Dassault Systèmes Reports 2021 First Quarter Results Above the High

End of Company Guidance

Dassault Systèmes

Reports 2021

First Quarter

Results Above

the High End of

Company Guidance

VÉLIZY-VILLACOUBLAY,

France — April 28, 2021

— Dassault Systèmes (Euronext Paris: #13065, DSY.PA) announces IFRS

unaudited financial results for the first quarter ended March 31,

2021. The Group’s Board of Directors reviewed these results on

April 27, 2021. This press release also includes financial

information on a non-IFRS basis and reconciliations with IFRS

figures in the Appendix to this communication.

First Quarter

Highlights and Financial

Summary(Unaudited, revenue growth in constant currencies,

EPS presented on a diluted basis)

-

IFRS EPS of €0.66, up

54% and non-IFRS EPS of €1.14, up

20%, 28% in constant

currencies

- On an

organic basis, non-IFRS

software revenue up

10%

-

Non-IFRS

licenses and other

software revenue up

25%, on upside

principally from China, North America

and Northern Europe

-

Non-IFRS software

revenue: Mainstream Innovation up 20% on

SOLIDWORKS and CENTRIC PLM; Life Sciences

up 16% with strong MEDIDATA

performance; Industrial Innovation up

4%

-

Cash flow from

operations up 40% to

€642

million

- 2021 Non-IFRS

objectives: Reaffirms

revenue up 9-10%;

Upgrades EPS to

€4.24-4.28,

up

17-18%

in constant currencies

Bernard Charlès, Dassault Systèmes’ Vice

Chairman and Chief Executive Officer commented, “It is

very clear from discussions with our clients and partners that

industries are entering a new cycle of innovation driven by

sustainability and characterized by a human-centric approach. These

trends were very recently highlighted at the Shanghai Auto Show,

where companies advanced timelines for their next generation

portfolios and mobility experiences.

“Similarly, in Infrastructure & Cities, we

are pleased to announce the extension of our strategic partnership

with Bouygues Construction. By bringing the virtual twin experience

to the construction industry, we’re introducing onto the market new

sustainable experiences - all on the cloud and mobile enabled -

empowering all actors in the value chain to collaborate and

innovate.

“The accelerated pace of innovation required in

the three sectors of the global economy we are addressing,

Manufacturing, Life Sciences & Healthcare, and Infrastructure

& Cities, can only be achieved by the continued platformization

of industries. With our 3DEXPERIENCE platform,

coupling Mod-Sim with extensive data capabilities, we are well

positioned to help customers become platform-driven. Building on a

rich portfolio of data driven Industry Processes and Roles, the

3DEXPERIENCE platform enables to reveal real world

data, from many disparate sources, elevated to a consistent

actionable semantic, and activate them into virtual twin

experiences of the products, assets, manufacturing facilities, or

even enterprises, themselves.”

Financial Summary

|

In millions of Euros, except per share data and percentages |

|

IFRS |

|

Non-IFRS |

|

|

Q1 2021 |

Q1 2020 |

Change |

Change in constant

currencies |

|

Q1 2021 |

Q1 2020 |

Change |

Change in constant

currencies |

|

Total Revenue |

|

1,172.9 |

1,134.7 |

3% |

9% |

|

1,173.6 |

1,144.4 |

3% |

8% |

|

Software Revenue |

|

1,067.8 |

1,014.2 |

5% |

11% |

|

1,068.4 |

1,023.0 |

4% |

10% |

|

Operating Margin |

|

19.7% |

13.3% |

+6.3pts |

|

|

33.9% |

29.2% |

+4.7pts |

|

|

Diluted EPS |

|

0.66 |

0.43 |

54% |

|

|

1.14 |

0.95 |

20% |

28% |

First Quarter 2021 versus 2020

Financial Comparisons(Unaudited, all revenue

growth rates in constant currencies)

- Total

Revenue: Total revenue increased 9% (IFRS). On a non-IFRS

basis, total revenue of €1.17 billion increased 8%.

- Software

Revenue: Software revenue grew 11% (IFRS) and 10%

(non-IFRS). On an organic basis, non-IFRS software revenue

increased 10%. Non-IFRS recurring software revenue, representing

81% of total software in the quarter, grew by 7%, with subscription

revenue up double-digits driven by MEDIDATA. Licenses and other

software revenue increased 25% (IFRS and non-IFRS on an organic

basis) to €203.8 million. During the first quarter, the Group

benefited from a strong performance in Mainstream Innovation and

large deal activity, in particular in Transportation &

Mobility. From a geographic perspective, results were particularly

good in Asia, led by China and Korea, and recorded strong growth in

North America, Northern and Southern Europe.

-

Operating Income and Margin: IFRS

operating income increased 53%. On a non-IFRS basis, operating

income of €397.4 million increased 19% as reported and 27% at

constant rate. The non-IFRS operating margin increased to 33.9%

from 29.2%, with underlying growth of about 510 basis points offset

in part by a net negative currency impact of about 40 basis

points.

-

Earnings per Share: IFRS diluted

earnings per share increased 54%. On a non-IFRS basis, diluted

earnings per share of €1.14 came in above the high end of the

Company’s guidance, growing 20% as reported or 28% excluding

currency headwinds.

-

Operating Cash Flow: Operating

cash flow totaled €641.8 million in the first quarter, up 40%

reflecting both strong growth in net income adjusted for non-cash

items, and non-operating working capital.

Balance Sheet Information

Dassault Systèmes’ net financial debt as at

March 31, 2021 decreased by €559 million to €(1.48) billion,

compared to €(2.04) billion as at December 31, 2020, reflecting

cash, cash equivalents and short-term investments of €2.71 billion

and debt related to borrowings of €4.19 billion as at March 31,

2021.

First Quarter 2021

Highlights by Product

Line(unaudited, all revenue growth rates in constant

currencies)

Industrial Innovation IFRS and

non-IFRS software revenue was €609 million in the first quarter and

represented 57% of total software revenue.

- Industrial

Innovation software performance was led by SIMULIA, with its

multi-physics portfolio, and NETVIBES, in data intelligence.

-

3DEXPERIENCE non-IFRS software revenue increased

18%, with licenses and other software revenue up sharply.

- Industrial

Innovation sales activities were a large contributor to the Group’s

Transportation & Mobility software revenue results, which

increased 14% (non-IFRS) in Q1, with a number of large transactions

with global manufacturers and start-ups. The Group noted an initial

recovery in the Transportation & Mobility supply network.

- Gartner Group

published its Manufacturing Execution Systems Magic Quadrant with

DELMIA positioned in the leaders’ quadrant for the fourth year in a

row.

Life Sciences software revenue

was €209 million (IFRS) and €210 million (non-IFRS) in the first

quarter, and represented 20% of total software revenue (IFRS and

non-IFRS).

- MEDIDATA

delivered a strong Q1 driven by momentum with mid-market customers

and key product areas including Rave EDC, Patient Cloud and Acorn

AI.

- Furthermore,

the Life Sciences & Healthcare sector non-IFRS software revenue

grew 16%, benefiting from growth in the Life Sciences product line

as well as from increased customer activity for SOLIDWORKS with

Medical Devices companies and SIMULIA. The Company noted increased

customer sales engagements in manufacturing with Life Sciences

companies.

Mainstream Innovation software

revenue was €249 million (IFRS and non-IFRS) in the first quarter,

and represented 23% of total software revenue.

- Mainstream

Innovation IFRS and non-IFRS software revenue increased 20% in Q1,

with SOLIDWORKS non-IFRS software revenue up 18% on broad-based

global demand. Sales by SOLIDWORKS’ resellers were up sharply for

its 3DEXPERIENCE WORKS cloud-based solutions. New

SOLIDWORKS customers increased 22% in the first quarter.

- CENTRIC PLM saw

significant growth in software revenue, driven by increased

activity in key geographic markets, including Asia with expansion

in China. CENTRIC PLM saw a strong increase in new customers in

Home & Lifestyle including fashion and retail and early

traction in Food & Beverage.

Corporate Information

As previously disclosed, Dassault Systèmes’

Board of Directors is proposing to the next General Meeting of

Shareholders of May 26, 2021 the approval of a dividend of €0.56

per share for the year 2020, payable in cash only. Shares would be

traded ex-dividend as of May 28, 2021 and dividends would be made

payable on June 1, 2021.

COO & CFO Commentary

(revenue growth rates in constant currencies, data on a non-IFRS

basis)

Pascal Daloz, Dassault

Systèmes’ Chief Operating

Officer, & Chief

Financial Officer, commented, “First quarter

revenue results came in at the high end of our guidance range, with

software above the range. On an organic basis, software revenue

increased 10%, with licenses and other software revenue up 25% and

subscription revenue up double-digits. Diluted EPS was well ahead

of our guidance, growing 20%, or 28% in constant currencies, thanks

to the combination of software growth and operating margin

expansion of 470 basis points. Finally, cash flow from operations

set a new quarterly record, up 40% to €642 million.

“We are seeing strong momentum in Life Sciences,

led by MEDIDATA where software revenue increased 20% in the first

quarter driven by Rave in clinical data management, Patient Cloud

and Acorn AI. In Mainstream Innovation, software revenue increased

20%, on an outstanding first quarter from SOLIDWORKS and CENTRIC

PLM. In Industrial Innovation, 3DEXPERIENCE

software revenue increased 18%, and its largest industry,

Transportation & Mobility, benefited from a broad return to

investments with global automotive leaders, EV start-ups and the

supply chain as well as large deals led by our domains strengths in

simulation and data analytics.

“Looking to the full year, we are confirming our

revenue growth objective range of 9 to 10%, with a higher

contribution from software as we saw in the first quarter. We are

increasing our non-IFRS diluted EPS objective leading to expected

growth of about 12% to 14%, or about 17-18% in constant currencies,

capturing the earnings upside from the first quarter.”

Financial

Objectives for 2021

Dassault Systèmes’ full year 2021 financial

objectives presented below are given on a non-IFRS basis and

reflect the principal 2021 currency exchange rate assumptions below

for the US dollar and Japanese yen as well as the potential impact

from additional non-Euro currencies:

|

|

|

Q2 2021 |

|

FY 2021 |

|

Total non-IFRS Revenue |

|

€1.130 to €1.155 billion |

|

€4.715 to €4.765 billion |

| Growth

in Constant Currencies (cc) |

|

+12-14% |

|

+9-10% |

| Non-IFRS

Operating Margin |

|

29.4% to 30.1% |

|

31.6% to 31.7% |

| Non-IFRS

EPS |

|

€0.94 to €0.98 |

|

€4.24 to €4.28 |

| Non-IFRS

EPS Growth |

|

+18-23% |

|

+12-14% |

| US

dollar |

|

$1.22 per Euro |

|

$1.22 per Euro |

| Japanese

yen (before hedging) |

|

JPY 126.0 per Euro |

|

JPY 126.5 per Euro |

These objectives are prepared and communicated

only on a non-IFRS basis and are subject to the cautionary

statement set forth below.

The 2021 non-IFRS financial objectives set forth

above do not take into account the following accounting elements

below and are estimated based upon the 2021 principal currency

exchange rates above: contract liabilities write-downs estimated at

approximately €2 million; share-based compensation expenses,

including related social charges, estimated at approximately €137

million; and amortization of acquired intangibles and of tangibles

reevaluation, estimated at approximately €353 million, largely

impacted by the acquisition of Medidata; and lease incentives of

acquired companies at approximately €3 million. The above

objectives also do not include any impact from other operating

income and expenses, net principally comprised of acquisition,

integration and restructuring expenses, and impairment of goodwill

and acquired intangible assets; from one-time items included in

financial revenue; from one-time tax effects; and from the income

tax effects of these non-IFRS adjustments. Finally, these estimates

do not include any new stock option or share grants, or any new

acquisitions or restructuring completed after March 31, 2021.

Today’s Webcast and Conference Call

Information

Today, Wednesday, April 28, 2021, Dassault

Systèmes will host a webcasted presentation at 9:00 London AM time/

10:00 AM Paris time and will then host a conference call at 9:00 AM

New York time / 2:00 PM London time / 3:00 PM Paris time. The

webcasted presentation and conference call will be available online

by accessing https://investor.3ds.com.

Additional investor information is available at

https://investor.3ds.com or by calling Dassault Systèmes’ Investor

Relations at +33 1 61 62 69 24.

Key Investor Relations

Events

Annual Meeting of Shareholders: May 26,

2021Second Quarter 2021 Earnings Release: July 27, 2021Third

Quarter 2021 Earnings Release: October 28, 2021Fourth Quarter 2021

Earnings Release: February 3, 2022

General Meeting of May 26,

2021

As indicated in the meeting notice published in

the BALO on Friday, April 16, 2021, the General Meeting of Dassault

Systèmes will be held on Wednesday, May 26, 2021 at 3:00 PM The

meeting will be broadcasted live online on the Company’s website:

https://investor.3ds.com. As the General Meeting represents a

privileged occasion to interact with shareholders, the Company also

wishes to give them the opportunity to physically attend the

General Meeting to the extent French Government’s recommendations

would allow it.

The Company strongly advises shareholders to

favor remote voting means available to them by using the secured

electronic voting platform VOTACCESS or voting by post.

Shareholders will be able to submit questions to be answered to

during the General Meeting by e-mail to the following email

address: investors@3ds.com.

For the latest information on how to participate

and vote, shareholders are invited to regularly check the section

dedicated to the General Meeting on the Company’s website:

https://investor.3ds.com/shareholders-meeting/home.

Forward-looking Information

Statements herein that are not historical facts

but express expectations or objectives for the future, including

but not limited to statements regarding the Group’s non-IFRS

financial performance objectives are forward-looking statements.

Such forward-looking statements are based on Dassault Systèmes

management's current views and assumptions and involve known and

unknown risks and uncertainties. Actual results or performances may

differ materially from those in such statements due to a range of

factors.

The Group’s actual results or performance may be

materially negatively affected by numerous risks and uncertainties,

as described in the “Risk Factors” section of the 2020 Universal

Registration Document (‘Document d'enregistrement universel’) filed

with the AMF (French Financial Markets Authority) on March 19,

2021, available on the Group’s website www.3ds.com.In particular,

please refer to the risk factor “Uncertain Global Economic

Environment” in section 1.9.1.1 of the 2020 Universal Registration

Document set out below for ease of reference:

“In light of the uncertainties regarding

economic, business, social, health, climate and geopolitical

conditions at the global level, Dassault Systèmes’ revenue, net

earnings and cash flows may grow more slowly, whether on an annual

or quarterly basis, mainly due to the following factors:

- the deployment of Dassault

Systèmes’ solutions may represent a large portion of a customer’s

investments in software technology. Decisions to make such an

investment are impacted by the economic environment in which the

customers operate. Uncertain global geopolitical, economic and

health conditions and the lack of visibility or the lack of

financial resources may cause some customers, e.g. within

automotive, aerospace or natural resources industries, to reduce,

postpone or terminate their investments, or to reduce or not renew

ongoing paid maintenance for their installed base, which impact

larger customers’ revenue with their respective

sub-contractors;

- the sales cycle of Dassault

Systèmes’ products – already relatively long due to the strategic

nature of such investments for customers – could further

lengthen;

- the political, economic and

monetary situation in certain geographic regions where Dassault

Systèmes operates could become more volatile and, for example,

result in stricter export compliance rules or the modification of

customs tariff;

- health

conditions in some geographic areas where Dassault Systèmes

operates will impact the economic situation of those regions.

Specifically, it is not possible to predict the impact, length and

scope of damages originating from the COVID-19 pandemic as of

issuance date of this document. Health conditions, including the

COVID-19 pandemic, may present risks for health and ability to

travel for Dassault Systèmes employees; and

- continued pressure or volatility on

raw materials and energy prices could also slow down Dassault

Systèmes’ industry diversification efforts.”

Dassault Systèmes makes every effort to take

into consideration this uncertain macroeconomic outlook. Dassault

Systèmes’ business results, however, may not develop as

anticipated. Furthermore, due to factors affecting sales of

Dassault Systèmes’ products and services, there may be a

substantial time lag between an improvement in global economic and

business conditions and an upswing in the Group’s business

results.

The economic context (as notably caused by the

COVID-19 pandemic crisis) may also adversely impact the financial

situation or financing capabilities of Dassault Systèmes’ existing

and potential customers, commercial and technology partners, some

of whom may be forced to temporarily close sites or cease

operations due to cash flow and profitability issues. Dassault

Systèmes’ ability to collect outstanding receivables may be

affected. In addition, the economic environment could generate

increased price pressure, as customers seek lower prices from

various competitors, which could negatively impact Dassault

Systèmes’ revenue, financial performance and market position.

In preparing such forward-looking statements,

the Group has in particular assumed an average US dollar to euro

exchange rate of US$1.22 per €1.00 as well as an average Japanese

yen to euro exchange rate of JPY126.0 to €1.00 before hedging for

the second, third and fourth quarters and US$1.22 per €1.00 as well

as an average Japanese yen to euro exchange rate of JPY126.5 to

€1.00 before hedging for the full year 2021. However, currency

values fluctuate, and the Group’s results of operations may be

significantly affected by changes in exchange rates.

Non-IFRS Financial

Information

Readers are cautioned that the supplemental

non-IFRS information presented in this press release is subject to

inherent limitations. This information is not based on any

comprehensive set of accounting rules or principles and should not

be considered as a substitute for IFRS measurements. In addition,

the Group’s supplemental non-IFRS financial information may not be

comparable to similarly titled non-IFRS measures used by other

companies. Further specific limitations for individual non-IFRS

measures, and the reasons for presenting non-IFRS financial

information, are set forth in the Group’s 2020 Universal

Registration Document filed with the AMF on March 19,

2021.

In the tables accompanying this press release

the Group sets forth its supplemental non-IFRS figures for revenue,

operating income, operating margin, net income and diluted earnings

per share, which exclude the effect of adjusting the carrying value

of acquired companies’ deferred revenue, share-based compensation

expense and related social charges, the amortization of acquired

intangible assets and of tangibles reevaluation, certain other

operating income and expense, net, including impairment of goodwill

and acquired intangibles, the effect of adjusting lease incentives

of acquired companies, certain one-time items included in financial

revenue and other, net, and the income tax effect of the non-IFRS

adjustments and certain one-time tax effects. The tables also set

forth the most comparable IFRS financial measure and

reconciliations of this information with non-IFRS information.

Social media:

Connect with Dassault Systèmes on Twitter

Facebook LinkedIn YouTube

###

About Dassault Systèmes

Dassault Systèmes, the

3DEXPERIENCE Company, is a catalyst for human

progress. We provide business and people with collaborative virtual

environments to imagine sustainable innovations. By creating

‘virtual experience twins’ of the real world with our

3DEXPERIENCE platform and applications, our

customers push the boundaries of innovation, learning and

production. Dassault Systèmes’ 20,000 employees are bringing value

to more than 290,000 customers of all sizes, in all industries, in

more than 140 countries. For more information, visit

www.3ds.com

©2021 Dassault Systèmes. All rights reserved.

3DEXPERIENCE, the Compass icon, the 3DS logo,

CATIA, BIOVIA, GEOVIA, SOLIDWORKS, 3DVIA, ENOVIA, EXALEAD,

NETVIBES, MEDIDATA, CENTRIC PLM, 3DEXCITE, SIMULIA, DELMIA, and

IFWE are commercial trademarks or registered trademarks of Dassault

Systèmes, a French “société européenne” (Versailles Commercial

Register # B 322 306 440), or its subsidiaries in the United States

and/or other countries. All other trademarks are owned by their

respective owners. Use of any Dassault Systèmes or its subsidiaries

trademarks is subject to their express written approval.

Dassault Systèmes Investor Relations’

Contacts

|

Corporate |

François-José BordonadoBéatrix MartinezMarie Dumas |

investors@3ds.com |

+33 1 61 62 69 24 |

|

|

|

|

|

| United States and Canada |

Michele Katz |

michele.katz@3ds.com |

|

| |

|

|

|

|

FTI Consulting |

Jamie RickettsArnaud de Cheffontaines |

|

+44 20 3727 1000+33 1 47 03 69 48 |

Dassault Systèmes Press

ContactsCorporate /

France Arnaud

MALHERBE arnaud.malherbe@3ds.com +33

1 61 62 87 73North

America Suzanne

MORAN suzanne.moran@3ds.com +1

781 810

3774EMEAR Virginie

BLINDENBERG virginie.blindenberg@3ds.com +33

1 61 62 84

21China Grace

MU grace.mu@3ds.com +86

10 6536 2288India

Santanu

BHATTACHARYA santanu.bhattacharya@3ds.com +91

124 457

7111Japan Yukiko

SATO yukiko.sato@3ds.com +81

3 4321

3841Korea Jeemin

JEONG jeemin.jeong@3ds.com

+82 2 3271 6653AP

South Pallavi

MISRA pallavi.misra@3ds.com

+65 9437 0714

APPENDIX TABLE OF CONTENTS

(Due to rounding, numbers presented throughout

this and other documents may not add up precisely to the totals

provided and percentages may not precisely reflect the absolute

figures).

Glossary of Definitions

Non-IFRS Financial Information

Condensed consolidated statements of income

Condensed consolidated balance sheets

Condensed consolidated cash flow statements

IFRS – non-IFRS reconciliation

DASSAULT SYSTEMES - Glossary of

Definitions

Information in Constant

Currencies

We have followed a long-standing policy of

measuring our revenue performance and setting our revenue

objectives exclusive of currency in order to measure in a

transparent manner the underlying level of improvement in our total

revenue and software revenue by type, industry, region and product

lines. We believe it is helpful to evaluate our growth exclusive of

currency impacts, particularly to help understand revenue trends in

our business. Therefore, we provide percentage increases or

decreases in our revenue; expenses and EPS (in both IFRS as well as

non-IFRS) to eliminate the effect of changes in currency values,

particularly the U.S. dollar and the Japanese yen, relative to the

euro. When trend information is expressed by us "in constant

currencies", the results of the "prior" period have first been

recalculated using the average exchange rates of the comparable

period in the current year, and then compared with the results of

the comparable period in the current year.

While constant currency calculations are not

considered to be an IFRS measure, we do believe these measures are

critical to understanding our global revenue results and to compare

with many of our competitors who report their financial results in

U.S. dollars. Therefore, we are including this calculation for

comparing IFRS revenue figures for comparable periods as well as

for comparing non-IFRS revenue figures for comparable periods. All

constant currency information is provided on an approximate

basis.

Information on Growth excluding

acquisitions (“organic growth”)

In addition to financial indicators on the

entire Group’s scope, Dassault Systèmes provides growth excluding

acquisitions’ effect, also named organic growth. The related growth

rate was determined by restating the scope of activity as follows:

for entities entering the consolidation scope in the current year,

subtracting the contribution of the acquisition from the aggregates

of the current year, and for entities entering the consolidation

scope in the previous year, subtracting the contribution of the

acquisition from January 1st of the current year, until the last

day of the month of the current year when the acquisition was made

the previous year.

Information on Industrial

Sectors

Dassault Systèmes’ Industries develop Solution

Experiences, industry-focused offerings that deliver specific value

to companies and users in a particular industry. We serve eleven

industries structured into three sectors:

- Manufacturing

Sector: Transportation & Mobility; Aerospace & Defense;

Marine & Offshore; Industrial Equipment; High-Tech; Home &

Lifestyle; Consumer Packaged Goods & Retail and a portion of

Business Services;

- Life Sciences

& Healthcare Sector: Life Sciences;

- Infrastructure

& Cities Sector: Energy & Materials; Construction, Cities

and Territories; Business Services.

Information on Product

Lines

Commencing with the first quarter of 2020 and as

previously disclosed, we have introduced a new presentation of our

product lines to reflect our broader ambitions. Our new product

line financial reporting includes: 1) Industrial Innovation

software revenue, comprised of our CATIA, ENOVIA, SIMULIA, DELMIA,

GEOVIA, NETVIBES, and 3DEXCITE brands; 2) Life Sciences software

revenue, comprised of our MEDIDATA and BIOVIA brands; and 3)

Mainstream Innovation software revenue, comprised of our SOLIDWORKS

brand as well as CENTRIC PLM, 3DVIA and the respective portion of

our new 3DEXPERIENCE WORKS family.

3DEXPERIENCE Licenses and Software

Contribution

To measure the progressive penetration of

3DEXPERIENCE software, we utilize the following

ratios: a) for Licenses revenue, we calculate the percentage

contribution by comparing total 3DEXPERIENCE

Licenses revenue to Licenses revenue for all product lines except

SOLIDWORKS and acquisitions (“related Licenses revenue”); and, b)

for software revenue, the Group calculates the percentage

contribution by comparing total 3DEXPERIENCE

software revenue to software revenue for all product lines except

SOLIDWORKS and acquisitions (“related software revenue”).

DASSAULT

SYSTEMESNON-IFRS FINANCIAL INFORMATION

(unaudited; in millions of Euros, except per share data,

percentages, headcount and exchange rates)

Non-IFRS key figures exclude the effects of

adjusting the carrying value of acquired companies’ contract

liabilities (deferred revenue), share-based compensation expenses,

including related social charges, amortization of acquired

intangible assets and of tangible assets revaluation, lease

incentives of acquired companies, other operating income and

expense, net, including the acquisition, integration and

restructuring expenses, and impairment of goodwill and acquired

intangible assets, certain one-time items included in financial

income (loss), net, certain one-time tax effects and the income tax

effects of these non-IFRS adjustments.Comparable IFRS financial

information and a reconciliation of the IFRS and non-IFRS measures

are set forth in the separate tables within this attachment.

|

In millions of Euros, except per share data, percentages, headcount

and exchange rates |

Non-IFRS reported |

|

Three months ended |

|

March 31, |

March 31, |

Change |

Change in constant

currencies |

|

2021 |

2020 |

|

Revenue |

€ 1,173.6 |

€ 1,144.4 |

3% |

8% |

|

|

|

|

|

|

|

Revenue breakdown by activity |

|

|

|

|

| Software

revenue |

1,068.4 |

1,023.0 |

4% |

10% |

|

Of which licenses and other software revenue |

203.8 |

172.3 |

18% |

25% |

|

Of which subscription and support revenue |

864.6 |

850.7 |

2% |

7% |

| Services

revenue |

105.2 |

121.4 |

(13)% |

(9)% |

|

|

|

|

|

|

|

Software revenue breakdown by product line |

|

|

|

|

|

Industrial Innovation (1) |

609.2 |

605.1 |

1% |

4% |

| Life

Sciences (2) |

209.9 |

195.0 |

8% |

16% |

|

Mainstream Innovation |

249.3 |

223.0 |

12% |

20% |

|

|

|

|

|

|

|

Revenue breakdown by geography |

|

|

|

|

|

Americas |

463.3 |

453.8 |

2% |

12% |

|

Europe |

435.9 |

421.5 |

3% |

5% |

|

Asia |

274.5 |

269.1 |

2% |

6% |

|

|

|

|

|

|

|

Operating income |

€ 397.4 |

€ 334.1 |

19% |

|

|

Operating margin |

33.9% |

29.2% |

|

|

|

|

|

|

|

|

|

Net income attributable to shareholders |

€ 301.2 |

€ 250.0 |

20% |

|

|

Diluted earnings per

share |

€ 1.14 |

€ 0.95 |

20% |

28% |

|

|

|

|

|

|

|

Closing headcount |

21,451 |

21,439 |

0% |

|

|

|

|

|

|

|

| Average

Rate USD per Euro |

1.20 |

1.10 |

9% |

|

|

Average Rate JPY per Euro |

127.81 |

120.10 |

6% |

|

(1) Excluding ENOVIA Life Sciences Compliance and Quality

Management(2) Including ENOVIA Life Sciences Compliance and Quality

Management

DASSAULT

SYSTEMESACQUISITIONS AND FOREIGN EXCHANGE

IMPACT(unaudited; in millions of Euros)

|

In millions of Euros |

Non-IFRS reported |

o/w growth at constant rate and scope |

o/w change of scope impact at current year

rate |

o/w FX impact on previous year figures |

|

March 31,2021 |

March 31,2020 |

Change |

|

Revenue QTD |

1,173.6 |

1,144.4 |

29.3 |

85.7 |

1.1 |

(57.5) |

DASSAULT

SYSTEMESCONDENSED CONSOLIDATED STATEMENTS OF

INCOME (IFRS)(unaudited; in millions of Euros, except per

share data and percentages)

|

In millions of Euros, except per share data and percentages |

IFRS reported |

|

Three months ended |

|

March 31, |

March 31, |

|

2021 |

2020 |

|

Licenses and other software revenue |

203.8 |

172.3 |

|

Subscription and Support revenue |

864.0 |

841.9 |

|

Software revenue |

1,067.8 |

1,014.2 |

|

Services revenue |

105.1 |

120.5 |

|

Total Revenue |

€ 1,172.9 |

€ 1,134.7 |

|

Cost of software revenue (1) |

(101.7) |

(76.5) |

|

Cost of services |

(93.9) |

(119.9) |

|

Research and development expenses |

(237.0) |

(230.2) |

|

Marketing and sales expenses |

(309.9) |

(331.3) |

|

General and administrative expenses |

(93.5) |

(97.4) |

|

Amortization of acquired intangible assets and of tangible assets

revaluation |

(89.5) |

(109.4) |

|

Other operating income and expense, net |

(16.9) |

(18.9) |

|

Total Operating Expenses |

(942.3) |

(983.7) |

|

Operating Income |

€ 230.6 |

€ 151.0 |

|

Financial income (loss), net |

(2.8) |

(6.5) |

|

Income before income taxes |

€ 227.8 |

€ 144.5 |

|

Income tax expense |

(53.7) |

(35.3) |

|

Net Income |

€ 174.0 |

€ 109.2 |

|

Non-controlling interest |

0.3 |

3.2 |

|

Net Income attributable to equity holders of the

parent |

€ 174.4 |

€ 112.4 |

|

Basic earnings per share |

0.67 |

0.43 |

|

Diluted earnings per

share |

€ 0.66 |

€ 0.43 |

|

Basic weighted average shares outstanding (in millions) |

261.2 |

259.5 |

|

Diluted weighted average shares outstanding (in millions) |

264.5 |

263.2 |

(1) Excluding amortization of acquired intangible assets and of

tangible assets revaluation

|

IFRS reported |

Three months ended

March 31,

2021 |

|

Change (4) |

Change in constant

currencies |

|

Revenue |

3% |

9% |

|

Revenue by activity |

|

|

| Software

revenue |

5% |

11% |

| Services

revenue |

(13)% |

(8)% |

|

Software Revenue by product line |

|

|

|

Industrial Innovation (2) |

1% |

5% |

| Life

Sciences (3) |

12% |

21% |

|

Mainstream Innovation |

12% |

20% |

|

Revenue by geography |

|

|

|

Americas |

4% |

14% |

|

Europe |

3% |

5% |

|

Asia |

2% |

6% |

(2) Excluding ENOVIA Life Sciences Compliance and Quality

Management(3) Including ENOVIA Life Sciences Compliance and Quality

Management (4) Variation compared to the same period in the prior

year

DASSAULT

SYSTEMESCONDENSED CONSOLIDATED BALANCE SHEETS

(IFRS)(unaudited; in millions of Euros)

|

In millions of Euros |

IFRS reported |

|

March 31, |

December 31, |

|

2021 |

2020 |

|

ASSETS |

|

|

| Cash and

cash equivalents |

2,714.1 |

2,148.9 |

| Trade

accounts receivable, net |

1,130.4 |

1,229.1 |

| Contract

assets |

27.1 |

27.0 |

| Other

current assets |

321.0 |

355.4 |

|

Total current assets |

4,192.5 |

3,760.3 |

| Property

and equipment, net |

856.4 |

861.1 |

| Goodwill

and Intangible assets, net |

8,170.5 |

7,937.2 |

| Other

non-current assets |

428.9 |

405.6 |

|

Total non-current assets |

9,455.9 |

9,203.9 |

|

Total Assets |

€ 13,648.4 |

€ 12,964.2 |

|

LIABILITIES AND EQUITY |

|

|

| Trade

accounts payable |

138.0 |

171.7 |

| Contract

liabilities |

1,345.3 |

1,169.1 |

|

Borrowings, current |

9.9 |

16.0 |

| Other

current liabilities |

701.2 |

730.1 |

|

Total current liabilities |

2,194.4 |

2,086.9 |

|

Borrowings, non-current |

4,186.5 |

4,174.3 |

| Other

non-current liabilities |

1,649.6 |

1,596.9 |

|

Total non-current liabilities |

5,836.2 |

5,771.2 |

|

Non-controlling interests |

46.6 |

44.8 |

| Parent

shareholders' equity |

5,571.1 |

5,061.3 |

|

Total Liabilities and equity |

€ 13,648.4 |

€ 12,964.2 |

DASSAULT

SYSTEMESCONDENSED CONSOLIDATED CASH FLOW

STATEMENTS (IFRS)(unaudited; in millions of Euros)

|

In millions of Euros |

IFRS reported |

|

Three months ended |

|

March

31,2021 |

March

31,2020 |

Change |

|

Net income attributable to equity holders of the parent |

174.4 |

112.4 |

62.0 |

|

Non-controlling interest |

(0.3) |

(3.2) |

2.9 |

| Net

income |

174.0 |

109.2 |

64.8 |

|

Depreciation of property and equipment |

43.3 |

48.9 |

(5.6) |

|

Amortization of intangible assets |

94.6 |

112.8 |

(18.2) |

|

Adjustments for other non-cash items |

65.9 |

49.8 |

16.1 |

| Changes

in working capital |

263.9 |

137.4 |

126.5 |

|

Net Cash Provided by (Used in) Operating

Activities |

€ 641.8 |

€ 458.1 |

€ 183.7 |

|

|

|

|

|

|

Additions to property, equipment and intangibles |

(27.5) |

(60.3) |

32.8 |

|

Purchases of short-term investments |

(0.6) |

- |

(0.6) |

|

Other |

(7.9) |

1.8 |

(9.8) |

|

Net Cash Provided by (Used in) Investing

Activities |

€ (36.0) |

€ (58.4) |

€ 22.4 |

|

|

|

|

|

| Proceeds

from exercise of stock options |

37.1 |

23.7 |

13.4 |

|

Repurchase and sale of treasury stock |

(88.3) |

(108.1) |

19.8 |

| Proceeds

from borrowings |

0.4 |

1.5 |

(1.1) |

|

Repayment of borrowings |

(8.3) |

- |

(8.3) |

|

Repayment of lease liabilities |

(24.3) |

(25.5) |

1.3 |

|

Net Cash Provided by (Used in) Financing

Activities |

€ (83.5) |

€ (108.5) |

€ 25.0 |

|

|

|

|

|

|

Effect of exchange rate changes on cash and cash

equivalents |

42.9 |

7.4 |

35.5 |

|

|

|

|

|

|

Increase (decrease) in cash and cash

equivalents |

€ 565.2 |

€ 298.6 |

€ 266.6 |

|

|

|

|

|

|

Cash and cash equivalents at beginning of

period |

€ 2,148.9 |

€ 1,944.9 |

|

|

Cash and cash equivalents at end of period |

€ 2,714.1 |

€ 2,243.5 |

|

DASSAULT

SYSTEMESSUPPLEMENTAL NON-IFRS FINANCIAL

INFORMATIONIFRS – NON-IFRS

RECONCILIATION(unaudited; in millions of Euros, except per

share data and percentages)

Readers are cautioned that the supplemental

non-IFRS information presented in this press release is subject to

inherent limitations. It is not based on any comprehensive set of

accounting rules or principles and should not be considered as a

substitute for IFRS measurements. Also, the Group’s supplemental

non-IFRS financial information may not be comparable to similarly

titled non-IFRS measures used by other companies. Further specific

limitations for individual non-IFRS measures, and the reasons for

presenting non-IFRS financial information, are set forth in the

Group’s Document d’Enregistrement Universel for the year ended

December 31, 2020 filed with the AMF on March 19, 2021. To

compensate for these limitations, the supplemental non-IFRS

financial information should be read not in isolation, but only in

conjunction with the Group’s consolidated financial statements

prepared in accordance with IFRS.

|

In millions of Euros, except per share data and percentages |

Three months ended

March 31, |

Change |

|

2021 |

Adjustment(1) |

2021 |

2020 |

Adjustment(1) |

2020 |

IFRS |

Non-IFRS(4) |

|

IFRS |

Non-IFRS |

IFRS |

Non-IFRS |

|

Total Revenue |

€ 1,172.9 |

€ 0.7 |

€ 1,173.6 |

€ 1,134.7 |

€ 9.7 |

€ 1,144.4 |

3% |

3% |

|

Total Revenue breakdown by activity |

|

|

|

|

|

|

|

|

| Software

revenue |

1,067.8 |

0.6 |

1,068.4 |

1,014.2 |

8.8 |

1,023.0 |

5% |

4% |

| Licenses

and other software revenue |

203.8 |

- |

203.8 |

172.3 |

- |

172.3 |

18% |

18% |

|

Subscription and Support revenue |

864.0 |

0.6 |

864.6 |

841.9 |

8.8 |

850.7 |

3% |

2% |

|

Recurring portion of Software revenue |

81% |

|

81% |

83% |

|

83% |

|

|

| Services

revenue |

105.1 |

0.1 |

105.2 |

120.5 |

0.9 |

121.4 |

(13)% |

(13)% |

|

Total Software Revenue breakdown by product

line |

|

|

|

|

|

|

|

|

|

Industrial Innovation (2) |

609.2 |

- |

609.2 |

604.3 |

0.7 |

605.1 |

1% |

1% |

|

Life Sciences (3) |

209.4 |

0.5 |

209.9 |

187.2 |

7.8 |

195.0 |

12% |

8% |

|

Mainstream Innovation |

249.2 |

0.1 |

249.3 |

222.7 |

0.3 |

223.0 |

12% |

12% |

|

Total Revenue breakdown by geography |

|

|

|

|

|

|

|

|

|

Americas |

462.7 |

0.6 |

463.3 |

444.6 |

9.2 |

453.8 |

4% |

2% |

|

Europe |

435.8 |

0.1 |

435.9 |

421.2 |

0.2 |

421.5 |

3% |

3% |

|

Asia |

274.5 |

- |

274.5 |

268.8 |

0.3 |

269.1 |

2% |

2% |

|

Total Operating Expenses |

€ (942.3) |

€ 166.1 |

€ (776.2) |

€ (983.7) |

€ 173.4 |

€ (810.3) |

(4)% |

(4)% |

|

Share-based compensation expense and related social charges |

(59.1) |

59.1 |

- |

(44.4) |

44.4 |

- |

|

|

|

Amortization of acquired intangible assets and of tangible assets

revaluation |

(89.5) |

89.5 |

- |

(109.4) |

109.4 |

- |

|

|

| Lease

incentives of acquired companies |

(0.7) |

0.7 |

- |

(0.7) |

0.7 |

- |

|

|

|

Other operating income and expense, net |

(16.9) |

16.9 |

- |

(18.9) |

18.9 |

- |

|

|

|

Operating Income |

€ 230.6 |

€ 166.8 |

€ 397.4 |

€ 151.0 |

€ 183.1 |

€ 334.1 |

53% |

19% |

|

Operating Margin |

19.7% |

|

33.9% |

13.3% |

|

29.2% |

|

|

|

Financial income (loss), net |

(2.8) |

0.3 |

(2.5) |

(6.5) |

0.3 |

(6.3) |

(57)% |

(61)% |

| Income

tax expense |

(53.7) |

(39.0) |

(92.7) |

(35.3) |

(44.5) |

(79.8) |

52% |

16% |

|

Non-controlling interest |

0.3 |

(1.3) |

(1.0) |

3.2 |

(1.3) |

1.9 |

(90)% |

(153)% |

|

Net Income attributable to shareholders |

€ 174.4 |

€ 126.8 |

€ 301.2 |

€ 112.4 |

€ 137.6 |

€ 250.0 |

55% |

20% |

|

Diluted Earnings Per

Share

(5) |

€ 0.66 |

€ 0.48 |

€ 1.14 |

€ 0.43 |

€ 0.52 |

€ 0.95 |

54% |

20% |

(1) In the reconciliation schedule above, (i)

all adjustments to IFRS revenue data reflect the exclusion of the

effect of adjusting the carrying value of acquired companies’

contract liabilities (deferred revenue); (ii) adjustments to IFRS

operating expense data reflect the exclusion of the amortization of

acquired intangible assets and of tangible assets revaluation,

share-based compensation expenses, including related social

charges, lease incentives of acquired companies, as detailed below,

and other operating income and expense, net including acquisition,

integration and restructuring expenses, and impairment of goodwill

and acquired intangible assets (iii) adjustments to IFRS financial

income (loss), net reflect the exclusion of certain one-time items

included in financial income (loss), net, and (iv) all adjustments

to IFRS income data reflect the combined effect of these

adjustments, plus with respect to net income and diluted earnings

per share, certain one-time tax effects and the income tax effect

of the non-IFRS adjustments.

|

In millions of Euros, except percentages |

Three months ended March

31, |

Change |

|

2021IFRS |

Share-based compensation expense and related social

charges |

Lease incentives of acquired companies |

2021Non-IFRS |

2020IFRS |

Share-based compensation expense and related social

charges |

Lease incentives of acquired companies |

2020Non-IFRS |

IFRS |

Non-IFRS |

|

Cost of revenue |

(195.6) |

4.2 |

0.2 |

(191.2) |

(196.4) |

3.9 |

0.2 |

(192.3) |

(0)% |

(1)% |

| Research

and development expenses |

(237.0) |

22.1 |

0.3 |

(214.5) |

(230.2) |

13.8 |

0.4 |

(216.0) |

3% |

(1)% |

|

Marketing and sales expenses |

(309.9) |

15.7 |

0.1 |

(294.2) |

(331.3) |

13.6 |

0.1 |

(317.6) |

(6)% |

(7)% |

| General

and administrative expenses |

(93.5) |

17.2 |

0.1 |

(76.3) |

(97.4) |

13.0 |

- |

(84.3) |

(4)% |

(10)% |

|

Total |

|

€ 59.1 |

€ 0.7 |

|

|

€ 44.4 |

€ 0.7 |

|

|

|

(2) Excluding ENOVIA Life Sciences Compliance and Quality

Management.(3) Including ENOVIA Life Sciences Compliance and

Quality Management.

(4) The non-IFRS percentage increase (decrease)

compares non-IFRS measures for the two different periods. In the

event there is non-IFRS adjustment to the relevant measure for only

one of the periods under comparison, the non-IFRS increase

(decrease) compares the non-IFRS measure to the relevant IFRS

measure.(5) Based on a weighted average 264.5 million diluted

shares for Q1 2021 and 263.2 million diluted shares for Q1

2020.

- Dassault Systèmes Reports 2021 First Quarter Results Above the

High End of Company Guidance

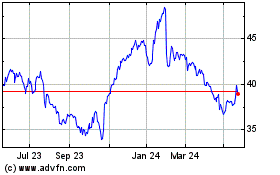

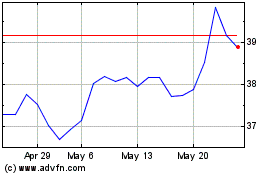

Dassault Systemes (EU:DSY)

Historical Stock Chart

From Feb 2025 to Mar 2025

Dassault Systemes (EU:DSY)

Historical Stock Chart

From Mar 2024 to Mar 2025