Euro Falls Amid French Political Uncertainty

02 December 2024 - 7:01PM

RTTF2

The euro weakened against other major currencies in the European

session on Monday, as the threat of France's far-right party

collapsing the government caused pressure on European markets.

According to media reports, France's far-right National Rally

(RN) party will likely back a no-confidence motion against the

government in the coming days unless the disputed draft budget

meets her party's demands.

Finance Minister Antoine Armand said the finance bill is vital

for the country and artificial budget deadlines won't be

accepted.

Sentiment was also dented by U.S. President-elect Donald Trump's

threat of 100 percent tariff on BRICS countries if they pursue new

currency alternatives to the U.S. dollar.

Data from S&P Global showed that the Eurozone manufacturing

sector contracted further in November on stronger declines in

factory orders, production, purchasing activity and inventories.

The final HCOB factory Purchasing Managers' Index fell to 45.2 in

November from 46.0 in October. The pace of decline was stronger

than seen on average over the current period of decline.

The German manufacturing sector remained deep in contraction

territory. The headline HCOB final manufacturing PMI held steady at

43.0, which was below the initial estimate of 43.2.

The PMI survey signaled a deepening downturn in the French

manufacturing sector. The factory PMI registered 43.1 in November,

down from 44.5 in October. The flash reading was 43.2.

In other economic news, data from Eurostat showed that the euro

area unemployment rate remained unchanged in October. The jobless

rate came in at seasonally adjusted 6.3 percent, the same as in

September and also matched expectations. The rate was below the 6.6

percent posted in October 2023.

The number of unemployed declined 3,000 from the previous month.

Compared to last year, unemployment was down 411,000.

In the European trading today, the euro fell to nearly a 2-week

low of 0.8270 against the pound and nearly a 2-1/2-month low of

157.59 against the yen, from early highs of 0.8304 and 158.64,

respectively. If the euro extends its downtrend, it is likely to

find support around 0.81 against the pound and 155.00 against the

yen.

The euro slipped to 5-day lows of 0.9289 against the Swiss franc

and 1.0496 against the U.S. dollar, from early highs of 0.9322 and

1.0547, respectively. On the downside, 0.91 against the franc and

1.03 against the greenback are seen as the next support levels for

the euro.

Against Australia, the New Zealand and the Canadian dollars, the

euro dropped to a 6-day low of 1.6159, a 1-week low of 1.7788 and a

5-day low of 1.4736 from early highs of 1.6223, 1.7864 and 1.4785,

respectively. The euro may test support near 1.58 against the

aussie, 1.76 against the kiwi and 1.44 against the loonie.

Looking ahead, U.S. and Canada manufacturing PMI for November

and U.S. construction spending for October are set to be released

in the New York session.

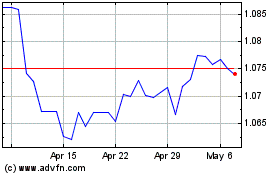

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Nov 2024 to Dec 2024

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Dec 2023 to Dec 2024