Van Lanschot Kempen: net profit at €51.8 million and net AuM inflows of €3.2 billion in H1 2023

24 August 2023 - 3:30PM

Van Lanschot Kempen: net profit at €51.8 million and net AuM

inflows of €3.2 billion in H1 2023

Amsterdam/’s-Hertogenbosch, the Netherlands, 24 August 2023

- Net profit at

€51.8

million (H1 2022:

€48.2

million)

- Net AuM inflows at Private

Clients:

€2.2

billion; Wholesale & Institutional

Clients: €1.0 billion

- Client assets:

€130.8

billion (2022:

€124.2

billion) and

AuM:

€115.2

billion (2022:

€107.8

billion)

- Robust capital ratio at

21.6%

(2022: 20.6%);

well above our 17.5% target

- Capital return proposal in the amount

of

€2.00

per share

Maarten Edixhoven, Chair of the Van

Lanschot Kempen Management Board,

said: “Against a volatile

economic and geopolitical backdrop, I am very pleased with the net

inflow of €3.2 billion in assets under management (AuM). This

demonstrates the trust existing and new private and institutional

clients have in Van Lanschot Kempen. We remain committed to growth

by continuously improving our services, with a focus on personal

attention and digital service. We also made good progress

integrating Mercier Vanderlinden in Belgium and preparing the

integration of Robeco’s online investment platform in the

Netherlands. Meanwhile, we remain disciplined in preserving our

robust capital and liquidity positions. The commitment of our

people and the confidence of our clients and shareholders allow us

to look back on a solid first half.

“Private Clients reported robust results. We expanded our

service offering by launching a proposition that enables private

banking clients to put their own personal stamp on their

discretionary management portfolios. Also, we added a further 15

private bankers to our team and launched a ‘Young Private Banking

Programme’ training our private bankers of the future. Profitable

growth is our focus at Wholesale & Institutional Clients.

Following up on initiatives announced last year, we’re taking

additional cost-saving measures while at the same time bolstering

our commercial strength. Investment Banking Clients faced a

persistently challenging environment for transactions. To achieve

an efficiency ratio of 70% – our target – we maintain a strict

focus on costs in all our activities.

“Our annual research report into the views of high net-worth

individuals in the Netherlands revealed that a majority want their

wealth managers to lead by example on sustainability. We’ve made

great strides in this respect since 2019, having cut our own carbon

emissions by 41%. Our ambition also remains to reduce the climate

impact of investments and mortgages year after year, in dialogue

with our clients and the companies in which we invest.

“Our capital and liquidity positions remained robust, with an

increase in our CET 1 ratio to 21.6%, well ahead of our target, and

a liquidity ratio of 172%. This enables us to propose a capital

return of €2.00 per share in the second half of 2023.”

Client assets

and AuMSolid net AuM inflows of

€3.2 billion combined with a positive market performance of €4.1

billion resulted in an increase in total AuM to €115.2 billion

(2022: €107.8 billion). Encouraged by a positive stock market

climate and rising capital market rates, clients shifted a

proportion of their savings to investments, taking client savings

down to €11.2 billion (2022: €12.7 billion). Total client assets

stood at €130.8 billion (2022: €124.2 billion).

PERFORMANCE

REPORT/PRESENTATION/WEBCAST

For a detailed discussion of Van Lanschot Kempen’s results and

balance sheet, please refer to its performance report and

presentation on the 2023 half-year results at

vanlanschotkempen.com/results. In a conference call on 24 August at

9:00 am CET, it will discuss its 2023 half-year results in greater

detail. This may be viewed live at vanlanschotkempen.com/results

and played back at a later date.

ADDITIONAL

INFORMATIONFor additional

information, go to vanlanschotkempen.com/financial.

FINANCIAL CALENDAR5 October

2023 Extraordinary

general meeting2 November

2023 Publication of

2023 third-quarter trading update 22 February 2024

Publication of 2023

full-year results

Media

Relations T

+31 20 354 45

85 mediarelations@vanlanschotkempen.comInvestor

Relations T

+31 20 354 45

90 investorrelations@vanlanschotkempen.com

About Van Lanschot KempenVan

Lanschot Kempen is an independent, specialist wealth manager active

in private banking, investment management and investment banking,

with the aim of preserving and creating wealth, in a sustainable

way, for both its clients and the society of which it is part.

Through our long-term focus, we create positive financial and

nonfinancial value. Listed at Euronext Amsterdam, Van Lanschot

Kempen is the Netherlands’ oldest independent financial services

company, with a history dating back to 1737.

For more information, please visit vanlanschotkempen.com

Important legal information and cautionary note on

forward-looking statementsThis press release may contain

forward-looking statements and targets on future events and

developments. These forward-looking statements and targets are

based on the current insights, information and assumptions of Van

Lanschot Kempen’s management about known and unknown risks,

developments and uncertainties. Forward-looking statements and

targets do not relate strictly to historical or current facts and

are subject to such risks, developments and uncertainties which by

their very nature fall outside the control of Van Lanschot Kempen

and its management. Actual results, performances and circumstances

may differ considerably from these forward-looking statements and

targets.

Van Lanschot Kempen cautions that forward-looking statements and

targets in this press release are only valid on the specific dates

on which they are expressed, and accepts no responsibility or

obligation to revise or update any information, whether as a result

of new information or for any other reason.

Van Lanschot Kempen’s semi-annual accounts are prepared in

accordance with IAS 34 (Interim Financial Reporting), as adopted by

the European Union. In preparing the financial information in this

press release, except as described otherwise, the same accounting

principles are applied as in the 2022 Van Lanschot Kempen

consolidated annual accounts. The figures in this press release

have not been audited. Small differences are possible in the tables

due to rounding. Percentages are calculated based on unrounded

figures.

This press release does not constitute an offer or solicitation

for the sale, purchase or acquisition in any other way or

subscription to any financial instrument and is not a

recommendation to perform or refrain from performing any

action.

Elements of this press release contain information about Van

Lanschot Kempen NV within the meaning of Article 7(1) to (4) of EU

Regulation No. 596/2014.

This press release is a translation of the Dutch language

original and is provided as a courtesy only. In the event of any

disparities, the Dutch language version will prevail. No rights can

be derived from any translation thereof

- Van Lanschot Kempen press release HY 2023

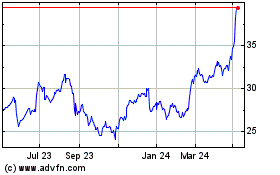

Van Lanschot Kempen NV (EU:VLK)

Historical Stock Chart

From Nov 2024 to Dec 2024

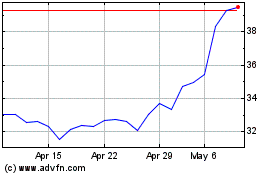

Van Lanschot Kempen NV (EU:VLK)

Historical Stock Chart

From Dec 2023 to Dec 2024