Canadian Dollar Drops On Weaker Oil Prices

22 July 2024 - 10:26PM

RTTF2

The Canadian dollar weakened against its most major counterparts

in the New York session on Monday amid falling oil prices, as U.S.

President Joe Biden's exit from the election race sparked political

uncertainty.

Amid pressure from party leaders, Biden dropped out of the

presidential race on Sunday and endorsed Vice President Kamala

Harris as the Democratic nominee.

Biden offered his "full support and endorsement" for Kamala

Harris and said he would complete his current term.

Later in the week, focus is likely to shift to a report on

personal income and spending in June, which includes readings on

inflation said to be preferred by the Federal Reserve.

The data could have a significant impact on the outlook for

interest rates, with the Fed currently widely expected to lower

interest rates by a quarter point in September.

The loonie fell to more than a 5-week low of 1.3775 against the

greenback and more than an 8-month low of 1.4986 against the euro,

off its early highs of 1.3705 and 1.4931, respectively. The loonie

is likely to challenge support around 1.39 against the greenback

and 1.51 against the euro.

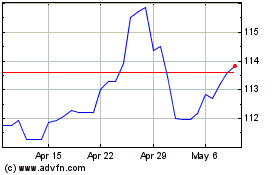

The loonie declined to a 4-day low of 113.74 against the yen and

held steady thereafter. The currency is poised to challenge support

around the 109.00 level.

Meanwhile, the loonie climbed to near a 3-week high of 0.9131

against the aussie. If the currency continues its uptrend, 0.90 is

possibly seen as its next resistance level.

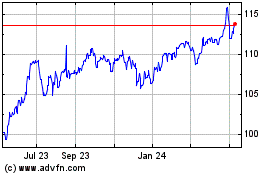

CAD vs Yen (FX:CADJPY)

Forex Chart

From Jun 2024 to Jul 2024

CAD vs Yen (FX:CADJPY)

Forex Chart

From Jul 2023 to Jul 2024