Canadian Dollar Rises; BoC Governor Says Canadian Economy Is On Track For A Soft Landing

25 June 2024 - 1:31PM

RTTF2

The Canadian dollar strengthened against other major currencies

in the Asian session on Tuesday, after the Bank of Canada Governor

Tiff Macklem said the Canadian economy is on track for a soft

landing.

Speaking at the Winnipeg Chamber of Commerce on late Monday, the

Bank of Canada governor Tiff Macklem said the Canadian economy

appears to be on track for a soft landing where inflation falls

back to the bank's target without a major spike in

unemployment.

"We continue to think that we don't need a large rise in the

unemployment rate to get inflation back to the 2% target," Macklem

said.

The crude oil prices gained on optimism about the outlook for

demand and likely supply disruptions due to tensions in the Middle

East. West Texas Intermediate Crude oil futures for August rose

$0.90 or 1.1 percent at $81.63 a barrel.

Asian stock markets traded higher, as traders seemed cautious

and reluctant to make significant moves ahead of some crucial

economic data, including a report on U.S. personal income &

spending due later in the week. They also await comments from U.S.

Fed officials for additional clues on the outlook for interest

rates.

Traders are also looking ahead to the presidential debate

between Joe Biden and Donald Trump as well as upcoming French and

U.K. elections later in the week.

In the Asian trading today, the Canadian dollar rose to a 3-week

high of 1.3641 against the U.S. dollar, from yesterday's closing

value of 1.3654. The USD/CAD may test resistance around the 1.35

region.

Against the euro and the Australian dollar, the loonie advanced

to 1.4647 and 0.9083 from early lows of 1.4660 and 0.9094,

respectively. If the loonie extends its uptrend, it is likely to

find resistance around 1.45 against the euro and 0.88 against the

aussie.

The loonie edged up to 116.94 against the yen, from Monday's

closing value of 116.84. On the upside, the CAD/JPY pair may test

resistance around the 117.00 region.

In economic news, producer prices in Japan were down 0.1 percent

on month in May, the Bank of Japan said on Tuesday. That follows

the 0.7 percent monthly jump in April. On a yearly basis, producer

prices were up 2.5 percent, easing from 2.7 percent in the previous

month.

Looking ahead, Canada May CPI data and manufacturing sales data

for May, U.S. Chicago Fed national activity index for May, U.S.

Redbook report, U.S. house price index for April, U.S. Consumer

Board's consumer confidence for June, U.S. Richmond Fed

manufacturing index for June and U.S. Dallas Fed services index for

June are slated for release in the New York session.

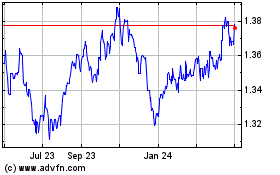

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From May 2024 to Jun 2024

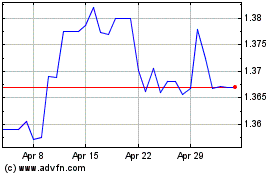

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Jun 2023 to Jun 2024