Indian Rupee Falls To Record Low Against U.S. Dollar

02 December 2024 - 5:13PM

RTTF2

The Indian rupee weakened against the U.S. dollar in the

European session on Monday, as Trump's tariff threat bolstered the

dollar.

The U.S. President-elect Donald Trump has threatened the BRICS

grouping with "100 percent tariffs" if they moved to create a new

currency or back any other option as the world's reserve.

In economic news, data from S&P Global showed that India's

manufacturing sector growth remained strong in November, but the

pace of expansion softened due to slower increases in orders and

production amid inflationary pressures.

The HSBC final manufacturing Purchasing Managers' Index dropped

to 56.5 in November from 57.5 in October. The flash reading was

57.3. A score above 50.0 indicates expansion.

Against the U.S. dollar, the rupee fell to a record low of

84.728 from an early high of 84.564.

If the rupee extends its downtrend, it is likely to find support

around the 85.00 region.

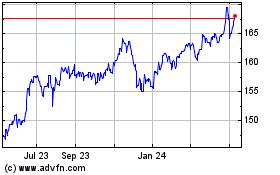

Euro vs Yen (FX:EURJPY)

Forex Chart

From Nov 2024 to Dec 2024

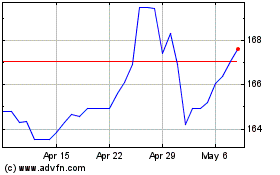

Euro vs Yen (FX:EURJPY)

Forex Chart

From Dec 2023 to Dec 2024