FTSE 100 Closes Up In Slow Start To The Week

23 January 2024 - 4:31AM

Dow Jones News

FTSE 100 index finished up 0.35% at 7,487.71 points on Monday in

what has been a slow start of the week for European markets.

Lifting the index into the green were top risers Entain, Persimmon

and JD Sports while London-listed miners were under pressure. "A

mixed Asia session which saw Chinese markets fall sharply after a

failure to cut loan rates which has served to weigh on commodity

prices more broadly," CMC Markets UK analyst Michael Hewson writes

in a market comment. The weakness in China has translated into

weakness in basic resources with Rio Tinto and Glencore trading

lower to close down 1.7% and 3.5%, respectively. Endeavour Mining

also fell 3.3% after posting disappointing fourth-quarter

results.

COMPANIES NEWS:

Endeavour Mining Meets Gold Production Estimates; Sees 2024

Growth

Endeavour Mining said gold production met its estimates, and

forecast further growth.

---

Getech Sells Part of Head Office to Pay Debt

Getech Group said it had sold part of its head office and that

it will use the net proceeds to pay debt and as working

capital.

---

S4 Capital Sees No Improvement in Backdrop, Expects Clients to

Remain Cautious

U.K. digital advertising company S4 Capital said it doesn't

expect the current market backdrop to improve in 2024, with client

caution on marketing spend likely to persist

---

Kooth Expects Strong Revenue Growth On U.S. Expansion

Strategy

Kooth said that it expects strong revenue growth for 2023 on the

back of its international-expansion strategy, which focused on the

U.S. market, and despite challenges in the U.K. market.

---

Virgin Wines Revenue Edges Up, Expects Full-Year in Line With

Market Views

Virgin Wines UK said total revenue for the first half of its

fiscal year rose slightly, despite a subdued consumer economic

landscape, and that it expects its performance for the year to be

in line with current market expectations.

---

HG Capital Trust Sells Argus Media Stake for $66.1 Mln

HG Capital Trust said it has sold all its shareholding in Argus

Media, a provider of intelligence to the energy and commodity

markets, in a deal valued at around 52 million pounds ($66.1

million).

---

Compass to Buy CH&CO for Initial Enterprise Value of $600

Mln

Compass Group said it has agreed to buy provider of premium

contract and hospitality services CH&CO for an initial

enterprise value of 475 million pounds ($603.4 million) to

complement its footprint in the U.K. and Ireland.

---

Trifast Cuts Guidance, Plans to Lay off Around 130 Employees

Trifast has cut its full fiscal-year guidance and plans to lay

off around 130 workers due to weaker-than-expected demand.

MARKET TALK:

U.K. Insurers Have Strong Capital Builds

1400 GMT - U.K. insurers are still well capitalized with a

strong dividend-paying capacity on Solvency II operating surplus

generation, despite swap rates being significantly down in the last

quarter of 2023, Mediobanca writes in a note to clients. "Solvency

II will remain strong with leverage continuing to improve, while

operating capital generation will continue to support dividends and

excess capital return capacity," analyst Fahad Changazi writes.

Strong returns, along with U.K. macro stability from lower

inflation and interest rates cuts, should at least keep the

performance of U.K. stocks from eroding, he adds. The broker raises

its rating on Aviva to outperform and cuts M&G to neutral. It

also downgrades motor insurer Admiral to underperform on valuation.

(elena.vardon@wsj.com)

---

Trifast's Cost-Saving Plan Could Drive Margin Recovery

1353 GMT - Trifast could recover margins via its cost saving

actions, Shore Capital analysts Tom Fraine and Robert Sanders write

in a research note. The industrial fastening specialist's pricing

power has proven to be limited in recent years, with price

increases lagging and possibly being below inflation, the analysts

say. "However, we believe there is scope for the new management

team to recover margins through cost saving initiatives," they say.

Due to a weak demand outlook, Trifast has moved forward a recovery

plan to save GBP3 million in costs, while undertaking a strategic

review to take further measures. Shares are down 19% at 75.00

pence. (christian.moess@wsj.com)

---

Trifast Looks Well-Prepared For Improving Markets

1344 GMT - Trifast's looks better prepared than before for when

market conditions improve, Peel Hunt analysts write in a research

note. "Despite the tough markets, management is delivering on the

strategy and creating a more focused organization," Peel Hunt says.

The U.K. maker and distributor of industrial fastening plans to

restructure its business to save GBP3 million, while looking into

making further cost-saving actions. It cut its guidance due to

persisting weak demand which particularly hit its Asia operations

and global distribution sales channel. Trifast is a corporate

client of Peel Hunt. Shares are down 19% at 75.00 pence.

(christian.moess@wsj.com)

Contact: London NewsPlus, Dow Jones Newswires;

(END) Dow Jones Newswires

January 22, 2024 12:16 ET (17:16 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

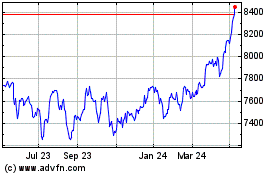

FTSE 100

Index Chart

From Nov 2024 to Dec 2024

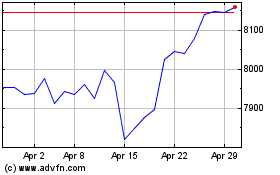

FTSE 100

Index Chart

From Dec 2023 to Dec 2024