Canadian Dollar Falls Ahead Of Canada CPI Data

15 October 2024 - 12:12PM

RTTF2

The Canadian dollar weakened against other major currencies in

the Asian session on Tuesday, as traders await the release of the

latest Canadian consumer inflation figures due later on the day.

The drop of crude oil prices also undermined the currency.

Traders speculate that the nation's inflation data for

September, due later in the day is unlikely to provide any optimism

for the Canadian dollar, as the Bank of Canada (BoC) is widely

expected to cut interest rates by an additional 50 basis points on

its October 23 monetary policy meeting.

Crude oil prices fell sharply on Monday, weighed down by another

downward revision in demand forecast by OPEC, and concerns about

demand from China. West Texas Intermediate Crude oil futures ended

down $1.73 or about 2.29 percent at $73.83 a barrel.

Traders also bet that the U.S. Fed will proceed with modest rate

cuts in the near term after recent data showed that producer prices

were unexpectedly unchanged in September, while the annual growth

rate slowed modestly.

Traders speculate that the Fed will reduce rates by 25 basis

points next month, even as chances of a further 50 basis point cut

have mostly vanished. CME Group's FedWatch Tool is currently

indicating an 86.1 percent chance the Fed will cut rates by a

quarter point at its November meeting.

In the Asian trading now, the Canadian dollar fell to nearly a

2-1/2-month low of 1.3807 against the U.S. dollar, from yesterday's

closing value of 1.3795. The loonie may test support near the 1.39

region.

Against the yen, the euro and the Australian dollar, the loonie

dropped to 108.31, 1.5057 and 0.9288 from Monday's closing quotes

of 108.55, 1.5049 and 0.9277, respectively. If the loonie extends

its downtrend, it is likely to find support around 104.00 against

the yen, 1.52 against the euro and 0.94 against the aussie.

Looking ahead, Germany's wholesale prices for September and U.K.

jobs data for August are due to be released at 2:00 am ET in the

pre-European session.

In the European session, Eurozone industrial production for

August and Germany's ZEW economic sentiment index for October are

slated for release.

In the New York session, Canada CPI data for September, U.S. NY

Empire State manufacturing index for October, U.S. Redbook report

and U.S. consumer inflation expectations for September are set to

be released.

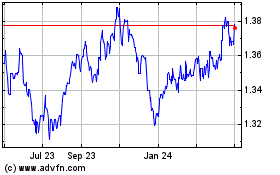

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Nov 2024 to Dec 2024

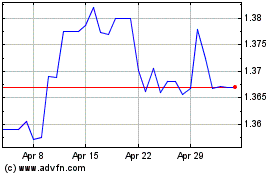

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Dec 2023 to Dec 2024