

energy and energy transition related projects and a favourable

currency effect.

Operating costs increased as a result of

investments in the sales force. Overall, EBIT continued to

increase, in line with our five-year plan.

|

Rest of world (unaudited) |

|

| P&L

amounts in EUR million |

|

|

|

|

|

|

|

|

|

|

Q3 2022 |

Q3 2021 |

Δ% |

|

|

YTD 2022 |

YTD 2021 |

Δ% |

|

| Revenue |

78.6 |

48.4 |

62% |

a |

|

227.0 |

130.3 |

74% |

b |

| Gross Profit |

14.1 |

8.6 |

64% |

|

|

41.0 |

23.4 |

75% |

|

| Gross margin |

17.9% |

17.7% |

|

|

|

18.1% |

18.0% |

|

|

| Operating costs |

10.1 |

6.4 |

58% |

b |

|

29.8 |

18.3 |

63% |

d |

| Operating result |

4.0 |

2.2 |

84% |

|

|

11.2 |

5.1 |

120% |

|

| Earn out related share based

payments* |

1.0 |

- |

|

|

|

3.2 |

- |

|

|

| EBIT |

3.0 |

2.2 |

37% |

c |

|

8.0 |

5.1 |

59% |

f |

| EBIT % |

3.8% |

4.5% |

|

|

|

3.5% |

3.9% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average directs |

2,693 |

2,471 |

9% |

|

|

3,061 |

2,182 |

40% |

|

| Average indirects |

314 |

273 |

15% |

|

|

343 |

266 |

29% |

|

| Ratio direct / Indirect |

8.6 |

9.0 |

|

|

|

8.9 |

8.2 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a 27 % like-for-like |

d 30 % at

like-for-like |

|

|

|

|

|

| b 7 % like-for-like |

e 9 % at

like-for-like |

|

|

|

|

|

| c 89 % like-for-like |

f 85 % at

like-for-like |

|

|

|

|

|

| Like-for-like is

measured excluding the impact of currencies acquisitions &

divestments |

|

|

|

|

|

| *Relates to the

acquisition related expenses for Taylor Hopkinson |

|

|

|

|

|

Rest of World includes Asia,

Belgium, Taylor Hopkinson and rest of Europe & Africa. The main

driver of growth in Q3 2022 continued to be Asia due to higher

volumes on construction projects. Taylor Hopkinson had another

strong quarter as the accelerated energy transition continues to

increase the demand for specialists in the renewables sector.

Until the divestment in June 2022, Rest of World also included

the results for our activities in Russia.

Acquisition of International Commissioning &

Engineering Pte Ltd (ICE)In Q3 2022, Brunel acquired 51%

of the shares of Singapore-based technical services company

International Commissioning & Engineering Pte Ltd (ICE). By

combining ICE’s specialist project assurance, execution &

delivery expertise with Brunel’s existing global recruitment,

workforce and mobilisation services, we can offer a unique

combination of capabilities.

Established in 2007, ICE is a Project Risk Assurance and

Commissioning & Start-Up company which specializes in the

coordination and delivery of large-scale Oil & Gas,

Infrastructure and Energy projects. ICE’s management services span

the complete project lifecycle, providing effective oversight and

assurance across all phases from initial assessment through to

construction, commissioning and operation.

The upfront payment connected to the acquisition of the 51% of

the shares amounts to EUR 0.8 million, with conditional future

payments of EUR 1.2 million. We have agreed to acquire the

remaining 49% after three years at a price that’s conditional to

the performance over the next three years. The current standalone

revenue of ICE is limited, but we are already experiencing

significant interests in our combined capabilities.

Cash positionThe cash balance

at 30 September 2022 increased to EUR 73.6 million from EUR 58.3

million at 30 June 2022 (and EUR 112.0 million per 31 December

2021), of which EUR 22.1 million restricted. The increase is

in line with normal seasonality, supported by improved collection

and favourable exchange rates.

Outlook Overall, the current

upward trend is expected to continue. The year-on-year comparison

for Q4 2022, as well as the sequential comparison to Q3 2022, will

be impacted by the lower number of working days in DACH and the

Netherlands.

Attachment:Press Release Q3 2022Source: Brunel

International NV

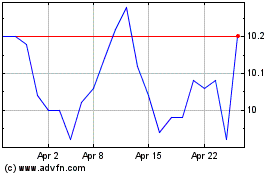

Brunel International NV (EU:BRNL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Brunel International NV (EU:BRNL)

Historical Stock Chart

From Jan 2024 to Jan 2025