Adecco Focuses On Profitability As Income Rises 12%

08 May 2012 - 3:40PM

Dow Jones News

Staffing company Adecco SA(ADEN.VX) Tuesday reported a 12%

increase in net profit on a 2% increase in sales and said it would

continue to focus on profitability in the coming months.

MAIN POINTS:

-1Q net profit EUR112 million versus EUR100 million in 2011

-1Q revenue EUR 5.04 billion versus EUR4.92 billion in 2011

- The company said revenue developments in April were a "touch

weaker" than in the first quarter

-Outlook: "Building on our strategic priorities we continue to

focus our efforts on constantly improving our HR solutions,

delivery models and the cost base, and we remain convinced that we

will achieve an EBITA margin of over 5.5% midterm," the company

said.

- Six analysts polled by Dow Jones Newswires on average forecast

a net profit of EUR95.3 million.

- Six analysts polled by Dow Jones Newswires on average forecast

revenue of EUR5 billion.

- Rival staffing companies Randstad holding NV (RAND.AE) last

month reported a 2% rise in first quarter earnings before interest,

tax and amortization for its first quarter, from a 12% increase in

revenues, driven by growth in its U.S. business. But its net profit

for the period fell 29% because of integration costs.

American rival ManpowerGroup (MAN) reported a 13% rise in

profit, helped by a rise in temporary hiring by companies reluctant

to take on permanent staff.

- Adecco shares closed Monday at CHF39.25, valuing the company

at CHF7.43 billion. The stock has lost 0.25% in value since the

start of the year.

-By John Revill, Dow Jones Newswires; +41 43 443 8042 ;

john.revill@dowjones.com

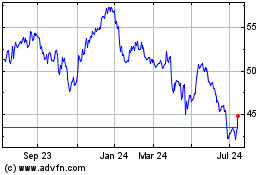

Randstad NV (EU:RAND)

Historical Stock Chart

From Nov 2024 to Dec 2024

Randstad NV (EU:RAND)

Historical Stock Chart

From Dec 2023 to Dec 2024