Pound Strengthens As European Shares Gain

31 October 2023 - 7:25PM

RTTF2

The pound firmed against its major counterparts in the European

session on Tuesday, as European stocks advanced amid positive

earnings results, while investors awaited the Federal Reserve's

monetary policy meeting for clues on the interest rate path.

The Fed is expected to hold rates steady at the end of its

two-day meeting that starts today.

Investors focus on U.S. reports on home prices, consumer

confidence and Chicago-area business activity due to be published

later in the day.

Earlier today, an official survey showed Chinese manufacturing

activity unexpectedly returned to contraction in October, and the

Bank of Japan announced a tweak to its yield curve control

policy.

Traders watched the latest developments in the Middle East after

Israeli Prime Minister Benjamin Netanyahu rejecting calls for a

ceasefire in the war against Hamas.

The pound advanced to a 1-week high of 1.2200 against the

greenback, 1-1/2-month high of 183.83 against the yen and a fresh

2-week high of 1.1004 against the franc, from its previous lows of

1.2136, 181.27 and 1.0951, respectively. The pound is seen finding

resistance around 1.24 against the greenback, 185.00 against the

yen and 1.11 against the franc.

In contrast, the pound weakened against the euro, touching

nearly a 6-month low of 0.8754. If the currency slides again, it

may find support around the 0.89 area.

Looking ahead, Canada GDP data for August, U.S. employment cost

data for the third quarter, U.S. Redbook report, U.S. S&P

Case-Shiller home price index for August, U.S. Chicago PMI for

August, U.S. consumer confidence for October and U.S. Dallas Fed

services index for October are set to be published in the New York

session.

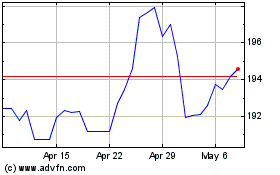

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Jun 2024 to Jul 2024

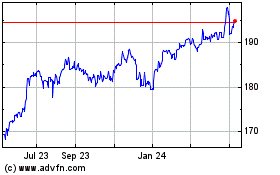

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Jul 2023 to Jul 2024