Yen Retreats After BoJ Ueda Comments Add Rate Hike Uncertainty

18 November 2024 - 2:33PM

RTTF2

The Japanese yen retreated from recent highs against other major

currencies in the Asian session on Monday, after the Bank of Japan

Governor Kazuo Ueda said the future interest rate decisions will be

data-dependent and avoided giving clear idea about the timing of

the next rate hike.

At each monetary policy meeting, the BoJ will make policy

decisions based on its assessment of economic activity and prices

with the data and information available at the time of each

meeting, Ueda told business leaders in Nagoya.

"The actual timing of the adjustments will continue to depend on

developments in economic activity and prices as well as financial

conditions going forward," he said.

Ueda said the bank will pay due attention to various risk

factors, such as the course of overseas economies, especially the

US economy and developments in financial and capital markets.

He avoided giving clear idea about the timing of the next

interest rate hike. Markets expect a quarter-point increase at the

next meeting in December.

In economic news, data from the Cabinet Office showed that the

total value of core machine orders in Japan was down a seasonally

adjusted 0.7% on Month in September, coming in at 852.0 billion

yen. That missed forecasts for an increase of 1.4 percent following

the 1.9 percent contraction in August.

On a yearly basis, core machine orders fell 4.8 percent after

slumping 3.4 percent in the previous month

In the Asian trading, the yen fell to 163.50 against the euro

and 174.62 against the Swiss franc, from a recent near 1-month

highs of 162.27 and 173.41, respectively. The yen may test support

near 166.00 against the euro and 178.00 against the franc.

Against the U.S. dollar, the yen advanced to 155.14 from a

recent 6-day high of 153.84. The next possible downside target is

seen around the 160.00 region.

The yen edged up to 195.99 against the pound, from a recent high

of 194.73. If the yen extends its downtrend, it is likely to find

support around the 200.00 region.

Looking ahead, Canada housing starts for October and U.S. NAHB

housing market index for November, are due to be released in the

New York session.

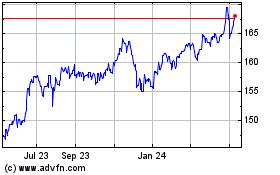

Euro vs Yen (FX:EURJPY)

Forex Chart

From Oct 2024 to Nov 2024

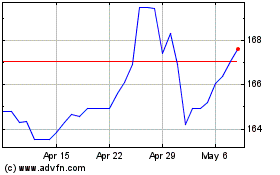

Euro vs Yen (FX:EURJPY)

Forex Chart

From Nov 2023 to Nov 2024