NEURONES: Description of the share buyback program - Effective implementation

19 March 2020 - 4:19AM

NEURONES: Description of the share buyback program - Effective

implementation

INFORMATION

Nanterre, March 16, 2020 (after the closing of the stock

exchange)

DESCRIPTION OF THE SHARE BUYBACK

PROGRAMEFFECTIVE IMPLEMENTATION

The Combined Shareholders’ Meeting held on June

6, 2019 renewed the authorization granted to the Board of

Directors, for a period of 18 months, to purchase or cause to be

purchased the company's own shares.

Pursuant to Articles 241-1 et seq. of

the General Regulation of the Autorité des Marchés Financiers, and

pursuant to Commission Delegated Regulation (EU) 2016/1052

supplementing Regulation (EU) No. 596/2014 with regard to

regulatory technical standards for the conditions applicable to

buyback programs and AMF-approved market practices, this

description sets out the objectives and the terms and conditions of

the buyback program under which NEURONES (henceforth "the Company")

will buy back its own shares, along with the conditions for its

effective implementation laid down by the Board of

Directors.

1.

Breakdown by objective of the securities held

On February 28, 2020, the number of shares held

directly or indirectly by the Company stood at 9,422, representing

less than 0.04% of the total capital of 24,285,862 shares.

These shares are held for the purposes of

supporting the market for the Company's shares under the liquidity

agreement concluded with CIC on August 1, 2019.

- Description of the share buyback program

authorized by the Shareholders’ Meeting

- Authorization of the program: sixteenth

resolution of the Combined Shareholders' Meeting of June 6,

2019

- Shares concerned: NEURONES common shares (ISIN

Code: FR0004050250)

- Maximum share of the capital approved by the

Shareholders' Meeting for buyback: 10% of the Company's

capital (i.e. 2,428,586 shares to date). However, by law, the

number of shares acquired with a view to subsequently offering them

for exchange or payment during external growth operations may not

exceed 5% of the share capital.

- Maximum purchase price: 30 euros (excluding

acquisition costs) per share. However, it should be noted that the

maximum purchase price will be adjusted, if need be, should the

company undertake financial operations or make decisions affecting

the share capital.

- Maximum value of the program authorized by the

Shareholders' Meeting: 72,857,580 euros

- Program objectives authorized by the Shareholders'

Meeting:

The Shareholders' Meeting, ruling pursuant to the provisions of

Article L.225-209 of the French Commercial Code, after having

reviewed the management report, authorizes the Board of Directors,

for a period not exceeding 18 months from this Meeting, to purchase

the Company's own shares in order to:1) subsequently cancel them;2)

cover:

- a. stock option plans and other forms of share allocation to

employees and/or to Group officers, in particular for Company

profit sharing, a Company Savings Plan (CSP) or the allocation of

free shares;

- b. financial securities conferring the right to receive Company

shares;

3) support the share

price through an Investment Service Provider via a liquidity

agreement pursuant to the code of professional conduct of the

Association Française des Marchés Financiers (French Association of

Financial Markets); 4)

hold purchased shares for subsequent use as exchange or payment

during an acquisition. The

shares may be purchased by intervening on the market or by

purchasing blocks, without any specific limitation on such block

acquisitions.

- Duration of the authorization to implement the

program: 18 months from the Shareholders’ Meeting, i.e. up

to December 6, 2020.

- Effective implementation of the share buyback program

authorized by the Shareholders' Meeting

The Company's Board of Directors has decided to

implement the share buyback program authorized by the Shareholders'

Meeting in order to pursue the following two objectives:

-

Support the market for the Company's shares, in particular

to encourage their liquidity, via a liquidity agreement pursuant to

a code of professional conduct recognized by the AMF, and concluded

with an investment service provider in compliance with AMF-approved

market practice.

The Company points out that it allocated the

cash sum of 400,000 euros to implementing the liquidity agreement

concluded on August 1, 2019 with CIC.

-

Cancel the shares bought back in order to reduce the

company's share capital, within the framework of and subject to a

current authorization from the Shareholders' MeetingThe

Board points out that the maximum number of shares that can be

acquired for this purpose has been set at 2,000,000, at a maximum

price of 21 euros per share (excluding acquisition costs), which

represents a maximum total of 42 million euros (excluding costs).

This implementation will be effective once this description has

been circulated.

About NEURONES

With 5,400 experts, the NEURONES Group

specializes in Consulting (Management, Organization and Digital)

and IT Services. It supports its clients in their digital

transformation projects and in the upgrading of their Information

Systems.

Euronext Paris (compartment B - NRO) - Enternext

Tech 40 – SRD medium values http://www.neurones.net

Investor

Relations:NEURONESPaul-César BonnelTel.: +33 (0)1

41 37 41 37investisseurs@neurones.net

-

NEURONES-Share-buyback-program-Effective-implementation-march-2020

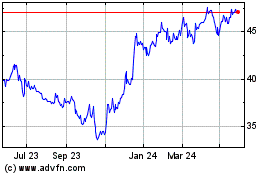

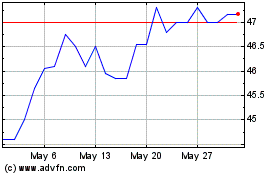

Neurones (EU:NRO)

Historical Stock Chart

From Nov 2024 to Dec 2024

Neurones (EU:NRO)

Historical Stock Chart

From Dec 2023 to Dec 2024