Good day. India is among the countries standing to benefit the

most from China's recent crackdown on its technology companies,

venture-capital executives say, as investors spooked by Beijing's

actions might look to redirect investments to its neighbor.

Historically, investing in India has been compared unfavorably

to doing so in China, venture firm March Capital co-founder and

managing partner Sumant Mandal said. That sentiment might be

shifting in favor of India, particularly after the country recently

introduced new rules that have made it more attractive to foreign

investments, such as a measure easing requirements for companies

aiming to go public.

Two recent Indian deals involving venture-capital-backed

startups show what the country can offer investors. Payment

platform IndiaIdeas.com Ltd., which does business as BillDesk,

agreed to be sold to Netherlands-based technology company Prosus NV

for $4.7 billion, while used-car dealer CarTrade Tech Ltd. was

valued at around $1 billion in its initial public offering last

month.

March Capital, a venture firm based in Santa Monica, Calif., was

an early backer of both businesses and stands to make close to $1

billion in returns across various funds from the two investments,

Mr. Mandal said. March has about $1 billion in assets under

management.

One potential challenge facing investors in India is rising

valuations, as local investment firms compete with large U.S.

venture-capital firms for the best deals. "Two years ago I would

have said that there was an India discount. Not anymore," Mr.

Mandal said.

And now on to the news...

Top News

Deals spree. Companies world-wide embarked on an unprecedented

deal spree this year, emerging from the depths of the pandemic

looking to bulk up and address the vulnerabilities it exposed, The

Wall Street Journal reports. Simultaneously, buyout firms and

blank-check companies have been deploying hundreds of billions of

dollars at a feverish pace. In the first eight months of 2021,

companies have announced mergers and acquisitions worth more than

$1.8 trillion in the U.S. and more than $3.6 trillion globally,

according to data provider Dealogic. Both figures are the highest

at this point in a year since at least 1995, when Dealogic started

keeping records. Deals are on track to surpass their record set in

2015.

$95 Billion

Rough value of new chip-making facilities that Intel Corp. plans

to build in Europe. (WSJ)

Bain Capital Backs Outdoor Gear Brand Cotopaxi

Cotopaxi, an outdoor gear and apparel brand that donates 1% of

its revenue to fighting poverty, has raised fresh capital that it

hopes will help it expand its business and its charitable impact,

WSJ Pro's Laura Kreutzer reports. Bain Capital Double Impact, a

unit of Boston-based Bain Capital that seeks to generate social and

environmental benefits along with financial returns, led a roughly

$45 million investment in the company, according to people with

knowledge of the deal. Bain invested in the Salt Lake City-based

company, whose legal name is Global Uprising PBC, from its second

impact fund, which closed with $800 million last year.

Tech Industry Seeks Bigger Role in Defense

Tech-industry leaders are pushing the Pentagon to adopt

commercially developed technologies on a grand scale to counter the

rise of China, an initiative that could transform the military and

the multibillion-dollar defense-contracting business, WSJ reports.

The Pentagon has long led the way in developing advanced technology

that found its way into civilian applications, such as GPS and the

internet. That balance has shifted, according to tech leaders and

others. They contend that the private sector has more talent and

greater research budgets than the government -- and more advanced

capabilities in artificial intelligence and cloud computing -- all

while the military grows more reliant on technology.

Industry News

Funds

Climate tech organization Elemental Excelerator is spinning out

Earthshot Ventures, a venture fund tackling climate change, with a

first close of $60 million. Limited partners include Emerson

Collective, McKinley Alaska, Microsoft, Employees' Retirement

System of Hawaii, Stafford Capital Partners, John Doerr and Tom

Steyer.

Exits

Small businesses software provider Ageras Group acquired

invoicing software developer Zervant for an undisclosed amount.

Philadelphia-based Ageras is backed by Investcorp Technology

Partners, Rabo Frontier Ventures and Lugard Road Capital. Zervant,

based in Helsinki, was backed by investors including Northzone, NFT

Ventures and Conor Venture Partners.

Capillary Technologies, a customer loyalty and customer

engagement services provider, acquired customer experience company

Persuade for an undisclosed sum. Based in Singapore, Capillary is

backed by Warburg Pincus, Sequoia Capital, Avataar Ventures and

Filter Capital.

New Money

Factorial, a Barcelona-based HR software startup, closed an $80

million Series B round. Tiger Global Management led the funding,

which included participation from CRV, Creandum and others.

ShopUp, a Bangladesh-based B2B commerce platform for small

businesses, picked up a $75 million Series B investment. Valar

Ventures led the round, which included support from VEON Ventures,

Prosus Ventures, Flourish Ventures and Sequoia Capital India.

Point Card, a San Francisco-based provider of a debit card for

millennials and Generation Z, completed a $46.5 million Series B

round. Valar Ventures led the investment, which included

contributions from Breyer Capital, Y Combinator Continuity and

Human Capital.

Cohere, a Toronto-based provider of natural language processing

models, secured $40 million in Series A financing. Index Ventures

led the round, which included participation from Section 32,

Radical Ventures and others. Mike Volpi, partner at Index Ventures,

will join the company's board.

aPriori Technologies, a Concord, Mass.-based digital

manufacturing software developer, snagged $30 million in Series D

funding. Co-led by Bruce Clarke of PBJ Capital and Gaurav Tewari of

Omega Venture Partners, the investment brings the company's

valuation up to $280 million.

Tritium Holdings, an Australian developer of direct current fast

charging technology for electric vehicles, landed a 40 million

Australian dollar ($29.6 million) investment from Cigna Investments

Inc.

DataChat Inc., a Madison, Wis.-based business data analytics

provider, nabbed a $25 million Series A round. Redline Capital and

Anthos Capital led the investment, which saw participation from

Celesta Capital and Nepenthe Capital.

Vowel Inc., a video conferencing tool, raised $13.5 million in

Series A funding led by Lobby Capital.

Ryd, a German startup offering a single digital payment service

for drivers, collected a EUR10 million ($11.8 million) investment

from bp ventures. Managing Partner Daniela Proske will join Ryd's

board.

Zebedee Inc., a Hoboken, N.J.-based payment service provider for

virtual worlds, grabbed an $11.5 million Series A round led by

Lakestar. New investors including Initial Capital, New Form Capital

and TVP also participated in the funding, along with existing

backers Collab+Currency, Cadenza Capital and Fulgur Ventures.

Novi Connect, a San Francisco-based B2B marketplace focused on

personal care, beauty and home goods, scored $10.3 million in new

funding from investors including Greylock and Defy Partners.

GoKwik, an India-based ecommerce enablement startup, fetched

$5.5 million in pre-Series A funding. Lead investor Matrix Partners

was joined by RTP Global in the round.

Tech News

El Salvador becomes first country to adopt bitcoin as national

currency

App developers' payments dilemma: easier with or without Apple

and Google?

Should ransomware payments be made illegal?

Toyota to spend $9 billion on electric-car battery plants

New Apple iPhone expected to be unveiled at Sept. 14 event

Around the Web

Here's why SoftBank just invested in the metaverse

(Protocol)

(END) Dow Jones Newswires

September 08, 2021 09:51 ET (13:51 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

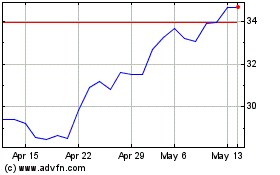

Prosus NV (EU:PRX)

Historical Stock Chart

From Jan 2025 to Feb 2025

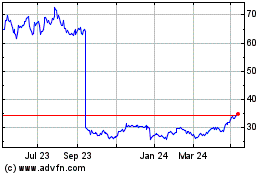

Prosus NV (EU:PRX)

Historical Stock Chart

From Feb 2024 to Feb 2025