NHOA : Implementation of the Compulsory Buyout of the Company's Shares

25 November 2024 - 11:00PM

Business Wire

- Continued suspension of trading in the company's shares.

Regulatory News:

NHOA (Paris:NHOA):

NHOA

(Euronext Paris)

1- On 21 November 2024, the Autorité des marchés financiers

announced that, following the simplified tender offer for the

shares of NHOA initiated by Taiwan Cement Europe Holdings B.V., the

latter held 273,162,697 NHOA shares representing the same number of

voting rights, i.e. 99.19% of the share capital and voting rights

of this company1&2 (see D&I 224C2394 of 21 November

2024).

2 - On 21 November 2024, Crédit Agricole Corporate and

Investment Bank, acting on behalf of Taiwan Cement Europe Holdings

B.V., informed the Autorité des marchés financiers of Taiwan Cement

Europe Holdings B.V.'s decision, in accordance with its intention

expressed at the time of the aforementioned public offer, to

implement a squeeze-out procedure for the NHOA shares not tendered

to the said public offer, at a price of €1.253 per share, on the

basis of Articles L. 433-4 II of the French Monetary and Financial

Code and 237-3 I, 2° of the French General Regulation.

The AMF has noted that the conditions laid down in Articles L.

433-4 II of the Monetary and Financial Code and 237-1 to 237-3 (in

particular Article 237-3 I, 2°) of the General Regulation have been

met, in particular:

the 2,239,720 NHOA shares not tendered to

the offer by minority shareholders2 represented 0.81% of this

company's capital and voting rights at the close of the offer1;

When examining the compliance of the

proposed simplified tender offer, the Autorité des marchés

financiers had before it the valuation report of the presenting

bank and the report of the independent expert, which concluded that

the price offered was fair in the context of a squeeze-out (see

D&I 224C2193 of 5 November 2024)3;

the squeeze-out includes the cash

settlement proposed in the simplified tender offer, i.e. €1.25 per

NHOA share, plus, if applicable, any additional consideration (see

D&I 224C2193 of 5 November 2024)3.

The squeeze-out will therefore take place on 10 December

2024 at a price of €1.25 per share and will relate to

2,239,720 NHOA shares, representing 0.81% of the company's share

capital and voting rights1.

Euronext Paris will publish a detailed timetable for the

implementation of the squeeze-out and the date on which the NHOA

shares will be delisted from Euronext Paris.

3 - The suspension of trading in NHOA shares will continue until

the squeeze-out has been implemented.

_________

1 Based on a share capital of 275,402,417 shares representing

the same number of voting rights, pursuant to paragraph 2 of

article 223-11 of the General Regulations. 2 There are 25,043 free

shares allocated to Mr Carlalberto Guglielminotti and Mr Giuseppe

Artizzu which are subject to a holding period expiring on 28 July

2025 (the "blocked shares"). These shares are not covered by the

offer; the offeror has proposed to the latter, as holders of

blocked shares, that they enter into a liquidity contract to enable

them to benefit from liquidity in cash on terms consistent with the

offer price (including any additional consideration) (see in

particular section 2.6.2 of the offeror's offer document). These

contracts were entered into on 1 and 4 November 2024. Consequently,

these 25,043 NHOA shares are held by the offeror by assimilation

under the provisions of article L. 233-9 I, 4° of the French

Commercial Code. 3 It should be noted that the simplified tender

offer was made at a price of €1.25 per NHOA share, plus a potential

price supplement of €0.65 (guaranteed by the presenting bank),

linked to Free2Move eSolutions S.p.A. The price supplement, which

is non-transferable, is evidenced by a financial security admitted

to trading on Euroclear France. This supplement will only be

distributed to shareholders who have tendered their shares to the

public offer centralised by Euronext Paris or who have received

compensation under the squeeze-out procedure (see in particular

section 2.2 of the offeror's offer document approved by the AMF

under no. 24461 on 5 November 2024, D&I 224C2193 dated 5

November 2024 and Euronext Paris notice PAR_20241121_33495_EUR

dated 21 November 2024).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241125593544/en/

NHOA

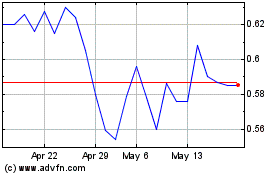

NHOA (EU:NHOA)

Historical Stock Chart

From Nov 2024 to Dec 2024

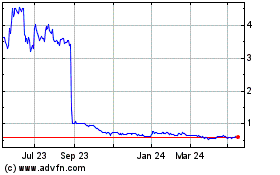

NHOA (EU:NHOA)

Historical Stock Chart

From Dec 2023 to Dec 2024