Canadian Dollar Extends Decline After BoC Rate Cut

24 July 2024 - 9:59PM

RTTF2

The Canadian dollar extended decline against its major

counterparts in the New York session on Wednesday, as the Bank of

Canada reduced its key policy rate further amid easing inflationary

pressures.

The BoC said it has reduced its target for the overnight rate by

25 basis points to 4.5 percent, with the bank rate at 4.75 percent

and the deposit rate at 4.5 percent.

The Canadian central bank said the decision to lower rates for

the second straight meeting came as broad price pressures continue

to ease and inflation is expected to move closer to 2 percent.

The Bank of Canada also said consumer price inflation is

expected to come down below core inflation in the second half of

this year, largely because of base year effects on gasoline

prices.

At the same time, the Canadian central bank noted price

pressures in some important parts of the economy—notably shelter

and some other services—are holding inflation up.

The Bank of Canada said its Governing Council is carefully

assessing these opposing forces on inflation and noted future

monetary policy decisions will be guided by incoming information

and their assessment of their implications for the inflation

outlook.

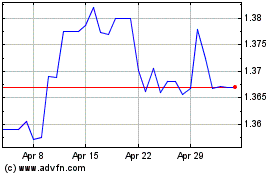

The loonie dropped to more than an 8-month low of 1.4998 against

the euro and more than 3-month lows of 1.3808 against the greenback

and 110.94 against the yen, off its early highs of 1.4933, 1.3778

and 113.17, respectively.

Against the aussie, the loonie retreated to 0.9113, from an

early 4-week high of 0.9083.

The loonie is likely to challenge support around 1.51 against

the euro, 1.39 against the greenback, 107.5 against the yen and

0.93 against the aussie.

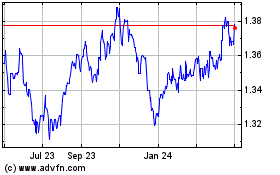

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Jun 2024 to Jul 2024

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Jul 2023 to Jul 2024