Pound Falls As U.K. Economy Shrinks Unexpectedly

13 December 2024 - 5:09PM

RTTF2

The British pound weakened against other major currencies in the

European session on Friday, after the U.K. economy contracted

marginally for the second straight month in October largely

reflecting the fall in industrial production.

Data from the Office for National Statistics showed that U.K.

real gross domestic product shrank unexpectedly 0.1 percent in

October, the same pace of decline as in September. GDP was forecast

to grow 0.1 percent.

Services output showed no growth in October, while industrial

production decreased 0.6 percent because of falls in manufacturing

and mining and quarrying.

Industrial output was forecast to grow 0.3 percent, following

September's 0.5 percent decline. Within industrial production,

manufacturing output registered a decline of 0.6 percent after a

1.0 percent fall.

At the same time, construction output slid 0.4 percent, in

contrast to the 0.1 percent increase in September.

On a yearly basis, GDP growth improved to 1.3 percent from 1.0

percent in September. Still, it was weaker than forecast of 1.6

percent.

Another data from the ONS showed that the visible trade deficit

widened to GBP 18.96 billion from GBP 16.32 billion in the previous

month. The expected level of shortfall was GBP 16.1 billion.

Meanwhile, the surplus on services rose to GBP 15.3 billion from

GBP 12.9 billion a month ago. As a result, the overall trade

shortfall totaled GBP 3.7 billion compared to a GBP 3.5 billion

shortfall in September.

Earlier in the day, survey data from the market research group

GfK showed a slight improvement in British consumer confidence in

December. The consumer sentiment index edged up by one point to -17

in December.

Investors also await an announcement on the appointment of a new

prime minister in France.

President Emmanuel Macron is set to announce the appointment

today, the Elysee Palace confirmed after Macron missed his

self-imposed Thursday deadline.

In the European trading now, the pound fell to a 1-week low of

0.8301 against the euro, nearly a 2-week low of 1.2619 against the

U.S. dollar and a 2-day low of 192.86 against the yen, from early

highs of 0.8260, 1.2680 and 194.06, respectively. If the pound

extends its downtrend, it is likely to find support around 0.84

against the euro, 1.24 against the greenback and 189.00 against the

yen.

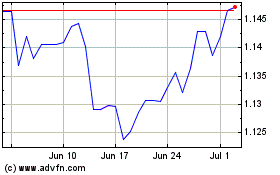

Against the franc, the pound edged down to 1.1277 from an early

high of 1.1309. On the downside, 1.11 is seen as the next support

level for the pound.

Looking ahead, U.K. NIESR monthly GDP tracker for November,

Canada manufacturing and wholesale sales data for October, U.S.

import and export prices for November and U.S. Baker Hughes oil rig

count data are due to be released in the New York session.

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Nov 2024 to Dec 2024

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Dec 2023 to Dec 2024