Vopak reports on Q1 2022 financial results

20 April 2022 - 3:00PM

Vopak reports on Q1 2022 financial results

Vopak reports on Q1 2022 financial

resultsRotterdam, the Netherlands, 20 April 2022

|

in EUR millions |

Q1 2022 |

Q4 2021 |

Q1 2021 |

| |

|

|

|

|

Revenues |

324.1 |

315.2 |

300.1 |

| |

|

|

|

| Results -excluding

exceptional items- |

|

|

|

|

Group operating profit before depreciation and amortization

(EBITDA) |

213.1 |

212.5 |

198.6 |

|

Group operating profit (EBIT) |

125.8 |

121.9 |

120.7 |

|

Net profit attributable to holders of ordinary shares |

74.7 |

69.1 |

72.5 |

|

Earnings per ordinary share (in EUR) |

0.60 |

0.55 |

0.58 |

| |

|

|

|

| Results -including

exceptional items- |

|

|

|

|

Group operating profit before depreciation and amortization

(EBITDA) |

213.1 |

206.5 |

198.6 |

|

Group operating profit (EBIT) |

125.8 |

115.9 |

120.7 |

|

Net profit attributable to holders of ordinary shares |

74.7 |

64.1 |

72.5 |

|

Earnings per ordinary share (in EUR) |

0.60 |

0.51 |

0.58 |

| |

|

|

|

|

Cash flows from operating activities (gross excluding

derivatives) |

169.1 |

313.1 |

139.9 |

|

Cash flows from operating activities (gross) |

150.2 |

312.2 |

122.4 |

|

Cash flows from investing activities (including derivatives) |

- 94.8 |

- 139.7 |

- 137.0 |

| |

|

|

|

|

Additional performance measures |

|

|

|

|

Proportional EBITDA -excluding exceptional items- |

253.7 |

250.6 |

243.9 |

|

Proportional capacity end of period (in million cbm) |

22.6 |

22.5 |

22.2 |

|

Proportional occupancy rate |

84% |

86% |

89% |

|

Storage capacity end of period (in million cbm) |

36.2 |

36.2 |

35.7 |

|

Subsidiary occupancy rate |

83% |

86% |

88% |

| |

|

|

|

|

Return on capital employed (ROCE) |

9.1% |

9.6% |

10.3% |

|

Average capital employed |

5,418.2 |

5,150.2 |

4,460.4 |

|

Net interest-bearing debt |

2,908.9 |

2,925.1 |

2,723.6 |

|

Senior net debt : EBITDA |

2.70 |

2.93 |

2.60 |

|

Total net debt : EBITDA |

2.92 |

3.16 |

2.82 |

Highlights for Q1

2022 -excluding exceptional

items-:

- EBITDA of EUR 213 million (Q1 2021:

EUR 199 million) in volatile market conditions, adjusted for EUR 9

million positive currency translation effects; EBITDA increased by

EUR 5 million (2.5%).

- EBITDA year on year improvement is

driven by growth projects contribution and good performance in the

Americas division that offset the impact of particularly

challenging market conditions in Europe.

- Proportional occupancy rate of 84%

declined compared to the fourth quarter last year which was 86%.

This was mainly driven by low occupancy performance in oil storage

in the Netherlands as a result of continued soft storage markets

for oil.

- Cost level for Q1 2022 amounted to

EUR 165 million (Q1 2021: EUR 151 million) mainly related to

increases in utility prices, currency exchange movements and

including costs for delivered growth projects and new business

development efforts.

- EBIT of EUR 126 million (Q1 2021:

EUR 121 million), increased due to positive business performance,

positive currency translation effect, partially offset by higher

depreciation.

- Net profit attributable to holders

of ordinary shares of EUR 75 million (Q1 2021: EUR 73

million).

- Cash Flow From Operations

(excluding derivatives) of EUR 169 million increased compared to Q1

2021 EUR 140 million driven by business performance and receipt of

dividends from joint ventures slightly offset by working capital

movements.

- Return on capital employed (ROCE)

of 9.1% decreased from Q1 2021: ROCE of 10.3% as a result of higher

capital employed from new capacity and investments in sustaining

and IT capex.

- The senior net debt: EBITDA ratio

is 2.70 (Q4 2021: 2.93) mainly due to positive EBITDA performance

and receipt of joint venture dividends.

Portfolio items:

- Vopak has signed an agreement

subject to customary closing conditions for the divestment of 4

Canadian terminals located in Hamilton, Montreal East and West and

Quebec City. Proceeds of around EUR 116 million are expected and

will be used for debt repayments. We expect a limited exceptional

divestment result upon closing.

- Following the outcome of the

previously announced strategic review of our assets in Australia,

Vopak decided to continue to operate these terminals. The

Australian market is solid and will continue to support the cash

flow generation of Vopak.

- Gate terminal, our joint venture

with Gasunie for LNG in Rotterdam, continues to play a key role in

the security of natural gas supplies in Northwest Europe supplying

the equivalent of 25% of the Netherlands’ gas needs. One of our

customers, Uniper, will increase its capacity rights by 1 BCM as of

October 2022. Following last year's announcement on expansion of

send out capacity which will become available in October 2024, it

is currently also being investigated if, in the short term, the

send out capacity of the Gate terminal can be expanded

further.

- Delivery of new capacity of 44,500

cbm during Q1 2022 in Altamira and Deer Park.

Exceptional items Q1 2022:

- There were no exceptional items in

Q1 2022.

Subsequent events:

- Vopak will be working together with

partners Gasunie and HES International to develop an import

terminal for green ammonia as a hydrogen carrier in Rotterdam, the

Netherlands. The companies have signed a cooperation agreement

which is a response to growing global demand for import and storage

of green energy. In Q2 2022, work will be started on the basic

design of the import terminal. The terminal, which will operate on

the Maasvlakte under the name ACE Terminal, is planned to be

operational from 2026.

Looking ahead:

- Vopak is on track with the prior

announced target of EUR 110 million to EUR 125 million EBITDA

contribution in 2023 from growth projects.

- We expect to manage the 2022 cost

base including additional cost for new growth projects around EUR

645 million, subject to currency exchange and utilities price

movements. In Q1 2022 there was upward pressure on currency

exchange and utilities price movements.

- In 2022, growth investments are

expected to be below EUR 300 million. The allocation of these

investments will be through existing committed projects, new

business development and pre-FID (Final Investment Decision)

feasibility studies in new energies including hydrogen.

- For the period 2020-2022, Vopak

expects to be at the higher end of the range EUR 750 million to EUR

850 million for sustaining and service improvement capex, subject

to additional discretionary decisions, policy changes and

regulatory requirements.

- As part of the strategic direction

for the period 2020-2022, Vopak indicated to invest annually up to

a maximum of EUR 45 million in IT capex, to complete Vopak’s

digital terminal management system. We expect to complete the roll

out of our Vopak Terminal System to our terminal network and joint

ventures by the end of 2023.

Impact of the

Russia-Ukraine war:The Russian invasion of Ukraine is a

major humanitarian drama and we sympathize with the people who are

now suffering from the violence of war. Vopak is monitoring the

situation closely and is fully committed to adhere to relevant

sanctions laws and regulations. At the moment, restrictions under

applicable EU sanctions are in general exempted in relation to the

import of energy products into the EU. As governments try to ensure

energy security and affordability, Vopak follows applicable

government regulations with regard to energy imports from

Russia.

The Russia-Ukraine war and the international

sanction regimes make the market situation volatile and uncertain.

Vopak’s direct exposure is assessed to be limited. There is,

however, an indirect exposure through factors such as utility

prices, inflation, market conditions and exchange rates.

Impact of Covid-19 pandemic in

2022:The pandemic spread of

Covid-19 remains an impactful event in several regions around the

world, such as recently China. Our first priority in the Covid-19

response continues to be to protect the health and well-being of

our people, their families and the communities in which we operate.

Also in times of crisis, Vopak plays an important role within

society by storing vital products with care.

Financial

calendar20 April 2022

Annual

General Meeting22 April 2022

Ex-dividend

quotation25 April 2022

Dividend

record date28 April 2022

Dividend payment

date12 May 2022

Capital Markets Day27

July 2022

Publication of 2022 half-year

results11 November 2022

Publication of 2022 third-quarter interim update

Disclaimer Any statement,

presentation or other information contained herein that relates to

future events, goals or conditions is, or should be considered, a

forward-looking statement. Although Vopak believes these

forward-looking statements are reasonable, based on the information

available to Vopak on the date such statements are made, such

statements are not guarantees of future performance and readers are

cautioned against placing undue reliance on these forward-looking

statements. Vopak’s outlook does not represent a forecast or any

expectation of future results or financial performance. The actual

future results, timing and scope of a forward-looking statement may

vary subject to (amongst others) changes in laws and regulations

including international treaties, political and foreign exchange

developments, technical and/or operational capabilities and

developments, environmental and physical risks, (energy) resources

reasonably available for our operations, developments regarding the

potential capital raising, exceptional income and expense items,

changes in the overall economy and market in which we operate,

including actions of competitors, preferences of customers, society

and/or the overall mixture of services we provide and products we

store and handle.

Vopak does not undertake to publicly update or

revise any of these forward-looking statements.

About Royal VopakRoyal Vopak is

the world’s leading independent tank storage company. We store

vital products with care. With over 400 years of history and a

focus on sustainability, we ensure safe, clean and efficient

storage and handling of bulk liquid products and gases for our

customers. By doing so, we enable the delivery of products that are

vital to our economy and daily lives, ranging from chemicals, oils,

gases and LNG to biofuels and vegoils. We are developing key

infrastructure solutions for the world’s changing energy and

feedstock systems, while simultaneously investing in digitalization

and innovation. Vopak is listed on the Euronext Amsterdam and is

headquartered in Rotterdam, the Netherlands. For more information,

please visit vopak.com.

For more information please

contact:Vopak Press: Liesbeth Lans -

Manager External Communication, e-mail:

global.communication@vopak.com Vopak Analysts and

Investors: Fatjona Topciu - Head of Investor Relations,

e-mail: investor.relations@vopak.com

The analysts’ presentation will be given via an

on-demand audio webcast on Vopak’s corporate website, starting at

8:45 AM CEST on 20 April 2022.

This press release contains inside information

as meant in clause 7 of the Market Abuse Regulation. The content of

this report has not been audited or reviewed by an external

auditor.

- Press Release - Vopak reports on Q1 2022

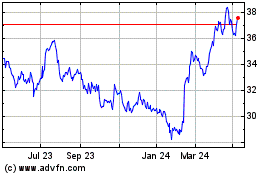

Koninklijke Vopak (EU:VPK)

Historical Stock Chart

From Nov 2024 to Dec 2024

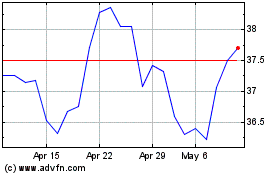

Koninklijke Vopak (EU:VPK)

Historical Stock Chart

From Dec 2023 to Dec 2024