LACROIX : First-half 2024: €350.3m revenue, down 4.9% on a

like-for-like basis. Increase in current operating profitability,

excl. North America.

30/09/2024

First-half 2024:

€350.3m revenue, down 4.9% on a like-for-like

basis

Increase in current operating profitability, excl. North

America

Net income strongly impacted by non-recurring

items

Annual targets:

Revenue around €640m on the new scope of

consolidation

2024 EBITDA margin between 4.0 and 4.5% adversely impacted

by North America, where recovery is the main priority

New roadmap 2025-2027 to be unveiled in

spring 2025.

|

In million euros |

H1 2024

|

H1 2023 |

Change |

|

Revenue |

350.3 |

376.6 |

-7.0% |

|

Current EBITDA |

18.3 |

23.6 |

-22.4% |

|

As % of revenue |

5.2% |

6.3% |

-104 pb |

|

Current operating income |

8.2 |

12.2 |

-33.4% |

|

As % of revenue |

2.3% |

3.2% |

-92 pb |

|

Operating income |

4.5 |

11.5 |

-61.4% |

|

Financial results |

(5.5) |

(3.6) |

|

|

Income taxes |

(1.8) |

0.2 |

|

|

Continuing operations net income |

(2.9) |

8.1 |

|

|

Discontinued operations net income * |

(14.0) |

(3.6) |

|

|

Consolidated net income |

(16.9) |

4.6 |

|

|

Net income, Group share |

(13.3) |

5.6 |

|

*The City - Mobility segment is treated as a

discontinued operation in accordance with IFRS 51.

In the first six months of the year, LACROIX

generated a revenue of €350.3 million, compared with €376.6 million

in the first half of 2023. As a reminder, over these two reference

periods, consolidated revenue does not include the City - Mobility

segment (comprising the Traffic and V2X business units), which is

now treated as a “Discontinued operation”. This accounting

treatment follows the planned divestiture of the City - Mobility

segment, as part of the reorganization announced last spring (press

release of May 22, 2024).

LACROIX's half-year consolidated revenue is down

7.0% compared with the first half of 2023. This decline is reduced

to 4.9% on a like-for-like basis, i.e. excluding the Road sign

segment, which was deconsolidated on April 30, 2024, after the

divestiture was completed (press release of May 2, 2024).

These changes in scope are part of the Group's

voluntary strategy to build a new organization focused on

value-creating activities.

Increase in current EBITDA margin,

excluding Electronics North America

Over the period, LACROIX's current2

EBITDA came to €18.3 million, compared with €23.6 million

previously. The Road Sign segment contributed €0.3m and €0.4m

respectively in the first half of 2024 (over 4 months) and the

first half of 2023 (over 6 months).

The Group's current EBITDA margin stood at 5.2%

at mid-year, compared with 6.3% a year earlier. This decline is

entirely due to LACROIX Electronics North America. Excluding the US

subsidiary, LACROIX would have posted a current EBITDA margin of

7.9% of sales, up 105 basis points on its H1 2023 level (6.9%).

Electronics activity

At mid-year, the Electronics activity recorded a

revenue of €268.1 million. This was down 9.1% on the first half of

2023, which represented a very high basis for comparison, due to

the strong catch-up that accompanied the normalization of

electronic component supplies. Compared with the first half of

2022, Electronics sales were up 8.2% in the first half of 2024.

In EMEA, sales trends were mixed, with growth in

the Industrial and Avionics sectors and a decline in the Automotive

and HBAS (Home & Building Automation Systems) segments. Across

the Atlantic, revenue declined in the first half of 2024, penalized

by sluggish demand and disruptions linked to the ongoing

restructuring of the business.

Over the period, the current EBITDA for the

Electronics activity came to €5.8 million, representing a margin of

2.2%, compared with 4.6% a year earlier.

The stable profitability rate for the EMEA region reflects

excellent operational control of both personnel and procurement

costs. This satisfactory profitability trend also reflects the

solid performance of the Beaupréau site in France and the Willich

site in Germany, as well as the pursuit of a demanding pricing

policy across the entire customer portfolio.

As regards Electronics North America, the return to operational

control has not had any visible impact on profitability in the

first half of 2024 yet.

Environment activity

As a reminder, this activity now includes the

Street Lighting segment (previously part of the City activity),

with retroactive effect to January 1, 2024 and restated accordingly

for fiscal 2023.

For the first half of 2024, Environment revenue

came to €64.4 million, up 17.9%, thanks to very positive trends

across all four segments: Water, Heating Networks, Smart Grids and

Street Lighting. Leveraging from structurally buoyant trends, the

Environment activity benefited in particular from major

international projects over the period.

Profitability also improved from a high base:

Environment's current EBITDA was €12.6 million at mid-year, up

28.6%. Current EBITDA margin thus reached 19.6% (vs. 18.0% a year

earlier).

All in all, excluding the consequences

of the persistently difficult situation in North America, the

Group's operating profitability trajectory remains in line with the

objectives set out in the Leadership 2025 plan. Against this

overall backdrop, LACROIX's priority over the coming months will

logically be to get its US subsidiary back on

track.

Results including significant

non-recurring expenses, with no cash impact

After taking into account depreciation and

amortization for an almost stable amount (+2.3% to €11.5 million),

the Group's current operating income for the first half of 2024

came to €8.2 million, representing a margin of 2.3%. Operating

income, on the other hand, fell by 61.5% over the period, to €4.5

million. This was largely due to the recognition of a non-recurring

charge (capital loss) of €3.0 million on the final divestiture of

the Road Sign segment.

Net income from continuing activities came to €

-2.9 million, after accounting for financial expenses (€ 5.5

million) and taxes (€ 1.8 million). Net income from discontinued

activities (-€14.0M) includes a non-cash write-down of €10.0M for

provisions for risks and impairment of non-current assets in the

City - Mobility segment.

Overall, LACROIX posted a net loss of €13.3

million for the first half of 2024, compared with a profit of €5.6

million previously.

A sound financial structure

After allocation of this net loss, shareholders'

equity stood at €171 million as of June 30, 2024, compared with

€190 million at the end of 2023. Changes in net debt, partly

reflecting unfavorable seasonal trends in the first half of the

year, remained contained: net debt rose over six months from €112.9

million to €124.8 million. This represents a gearing ratio of 73%,

well below the 80% ceiling set for 2025.

In terms of cash flow, LACROIX continues to post

a positive Free Cash Flow (FCF) of €0.9M. This level is the result

of good control of Working Capital Requirement (WCR) and a

controlled level of net investment (Capex), at €5.6M.

New annual targets incorporating the

situation at Electronics North America and changes in the scope of

consolidation

For the second half of the current financial

year, LACROIX anticipates the continuation of contrasting

trends.

The Environment activity should continue to

enjoy positive momentum, driven by the water and smart grids

markets, despite a slight slowdown in growth after the excellent

performance of the 1st half of 2024.

The Electronics activity, which will benefit from a more favorable

base effect in the second half, continues to face limited

visibility in the Automotive and HBAS markets in EMEA, while across

the Atlantic, the restructuring underway will produce positive

effects only from 2025 onwards.

Electronics North America's recovery remains

hampered by persistent industrial inefficiencies. Faced with this

situation, the action plan launched in 2023 is continuing: the full

integration of the entity into Electronics EMEA is now complete,

with the arrival of a new General Manager at the end of August; the

ramp-up of the new Juarez site is underway.

In this context, and in view of the recent and

forthcoming changes in scope, the Group is clarifying its targets

for the current year, as announced at the time of publication of

its half-year sales figures. LACROIX now anticipates a revenue of

around €640 million on the new scope (4 months of the Road Sign

segment and excluding City - Mobility). As a reminder, the previous

forecast included City - Mobility (revenue > €710 million).

In terms of profitability, the Group has revised its current EBITDA

margin forecast to between 4.0% and 4.5% (previous range: between

5.5% and 6.5% in 2024).

Roadmap for 2025-2027 to be announced

with the release of the next annual results

After this transitional 2024 financial year,

marked by the restructuring of North American operations and major

changes in scope, LACROIX remains fundamentally confident in its

ability to return to a solid growth dynamic in sales and results.

This momentum will be fuelled by the ongoing refocusing on the most

profitable activities, targeting markets with strong potential for

growth, synergies and development with a positive environmental

impact. At the same time, the Group's transatlantic positioning,

whose strategic relevance remains undeniable despite current

operational difficulties, will enable it to address new strategic

targets and strengthen its market share.

LACROIX thus remains serene in the medium term,

and is preparing a roadmap for 2025-2027, based on the continued

deployment of the strategic pillars of the Leadership 2025 plan.

This three-year roadmap will be unveiled when the annual results

are published on March 31, 2025.

Upcoming events

Q3 2024 revenue: November 7, 2024 after the market closes

Find more financial information in the

Investor’s Zone

https://www.lacroix-group.com/investors/

About LACROIX

Convinced that technology must contribute to

simple, sustainable, and safer environments, LACROIX supports its

customers in developing more sustainable living ecosystems, thanks

to useful, robust, and secure electronic equipment and connected

technologies.

As a listed, family-owned midcap with a €761 million euros revenue

in 2023, LACROIX combines agile innovation, industrialization

capacity, cutting-edge technological know-how and a long-term

vision to meet environmental and societal challenges through its

activities: Electronics and Environment.

Through its Electronics business, LACROIX designs and manufactures

industrial IoT solutions (hardware, software, and cloud) and

electronic equipment for the automotive, industrial, connected

homes and buildings (HBAS), avionics and defense, and healthcare

sectors. As the Group's industrial backbone, the Electronics

activity of LACROIX, is ranked among the TOP 50 worldwide and TOP

10 European EMS,

Through its Environment activity, LACROIX also supplies secure and

connected electronic equipment and IoT solutions to optimize the

management of water networks, heating, ventilation, and air

conditioning installations, as well as smart grids and street

lighting networks.

1Standard relating to non-current assets held for

sale and discontinued operations. This treatment in the income

statement is also applied to the cash flow statement and balance

sheet, where the assets and liabilities concerned are reclassified

under specific headings.

2 Current EBITDA is an alternative

performance indicator, defined as operating income before

non-recurring items plus depreciation and amortization on property,

plant and equipment, intangible assets and rights of use, plus

compensation costs linked to shares (IFRS 2) and/or to the

achievement of post-integration targets for newly-acquired

entities.

Contacts

LACROIX

COO & Executive Vice-President

Nicolas Bedouin

investors@lacroix.group

Tel.: +33 (0)2 72 25 68 80 |

SEITOSEI ACTIFIN

Press Relations

Jennifer Jullia

jennifer.jullia@seitosei-actifin.com

Tel. : +33 (0)1 56 88 11 19 |

SEITOSEI ACTIFIN

Financial Communication

Marianne Py

marianne.py@seitosei-actifin.com

Tel.: +33 (0)6 88 78 59 99 |

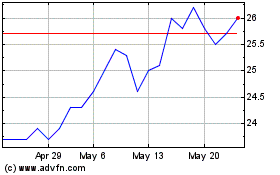

Lacroix (EU:LACR)

Historical Stock Chart

From Dec 2024 to Jan 2025

Lacroix (EU:LACR)

Historical Stock Chart

From Jan 2024 to Jan 2025