U.S. Dollar Rises Amid Heightened Trade Tensions

03 February 2025 - 4:42PM

RTTF2

The U.S. dollar strengthened against other major currencies in

the Asian session on Monday, as investors flock to safe-haven

fleets amid the global trade war.

It is feared that a potential trade war could weigh on global

economic growth and hit the earnings of major companies.

Investors hurt by weakness in global markets following the Trump

administration imposing punitive tariffs on Canada, Mexico and

China, and threatening to levy tariffs on the EU and UK as

well.

The Trump administration's 25% tariffs on Canada and Mexico came

into force on Saturday (February 1). Canadian energy faces a 10%

tariff as do Chinese goods, effective Wednesday (February 5).

Investors await the U.S. ISM Manufacturing PMI data for January,

due later in the day.

In the Asian trading today, the U.S. dollar rose to nearly a

2-week low of 1.2249 against the pound and a 6-day low of 155.89

against the yen, from Friday's closing quotes of 1.2390 and 155.18,

respectively. If the greenback extends its uptrend, it is likely to

find resistance around 1.21 against the pound and 159.00 against

the yen.

Against the euro and the Swiss franc, the greenback advanced to

3-week highs of 1.0212 and 0.9197 from last week's closing quotes

of 1.0362 and 0.9107, respectively. The greenback may test

resistance near 1.01 against the euro and 0.93 against the

franc.

Looking ahead, U.S. and Canada PMI data for January and U.S.

construction spending for December are set to be released in the

New York session.

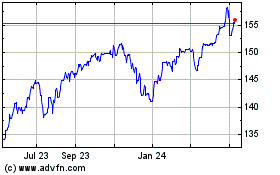

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Jan 2025 to Feb 2025

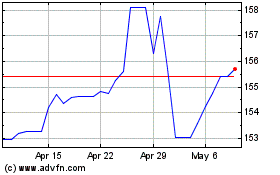

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Feb 2024 to Feb 2025