Chinese Yuan Rises To 16-month High As China Steps Up Stimulus

24 September 2024 - 4:23PM

RTTF2

The Chinese yuan strengthened against the U.S. dollar in the

European session on Tuesday, after China's central bank unveiled

its biggest stimulus since the pandemic to support the economy and

counter a prolonged downturn in the property sector.

At a press conference on Tuesday, People's Bank of China

Governor Pan Gongsheng said the bank will reduce the reserve

requirement ratio by 50 basis points.

He announced that the rate on seven-day reverse repo will be cut

by 20 basis points to 1.50 percent and the rate on one-year

medium-term lending facility by 30 basis points.

The central bank said it will lower borrowing costs and inject

more liquidity into the system that would free up more money for

lending.

Regulators also unveiled plans to support stable development of

the stock market.

Against the U.S. dollar, the yuan rose to a 16-month high of

7.0332 from an early low of 7.1253. The yuan was trading at 7.0900

against the greenback at yesterday's close.

If the yuan extends its uptrend, it is likely to find resistance

around the 6.80 region.

The Chinese central bank sets central parity rate every morning

and allows the yuan to fluctuate up to 2 percent from that

level.

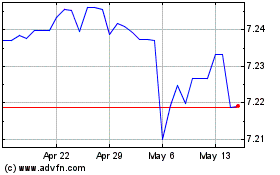

US Dollar vs CNY (FX:USDCNY)

Forex Chart

From Feb 2025 to Mar 2025

US Dollar vs CNY (FX:USDCNY)

Forex Chart

From Mar 2024 to Mar 2025