ACI Worldwide Study Reveals Real-Time Payments To Boost Global GDP By $285.8 Billion, Create 167 Million New Bank Account Holders By 2028

21 October 2024 - 10:00AM

Business Wire

Real-time payments drive economic growth and

bring millions into the financial ecosystem, according to ACI

Worldwide’s Real-Time Payments: Economic Impact and Financial

Inclusion report

Real-time payments are forecast to generate

$285.8 billion of additional global GDP growth and create more than

167 million new bank account holders by 2028, according to a new

report published by ACI Worldwide (NASDAQ: ACIW), an original

innovator in global payments technology, in collaboration with The

Centre for Economics and Business Research (Cebr).

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20241020352057/en/

Infographic: Real-Time Payments: Economic

Impact and Financial Inclusion, Report ACI Worldwide

ACI Worldwide’s second Real-Time Payments: Economic Impact and

Financial Inclusion report leverages data from 40 countries and

reveals—for the first time—an empirical link between real-time

payments and financial inclusion.

The research indicates that by providing citizens with access to

affordable financial services, real-time payments drive economic

growth and could potentially help lift millions of people out of

poverty. Additionally, the associated financial inclusion uplift

experienced by many countries as a result of increasing real-time

transactions presents significant new revenue opportunities for

financial institutions.

“Real-time payments act as a powerful catalyst for economic

growth and societal transformation in modern, digital economies.

They improve the efficiency of financial systems and enable

greater financial inclusion,” said Thomas Warsop, president and

CEO, ACI Worldwide. “This research demonstrates how payments

modernization presents a win-win proposition for everyone,

including governments and banks.”

Key findings

Economic impact of real-time

payments Real-time payments improve overall market

efficiencies in the economy by allowing for the transfer of money

between consumers and businesses within seconds, rather than days.

They reduce transaction costs and formalize segments of the

cash-based “shadow economy,” thereby increasing revenue

opportunities.

- Across all 40 countries in the study, real-time payments

boosted GDP by a total of $164.0 billion in 2023 – equivalent to

the labor output of 12 million workers.

- Forecast for 2028: GDP contributions from real-time payments

will total $285.8 billion – a 74.2% increase over five years,

equivalent to the labor of 16.9 million workers.

- Aggregated net savings for consumers and businesses: $116.9

billion in 2023 – predicted to grow to $245.8 billion by 2028.

Financial inclusion The

research shows a “positive empirical link between instant payments

and financial inclusion.” Real-time payments are boosting financial

inclusion, especially among three demographic groups: younger

people (aged 18-24 years); women; and people in lower income groups

(40% of the population with the lowest incomes).

- By 2028, 167.2 million previously excluded from the financial

system across the 28 countries studied for financial inclusion

could have bank accounts.

- Top five countries for financial inclusion uplift (number of

newly banked citizens): Pakistan – 63.5 million; India – 25.5

million; Philippines – 20.9 million; Nigeria – 13.8 million; China

– 13.8 million.

Profit opportunities for financial

institutions The phenomenal growth of real-time payments

and the resulting rise in financial inclusion present a significant

profit opportunity for banks.

- The top five markets for profit opportunity: Pakistan – $173.0

billion; Nigeria – $40.4 billion; Philippines – $28.7 billion;

India – $24.6 billion; China – $21.2 billion.

Regional highlights

- Asia Pacific: Asia Pacific is home to some of the

world’s largest real-time payments markets, including India, China

and Thailand. Real-time payments boosted India’s GDP by $50 million

in 2023, making it the world’s largest market in terms of GDP

growth. In Indonesia, one of the world’s top 10 fastest-growing

markets, real-time payments are forecast to contribute $3.6 billion

of additional GDP to the economy by 2028, 0.21% of total GDP. The

region also boasts the top three countries for financial inclusion

uplift: Pakistan, India and the Philippines.

- Africa: As Africa’s largest real-time payments market,

Nigeria is reaping the biggest economic benefits. Real-time

payments added $7.0 billion to the country’s GDP in 2023,

equivalent to 1.4% of combined GDP. Nigeria is also the top market

for bank profit opportunities in the region, followed by South

Africa, with projected profit opportunities for banks of $40.4

billion and $899.1 million, respectively.

- Europe: Europe’s shift to instant payments, mandated by

the EU’s Instant Payments Regulation, is expected to unlock

economic growth and improve financial inclusion across the 27 EU

member states. The EU aims to replicate the success of other

countries in the region, such as Turkey, which is expected to

generate $5.1 billion of additional GDP by 2028 due to real-time

payments, followed by the UK, with an expected additional GDP

growth of $4.0 billion by 2028.

- Middle East: The economic and financial inclusion

benefits of real-time payments in the Middle East—the world’s

fastest-growing real-time payments market—are most felt in Saudi

Arabia, Bahrain and the UAE. Saudi Arabia’s GDP is expected to get

a boost of $1.1 billion by 2028, while Bahrain is forecast to have

additional GDP growth of $677.6 million by 2028.

- Latin America: In Brazil, the largest economy in the

region, real-time payments contributed $24.6 billion to the overall

economy – equivalent to the labor of more than 1.3 million workers.

Mexico is in the top five countries worldwide for economic benefits

of real-time payments, with a GDP boost of $10.3 billion in 2023.

Colombia is expected to experience the biggest financial inclusion

uplift in the region, with 5.1 million new account holders

projected by 2028.

- North America: The impact from real-time payments is

already clear in the U.S., where businesses and consumers reaped

more than $1.0 billion in savings in 2023 – expected to quadruple

to $4.4 billion by 2028. The U.S. is among the top 10 countries

with the largest projected financial inclusion uplift from

real-time payments: 4.9 million citizens previously excluded from

the financial system could have bank accounts by 2028.

“The research for the first time identifies a positive empirical

link between instant payments and financial inclusion. As economies

increase adoption of instant payments, reduction in transaction

costs, enhancements to user experience and wider behavioural

factors are directed linked to increasing the share of the

population engaging with financial institutions,” commented Owen

Good, Head of Economic Advisory, Cebr. “Specifically, we find that

real-time payments adoption is expected to create significant

benefits for individuals, the financial sector itself and the wider

economy. Put simply, we continue to see that moving money in

seconds rather than days rewards everyone associated with the

transaction.”

About ACI Worldwide ACI Worldwide, an original innovator

in global payments technology, delivers transformative software

solutions that power intelligent payments orchestration in real

time so banks, billers, and merchants can drive growth, while

continuously modernizing their payment infrastructures, simply and

securely. With nearly 50 years of trusted payments expertise, we

combine our global footprint with a local presence to offer

enhanced payment experiences to stay ahead of constantly changing

payment challenges and opportunities.

About Cebr For over 30 years the Centre for Economics and

Business Research (Cebr) has supplied independent economic

forecasting and analysis to hundreds of private firms and public

organisations. Our Economic Advisory team is one of the UK’s

strongest and has advised government departments, as well as FTSE

and multinational firms on a range of topics. Cebr’s Forecasting

and Thought Leadership team delivers award-winning forecasts of the

UK and global economies, helping our clients stay ahead of the game

in anticipating future economic developments. For further

information about Cebr please visit www.cebr.com.

© Copyright ACI Worldwide, Inc. 2024 ACI, ACI Worldwide,

ACI Payments, Inc., ACI Pay, Speedpay, and all ACI product/solution

names are trademarks or registered trademarks of ACI Worldwide,

Inc., or one of its subsidiaries, in the United States, other

countries, or both. Other parties’ trademarks referenced are the

property of their respective owners.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241020352057/en/

Media Nick Karoglou | Head of Communications and

Corporate Affairs | nick.karoglou@aciworldwide.com Katrin Boettger

I Communications and Corporate Affairs Director, Americas/Europe I

katrin.boettger@aciworldwide.com

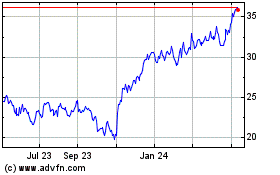

ACI Worldwide (NASDAQ:ACIW)

Historical Stock Chart

From Jan 2025 to Feb 2025

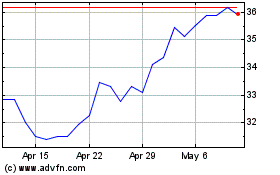

ACI Worldwide (NASDAQ:ACIW)

Historical Stock Chart

From Feb 2024 to Feb 2025