Euro Slides Amid Risk Aversion, French Political Uncertainty

10 June 2024 - 2:30PM

RTTF2

The euro weakened against other major currencies in the European

session on Monday amid risk aversion, in the wake of political

upheaval in France following President Emmanuel Macron's demand for

an early legislative election.

French President Emmanuel Macron called a shock election after

being trounced in the European Union vote by the far-right

parties.

Italian Prime Minister Giorgia Meloni's far-right party has won

European elections in Italy with a strong 28 percent of the

votes.

Markets in China, Hong Kong and Australia are closed for public

holidays.

In the European trading now, the euro fell to nearly a 2-year

low of 0.8453 against the pound and nearly a 2-month low of 0.9642

against the Swiss franc, from early highs of 0.8472 and 0.9668,

respectively. The euro is likely to find support around 0.82

against the pound and 0.93 against the franc.

Against the yen and the U.S. dollar, the euro slipped to a 5-day

low of 168.71 and a 1-month low of 1.0748 from early highs of

169.22 and 1.0782, respectively. The next possible downside target

for the euro is seen around 164.00 against the yen and 1.05 against

the greenback.

Against the Australia and the Canadian dollars, the euro dropped

to a 4-day low of 1.6301 and a 1-week low of 1.4790 from early

highs of 1.6388 and 1.4838, respectively. If the euro extends its

downtrend, it is likely to find support around , 1.61 against the

aussie and 1.46 against the loonie.

The euro edged down to 1.7591 against the NZ dollar, from an

early high of 1.7670. On the downside, 1.74 is seen as the next

support level for the euro.

Meanwhile, the safe-haven currency or the U.S. dollar,

strengthened against its major rivals amid risk aversion.

The stronger-than-expected jobs data for May also boosted the

dollar and reduced hopes of an interest rate cut by the Federal

Reserve in September.

Data from the Labor Department showed on Friday that non-farm

payroll employment surged by 272,000 jobs in May after climbing by

a downwardly revised 165,000 jobs in April.

Economists had expected employment to increase by about 185,000

jobs compared to the addition of 175,000 jobs originally reported

for the previous month.

Against the pound, the Swiss franc and the yen, the U.S. dollar

advanced to 1-week highs of 1.2707, 0.8983 and 157.20 from early

lows of 1.2731, 0.8957 and 156.72, respectively. If the greenback

extends its uptrend, it is likely to find resistance around 1.24

against the pound, 0.93 against the franc and 160.00 against the

yen.

Against Australia, the New Zealand and the Canadian dollars, the

greenback advanced to a 1-month high of 0.6576, nearly a 2-week

high of 0.6099 and nearly a 1-1/2-month high of 1.3774 from early

lows of 0.6596, 0.6112 and 1.3756, respectively. The greenback may

test resistance near 0.63 against the aussie, 0.58 against the kiwi

and 1.39 against the loonie.

Looking ahead, U.S. CB employment trends index for May is slated

for release in the New York session.

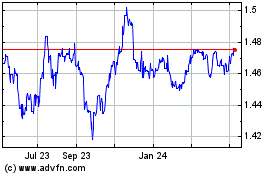

Euro vs CAD (FX:EURCAD)

Forex Chart

From Nov 2024 to Dec 2024

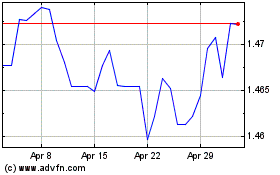

Euro vs CAD (FX:EURCAD)

Forex Chart

From Dec 2023 to Dec 2024