Pound Slides On Middle East Tensions, Declining Fed Rate Cut Bets

07 October 2024 - 5:25PM

RTTF2

The British pound weakened against other major currencies in the

European session on Monday, amid growing worries about Israel's

potential retaliation against Iran for a missile attack and robust

U.S. jobs data signaled economic resilience but prompted trades to

pare bets on aggressive Federal Reserve interest-rate cuts.

Today marks a year after the Palestinian militant group Hamas

attacked Israel, which led to its retaliation in Gaza.

Hezbollah rockets hit Israel's third largest city Haifa early

today. Israeli military said that air raid sirens were activated in

central Israel after rockets were fired from the Gaza Strip.

After Friday's blowout payrolls report, traders now price in

only a quarter-point cut in interest rates at the Federal Reserve's

next policy announcement on Nov. 7, with a small chance that the

policy rate stays unchanged.

European stocks were subdued due to pressure from higher bond

yields following robust U.S. jobs data released last week.

In addition to the cautious outlook in the market, the pound

sterling has been negatively impacted by growing anticipation that

the Bank of England (BoE) would lower interest rates once more in

November.

In economic news, data from the Lloyds Bank subsidiary Halifax

showed that U.K. house prices rose at the fastest annual rate in

almost two years in September due to base effects. The house price

index rose 4.7 percent year-on-year in September, faster than the

4.3 percent rise in August. Further, this was the steepest increase

since November 2022.

On a month-on-month basis, house prices rose at a stable rate of

0.3 percent in September. Economists had forecast a 0.2 percent

increase. Prices rose for the third successive month.

The British sterling held steady against its major rivals in the

Asian session today.

In the European trading today, the pound fell to nearly a 4-week

low of 1.3066 against the U.S. dollar, from an early high of

1.3135. The pound may test support near the 1.29 region.

Against the euro, the yen and the Swiss franc, the pound edged

down to 0.8389, 193.73 and 1.1205 from early highs of 0.8356,

195.26 and 1.1271, respectively. If the pound extends its

downtrend, it is likely to find support around 0.85 against the

euro, 186.00 against the yen and 1.10 against the franc.

Looking ahead, U.S. consumer credit change for August is due to

be released at 3:00 pm ET in the New York session.

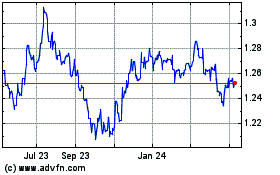

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Oct 2024 to Nov 2024

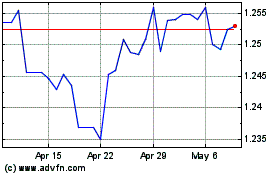

Sterling vs US Dollar (FX:GBPUSD)

Forex Chart

From Nov 2023 to Nov 2024