Hermès International: Third Quarter 2024 Revenue

HERMÈS

Quarterly information report as at the end of

September 2024

Continued solid sales growth at the end

of September

(+14% at constant exchange rates and +11% at current

exchange rates)

Paris, 24 October 2024

The group’s consolidated revenue amounted to

€11.2 billion at the end of September 2024, up 14% at constant

exchange rates and 11% at current exchange rates compared to the

same period in 2023.

In the third quarter, sales continued to rise

and reached €3.7 billion, up 11% at constant exchange rates and 10%

at current exchange rates. All regions are growing, despite a

particularly high comparison basis in Europe and Asia-Pacific.

Axel Dumas, Executive Chairman of Hermès, said:

“In a more uncertain economic and geopolitical context, I want

to thank all employees for the robust third-quarter performance,

and our customers for their loyalty. Thanks to the singularity of

its model, Hermès is continuing its recruitments and long-term

investments.”

Sales by geographical area at the end of

September

(at constant exchange rates, unless otherwise

indicated)

At the end of September 2024, all the

geographical areas posted solid growth, and the exclusive

distribution network continued its development.

Asia excluding Japan (+7%) posted growth,

supported by solid sales in Korea, Singapore, Australia and

Thailand. The region is growing in the third quarter despite the

downturn in traffic in Greater China observed since the end of the

Chinese New Year, and a high base in the third quarter last year.

The Shenzhen store in China reopened in October after renovation

and expansion, following the Lee Gardens store reopening in Hong

Kong in June. In August, the Collins Street store in Melbourne

reopened after renovation.

Japan (+23%), after an excellent third quarter,

confirmed its strong growth thanks to the loyalty of its local

clients. The new Ginza Mitsukoshi store was inaugurated in Tokyo in

June, after the Azadubai Hills store in February.

The Americas (+13%) continued their solid

momentum in the third quarter, with growth close to the previous

two quarters. The new Princeton store in New Jersey opened in April

and online sales continued their development with their extension

to Mexico in September.

Europe excluding France (+18%) achieved a

remarkable performance, notably in the third quarter thanks to

solid local demand and continued dynamics of tourist flows in all

the countries of the region.

France (+14%) after a sustained third quarter

confirmed its momentum despite a slight slowdown in traffic in the

Parisian stores due to the Olympic games. The Nantes store reopened

in June after being renovated.

Sales by sector at the end of

September

(at constant exchange rates, unless otherwise

indicated)

At the end of September 2024, all the métiers

with the exception of the Watches métier, posted solid growth.

The Leather Goods and Saddlery métier (+17%)

continued its solid growth. Demand remained sustained for both

iconic models, which are constantly being reinvented, and for new

models, such as the Constance Élan and Bolide à

dos bags with a marked saddler spirit. Production capacity

continued to increase, with the opening of the group’s twenty-third

leather goods workshop in Riom, in the Puy-de-Dôme, in September.

This new facility reinforces the company’s nine centres of

expertise located across the national territory.

The Ready-to-wear and Accessories sector (+15%)

confirmed its sustained momentum. The men’s spring-summer 2025

fashion show, held at the Palais d’Iéna in June, was very well

received. The women’s spring-summer 2025 collection, was presented

at the end of September at the Garde Républicaine. It is inspired

by the workshop as a place of creation and offers a combination of

soft leather and transparency.

The Silk and Textiles sector (+2%) grew in the

third quarter, thanks to creations combining exceptional materials

and savoir-faire.

Perfume and Beauty (+7%) achieved a steady

growth in the third quarter. In September, the house successfully

launched the new women’s perfume, Barénia, imagined by

Christine Nagel. This new fragrance bears the name of an heritage

leather and is displayed in an object bottle inspired by the

Collier de chien bracelet. Beauty enriched its offering

with the second part of Le Regard, the Trait

Hermès, composed of pencils for the eyes and the lips.

In a more challenging context, the Watches

métier (-6%) was penalised by a high comparison base due to

exclusive events in the third quarter last year. The Hermès

H08 collection continues to be well received.

The Other Hermès sectors (+17%), which include

Jewellery and the Home universe, pursued their strong growth,

illustrating the singularity and creativity of the house. The

eighth Haute Bijouterie collection, Les formes de la

couleur, was presented in September in Beijing after Paris in

June.

A sustainable and responsible

model

True to its commitment to local anchoring and

job creation, the house inaugurated the Riom leather goods workshop

in September. This new site will ultimately host 250 artisans

trained locally with the house’s exceptional know-how, following

the installation in Riom since 2022, of the École Hermès des

savoir-faire to pass on the expertise of the house’s artisan

saddler-leather workers. The establishment of the leather goods

workshop in the former Manufacture des Tabacs, a former industrial

site registered as a historic site and fully rehabilitated,

reflects the house’s approach of enhancing industrial heritage and

minimizing the artificialisation of soils.

The sustainable and responsible dimension of the

house’s craftsmanship model was rewarded in August by S&P, with

an increase in its rating up 11 points to 65/100. The MSCI rating

agency also confirmed the house’s AA rating in a context of

increased regulatory constraints and transparency. These results

demonstrate the commitments and values of the house.

Other highlights

At the end of September 2024, currency

fluctuations represented a negative impact of €242 million on

revenue.

During the first nine months, Hermès

International redeemed 21,316 shares for €40 million, excluding

transactions completed within the framework of the liquidity

contract.

Outlook

In a more complex economic and geopolitical

context, the group continues its development with confidence,

thanks to the highly integrated artisanal model, the balanced

distribution network, the creativity of collections and the loyalty

of clients.

In the medium-term, despite the economic,

geopolitical and monetary uncertainties around the world, the group

confirms an ambitious goal for revenue growth at constant exchange

rates.

Thanks to its unique business model, Hermès is

pursing its long-term development strategy based on creativity,

maintaining control over know-how and singular communication.

In the Spirit of the Faubourg is the

theme of the year. This place, the fruit of Emile Hermès’ dream, is

the beating heart of the house. It accompanies Hermès everywhere

and inspires the effervescence and joyful spirit so dear to the

house.

The press release on Revenue at the end of

September 2024 is available

on the group’s website: https://finance.hermes.com.

Upcoming events:

- 14 February 2025: 2024 full-year

results publication

- 17 April 2025: Q1 2025 revenue

publication

- 30 April 2025: General Meeting of

shareholders

Revenue by geographical area

(a)

|

|

|

At the end of September |

Evolution /2023 |

| In

€m |

|

2024 |

2023 |

Published |

At constant exchange rates |

| France |

|

1,045 |

916 |

14.2% |

14.2% |

| Europe (excl.

France) |

|

1,554 |

1,327 |

17.1% |

18.4% |

|

Total Europe |

|

2,600 |

2,243 |

15.9% |

16.7% |

| Japan |

|

1,053 |

939 |

12.1% |

22.6% |

| Asia-Pacific

(excl. Japan) |

|

5,105 |

4,872 |

4.8% |

7.0% |

|

Total Asia |

|

6,158 |

5,811 |

6.0% |

9.5% |

| Americas |

|

1,995 |

1,785 |

11.7% |

12.8% |

| Other (Middle

East) |

|

456 |

223 |

104.4% |

104.8% |

|

TOTAL |

|

11,208 |

10,063 |

11.4% |

13.8% |

|

|

|

3rd

quarter |

Evolution /2023 |

| In

€m |

|

2024 |

2023 |

Published |

At constant exchange rates |

| France |

|

365 |

323 |

13.1% |

13.1% |

| Europe (excl.

France) |

|

584 |

492 |

18.8% |

20.3% |

|

Total Europe |

|

949 |

814 |

16.5% |

17.4% |

| Japan |

|

360 |

304 |

18.5% |

22.8% |

| Asia-Pacific

(excl. Japan) |

|

1,584 |

1,575 |

0.6% |

1.0% |

|

Total Asia |

|

1,944 |

1,879 |

3.5% |

4.6% |

| Americas |

|

666 |

600 |

11.0% |

13.4% |

| Other (Middle

East) |

|

145 |

72 |

102.2% |

104.4% |

|

TOTAL |

|

3,704 |

3,365 |

10.1% |

11.3% |

(a) Sales by destination.

Revenue by sector

|

|

|

At the end of September |

Evolution /2023 |

| In

€m |

|

2024 |

2023 |

Published |

At constant exchange rates |

| Leather Goods

and Saddlery (1) |

|

4,789 |

4,176 |

14.7% |

17.3% |

| Ready-to-wear

and Accessories (2) |

|

3,296 |

2,934 |

12.3% |

14.8% |

| Silk and

Textiles |

|

646 |

648 |

(0.2%) |

2.2% |

| Other Hermès

sectors (3) |

|

1,421 |

1,239 |

14.7% |

17.0% |

| Perfume and

Beauty |

|

388 |

367 |

5.9% |

6.8% |

| Watches |

|

434 |

473 |

(8.2%) |

(6.2%) |

| Other products

(4) |

|

233 |

226 |

3.3% |

4.6% |

|

TOTAL |

|

11,208 |

10,063 |

11.4% |

13.8% |

|

|

|

3rd

quarter |

Evolution /2023 |

| In

€m |

|

2024 |

2023 |

Published |

At constant exchange rates |

| Leather Goods

and Saddlery (1) |

|

1,573 |

1,396 |

12.7% |

14.0% |

| Ready-to-wear

and Accessories (2) |

|

1,134 |

1,012 |

12.1% |

13.5% |

| Silk and

Textiles |

|

210 |

204 |

3.0% |

4.0% |

| Other Hermès

sectors (3) |

|

455 |

403 |

12.7% |

13.6% |

| Perfume and

Beauty |

|

129 |

117 |

10.2% |

10.6% |

| Watches |

|

126 |

155 |

(18.9%) |

(18.2%) |

| Other products

(4) |

|

76 |

76 |

(0.0%) |

0.6% |

|

TOTAL |

|

3,704 |

3,365 |

10.1% |

11.3% |

(1) The “Leather Goods and Saddlery”

business line includes women’s and men’s bags, travel items, small

leather goods and accessories, saddles, bridles and all equestrian

objects and clothing.

(2) The “Ready-to-wear and Accessories” business line

includes Hermès Ready-to-wear for men and women, belts, costume

jewellery, gloves, hats and shoes.

(3) The “Other Hermès business lines” include Jewellery

and Hermès home products (Art of Living and Hermès Tableware).

(4) The “Other products” include the production

activities carried out on behalf of non-group brands (textile

printing, tanning…), as well as John Lobb, Saint-Louis and

Puiforcat.

REMINDER –

FIRST HALF 2024 KEY FIGURES

|

In millions of euros |

H1 2024 |

2023 |

H1 2023 |

| |

|

|

|

|

Revenue |

7,504 |

13,427 |

6,698 |

|

Growth at current exchange rates vs. n-1 |

12.0% |

15.7% |

22.3% |

|

Growth at constant exchange rates vs. n-1

(1) |

15.1% |

20.6% |

25.2% |

|

|

|

|

|

|

Recurring operating income (2) |

3,148 |

5,650 |

2,947 |

|

As a % of revenue |

42.0% |

42.1% |

44.0% |

|

|

|

|

|

|

Operating income |

3,148 |

5,650 |

2,947 |

|

As a % of revenue |

42.0% |

42.1% |

44.0% |

|

|

|

|

|

|

Net profit – Group share |

2,368 |

4,311 |

2,226 |

|

As a % of revenue |

31.6% |

32.1% |

33.2% |

|

|

|

|

|

|

Operating cash flows |

2,829 |

5,123 |

2,615 |

|

|

|

|

|

|

Operating investments |

319 |

859 |

249 |

|

|

|

|

|

|

Adjusted free cash flows (3) |

1,776 |

3,192 |

1,720 |

|

|

|

|

|

|

Equity – Group share |

15,052 |

15,201 |

13,249 |

|

|

|

|

|

|

Net cash position (4) |

9,477 |

10,625 |

9,326 |

|

|

|

|

|

|

Restated net cash position (5) |

10,033 |

11,164 |

9,848 |

|

|

|

|

|

|

Workforce (number of employees)

(6) |

23,242 |

22,037 |

20,607 |

(1) Growth at

constant exchange rates is calculated by applying, for each

currency, the average exchange rates of the previous period to the

revenue for the period.

(2) Recurring

operating income is one of the main performance indicators

monitored by Group Management. It corresponds to operating income

excluding non‑recurring items having a significant impact that may

affect understanding of the Group’s economic performance.

(3) Adjusted

free cash flows are the sum of cash flows related to operating

activities, less operating investments and the repayment of lease

liabilities recognised in accordance with IFRS 16

(aggregates in the consolidated statement of cash flows).

(4) Net

cash position includes cash and cash equivalents presented under

balance sheet assets, less bank overdrafts which appear under

short‑term borrowings and financial liabilities on the liabilities

side. Net cash position does not include lease liabilities

recognised in accordance with IFRS 16.

(5) The

restated net cash position corresponds to net cash plus cash

investments that do not meet the IFRS criteria for cash equivalents

due in particular to their original maturity of

more than three months, less borrowings and financial

liabilities.

(6) The

headcount relates to employees on permanent contracts and those on

fixed-term contracts lasting more than 9 months.

- hermes_20241024_q3revenue_en

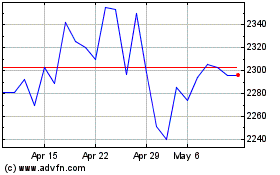

Hermes (EU:RMS)

Historical Stock Chart

From Jan 2025 to Feb 2025

Hermes (EU:RMS)

Historical Stock Chart

From Feb 2024 to Feb 2025