Pound Lower As U.K. Private Sector Remains In Contraction

24 October 2023 - 10:33PM

RTTF2

The pound declined against its major counterparts in the

European session on Tuesday, as a data showed that nation's private

sector activity deteriorated for the third successive month in

October.

Flash survey results from S&P Global and the Chartered

Institute of Procurement & Supply showed that the composite

output index rose slightly to 48.6 in October to 48.5 in the

previous month. However, any score below 50 indicates contraction

in the sector.

Both the manufacturing and service sectors experienced lower

output, with the former showing a steeper rate of reduction.

The manufacturing PMI came in at a 3-month high of 45.2 in

October versus 44.3 in the previous month.

The services business activity index fell to a 9-month low of

49.2 in October from 49.3 in September.

The pound eased to 0.8711 against the euro and 1.0875 against

the franc, down from an early 5-day high of 0.8682 and a 6-day high

of 1.0940, respectively. The currency is poised to challenge

support around 0.88 against the euro and 1.01 against the

franc.

The pound dropped to 1.2167 against the greenback and 182.35

against the yen, from its early nearly 2-week highs of 1.2288 and

183.75, respectively. The next possible support for the currency is

seen around 1.20 against the greenback and 176.00 against the

yen.

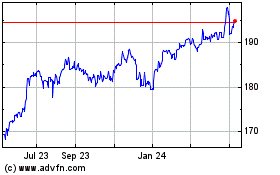

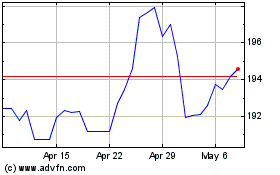

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Jun 2024 to Jul 2024

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Jul 2023 to Jul 2024