AXA 1Q Revenue Rose, Solvency Ratio Improved

05 May 2021 - 2:18AM

Dow Jones News

By Joshua Kirby

AXA SA said Tuesday that revenue in the first quarter increased

on a comparable basis, driven by growth in the company's preferred

segments.

The French insurer posted revenue of 30.7 billion euros ($37.04

billion), up 2% on a comparable basis from the same period the

previous year.

Revenue in the preferred-segments division came to EUR19.9

billion, up 3% on the same basis, with asset management seeing the

biggest increase at 17% on the year.

Annual premium equivalent came to EUR1.63 billion, down from

EUR1.71 billion the previous year. AXA's solvency II ratio --a key

measure of financial strength for insurance companies-- was 208% at

the end of the quarter, up 8 percentage points from the end of

2020.

U.S. subsidiary AXA XL delivered a revenue increase of 4% in the

quarter, thanks to price increases and underwriting discipline, the

company said. The business is set to meet its EUR1.2 billion

underlying earnings target for 2021, despite catastrophe costs from

the severe winter freeze in Texas.

Write to Joshua Kirby at joshua.kirby@wsj.com;

@joshualeokirby

(END) Dow Jones Newswires

May 04, 2021 12:03 ET (16:03 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

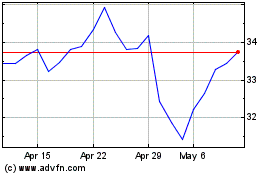

Axa (EU:CS)

Historical Stock Chart

From Jan 2025 to Feb 2025

Axa (EU:CS)

Historical Stock Chart

From Feb 2024 to Feb 2025

Real-Time news about Axa (Euronext): 0 recent articles

More Axa News Articles