NZ Dollar Falls As Traders Await U.S. CPI Data

11 December 2024 - 11:58AM

RTTF2

The New Zealand dollar weakened against other major currencies

in the Asian session on Wednesday, as traders await key U.S.

consumer price inflation readings later in the day that could

influence the U.S. Fed's rate trajectory.

Signals of a policy shift in China boosted sentiment, while

persisting geopolitical tension due to escalating violence in Syria

is weighing on market sentiment.

While the U.S. Fed is widely expected to lower rates by another

25 basis points next week, the data could impact the outlook for

future rate cuts by the central bank.

CME Group's FedWatch Tool is currently indicating an 86.1

percent chance the Fed will lower rates by a quarter point next

week but a 69.1 percent chance the central bank will then leave

rates unchanged in late January.

Investors also focused their attention on the headlines from

China's closed-door Central Economic Work Conference, due this

week.

The NZ dollar, along with other commodity currencies such as the

Australia and the Canadian dollars, fell against its major rivals

on Tuesday, after data showed China's exports growth slowed in

November and imports declined the most in 14 months, fueling

worries about the health of the world's second-largest economy.

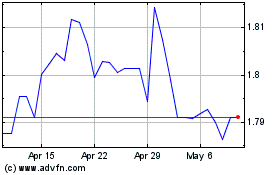

In the Asian trading today, the NZ dollar fell to a 1-year low

of 0.5789 against the U.S. dollar and more than a 1-month low of

1.8176 against the euro, from yesterday's closing quotes of 0.5799

and 1.8176, respectively. If the kiwi extends its downtrend, it is

likely to find support around 0.56 against the greenback and 1.83

against the euro.

Against the yen and the Australian dollar, the kiwi dropped to

2-day lows of 87.73 and 1.1007 from Tuesday's closing quotes of

88.12 and 1.0989, respectively. The kiwi may test support near

86.00 against the yen and 1.11 against the aussie.

Looking ahead, U.S. MBA mortgage approvals data, U.S. CPI data

for November, U.S. EIA crude oil data and U.S. monthly budget

statement are slated for release in the New York session.

At 9:45 am ET, the Bank of Canada will announce its interest

rate decision. The BoC is expected to lower the benchmark rate by

50 basis points, following the same action in October, to 3.25

percent.

Following the announcement of the BoC monetary policy decision,

the BoC Governor Tiff Macklem will deliver a speech in a press

conference at 10:30 am ET.

Euro vs NZD (FX:EURNZD)

Forex Chart

From Nov 2024 to Dec 2024

Euro vs NZD (FX:EURNZD)

Forex Chart

From Dec 2023 to Dec 2024