false

0001726711

0001726711

2024-07-01

2024-07-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION

13 OR 15(d) OF THE

SECURITIES EXCHANGE

ACT OF 1934

Date of Report (Date

of earliest event reported): July 1, 2024

Aditxt, Inc.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

001-39336 |

|

82-3204328 |

| (State or other jurisdiction |

|

(Commission |

|

(I.R.S. Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

| 2569 Wyandotte Street,

Suite 101, Mountain View, CA 94043 |

| (Address of principal executive offices, including zip code) |

Registrant’s

telephone number, including area code: (650) 870-1200

Not Applicable

(Former name or

former address, if changed since last report)

Check

the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of

the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, par value $0.001 |

|

ADTX |

|

The Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 1.01. |

Entry into a Material Definitive Agreement |

Arrangement

Agreement

As

previously reported in a Current Report on Form 8-K filed by Aditxt, Inc. (“Aditxt” or the “Company”),

on April 1, 2024 (the “Execution Date”), the Company entered into an Arrangement Agreement (the “Arrangement

Agreement”) with Adivir, Inc., a Delaware corporation and wholly owned subsidiary of the Company (“Adivir”

or the “Buyer”), and Appili Therapeutics, Inc., a Canadian corporation (“Appili”), pursuant to

which, Adivir will acquire all of the issued and outstanding Class A common shares of Appili (the “Appili Shares”)

on the terms and subject to the conditions set forth therein. The acquisition of the Appili Shares (the “Arrangement”)

will be completed by way of a statutory plan of arrangement under the Canada Business Corporation Act (the “CBCA”).

On

July 1, 2024, the Company, Adivir and Appili entered into an Amending Agreement (the “Amending Agreement”), pursuant

to which the Parties (as defined in the Arrangement Agreement) agreed that: (i) the Outside Date (as defined in the Arrangement Agreement)

would be changed to August 30, 2024; (ii) Adivir agreed that it would convene the Company Meeting (as defined in the Arrangement Agreement)

no later than August 30, 2024, provided that Appili shall be under no obligation to convene the Company Meeting prior to the date that

is 50 days following the date that Aditxt delivers to Appili all complete Additional Financial Disclosure (as defined in the Arrangement

Agreement) required for inclusion in the Company Circular (as defined in the Arrangement Agreement); (iii) Aditxt shall use commercially

reasonable efforts to complete the Financing (as defined in the Arrangement Agreement) no later than August 30, 2024; and (iv) Aditxt

or Appili may terminate the Arrangement Agreement if the Financing is not completed by 5:00 p.m. (ET) on August 30, 2024 or such later

date as the Parties may agree in writing.

A

copy of the Amending Agreement is filed with this Current Report on Form 8-K as Exhibit 2.1 and is incorporated herein by reference.

The foregoing description of the Amending Agreement and the transactions contemplated thereby is incomplete and is subject to, and qualified

in its entirety by, reference to the actual agreement. The Amending Agreement and other agreements described below have been included

as exhibits to this Current Report on Form 8-K to provide security holders with information regarding their terms. They are not intended

to provide any other factual information about the Company, Adivir or Appili. In particular, the assertions embodied in representations

and warranties by the Company, Adivir and Appili contained in the Amending Agreement were made as of a specified date, are subject to

important qualifications and limitations agreed to by the parties in connection with negotiating such agreement, including being qualified

by confidential information in the disclosure letters provided by the parties in connection with the execution of the Amending Agreement,

and are subject to standards of materiality applicable to the contractive parties that may differ from those applicable to security holders.

The confidential disclosures contain information that modifies, qualifies and creates exceptions to the representations and warranties

set forth in the Amending Agreement. Moreover, certain representations and warranties in the Amending Agreement were used for the purpose

of allocating risk between the parties, rather than establishing matters as facts. Accordingly, security holders should not rely on the

representations and warranties in the Amending Agreement as characterizations of the actual state of facts about the Company, Adivir

or Appili. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the

Amending Agreement, which subsequent information may or may not be fully reflected in the Company’s public disclosures.

Cautionary Note on Forward-Looking

Statements

This

Current Report on Form 8-K contains certain forward-looking statements within the meaning of the “safe harbor “provisions

under the United States Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts contained

in this Current Report on Form 8-K, including statements regarding

the Company’s or Appili’s future results of operations and financial position are forward-looking statements. These forward-looking

statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,”

“estimate,” “target,” “intend,” “strategy,” “future,” “opportunity,”

“plan,” “may,” “should,” “will,” “would,” “will be,” “will

continue,” “will likely result,” and similar expressions. These statements are based on various assumptions,

whether or not identified in this Current Report on Form 8-K, and on the current expectations of the respective management teams of the

Company and Appili and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes

only and are not intended to serve as, and must not be relied on by an investor as, a guarantee, an assurance, a prediction or a definitive

statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions.

Many actual events and circumstances are beyond the control of the Company and Appili.

These

forward-looking statements are subject to a number of risks including, but not limited to, the following risks relating to the proposed

transactions: (1) the risk that the proposed transactions may not be completed in a timely manner or at all, which may adversely affect

the price of the Company’s securities; (2) the failure to satisfy the conditions to the Closing, including the approval by the

shareholders of Appili and the completion of the Financing by the Company; (3) the ability to realize the anticipated benefits of the

proposed transactions; and (4) other risks and uncertainties indicated from time to time in the Company’s

public filings with the SEC. If any of these risks materialize or the Company’s and Appili’s assumptions prove incorrect,

actual results could differ materially from the results implied by these forward-looking statements. You should carefully consider the

risks and uncertainties described in the “Risk Factors” section of our Annual Report on Form 10-K for the fiscal year ended

December 31, 2023 and other documents we filed, or will file with the SEC. There may be additional risks that neither the Company nor

Appili presently know, or that the Company or Appili currently believe are immaterial, that could also cause actual results to differ

from those contained in the forward-looking statements. In addition, forward-looking statements reflect the Company’s and Appili’s

expectations, plans or forecasts of future events and views as of the date of this Current Report on Form 8-K. The Company and Appili

anticipate that subsequent events and developments will cause the Company’s and Appili’s assessments to change. However,

while the Company and Appili may elect to update these forward-looking statements at some point in the future, the Company and Appili

specifically disclaim any obligation to do so, except as otherwise required by law. These forward-looking statements should not be relied

upon as representing the Company’s and Appili’s assessments of any date subsequent to the date of this Current Report on

Form 8-K. Accordingly, undue reliance should not be placed upon the forward-looking statements.

| Item 9.01. |

Financial Statements and Exhibits. |

(d)

Exhibits.

†

Certain of the schedules (and/or exhibits) have been omitted pursuant to Item 601(b)(2) of Regulation

S-K. A copy of any omitted schedule (and/or exhibit) will be furnished to the SEC upon request

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Aditxt, Inc. |

| |

|

|

| Date: July 8, 2024 |

By: |

/s/ Amro Albanna |

| |

Name: |

Amro Albanna |

| |

Title: |

Chief Executive Officer |

Exhibit 2.1

AMENDING AGREEMENT

THIS AMENDING AGREEMENT

is made as of July 1, 2024,

BETWEEN:

Appili Therapeutics Inc., a corporation

existing under the laws of Canada

(the “Company”)

- and –

Aditxt, Inc., a corporation existing

under the laws of the State of Delaware

(the “Parent”)

- and –

Adivir, Inc., a corporation existing

under the laws of the State of Delaware

(the “Buyer”)

(collectively referred to as the “Parties”,

and each individually as a “Party”)

WHEREAS:

| A. | The Parties entered into an arrangement agreement dated April 1, 2024 (the “Arrangement Agreement”)

pursuant to which, among other things, the Parent, through its wholly-owned subsidiary, the Buyer, has agreed to acquire all of the issued

and outstanding Company Shares on the terms set forth in the Arrangement Agreement pursuant to an arrangement under the provisions of

the Canada Business Corporations Act; |

| B. | The Parties wish to enter into this amending agreement (this “Amending Agreement”)

to amend certain terms of the Arrangement Agreement. All capitalized terms used herein but not defined herein shall have their respective

meanings set forth in the Arrangement Agreement. |

NOW THEREFORE in consideration of the premises

and the mutual agreements and covenants herein contained and other good and valuable consideration (the receipt and adequacy of which

is hereby acknowledged), the Parties hereto hereby covenant and agree as follows:

| 1. | The definition of “Outside Date” in Section 1.01 of the Arrangement Agreement shall be deleted

in its entirety and replaced with the following: |

“Outside Date”

means August 30, 2024.

| 2. | Section 2.06(a) of the Arrangement Agreement Agreement shall be deleted in its entirety and replaced with

the following: |

“convene and

conduct the Company Meeting in accordance with the Interim Order, the Company’s constating documents and applicable Laws as promptly

as practicable (and in any event the Company will use commercially reasonable efforts to do so not later than August 30, 2024, provided

that the Company shall be under no obligation to hold the Company Meeting prior to the date that is 50 days following the date that the

Parent delivers to the Company all complete Additional Financial Disclosure required for inclusion in the Company Circular as contemplated

by Section 5.02(c)(v), and in this regard, the Company may abridge any time periods that may be abridged under Securities Laws for the

purpose of considering the Arrangement Resolution and for any other purposes as may be set out in the Company Circular and agreed to by

the Parent in writing, acting reasonably; set, publish and give notice of, the record date for the Company Shareholders entitled to vote

at the Company Meeting as promptly as reasonably practicable; and not adjourn, postpone or cancel (or propose the adjournment, postponement

or cancellation of) the Company Meeting without the prior written consent of the Parent (such consent not to be unreasonably withheld,

conditioned or delayed), except as required or permitted under Section 6.04 or Section 7.03(b) or as required for quorum purposes (in

which case, the Company Meeting shall be adjourned and not cancelled) or as required by applicable Laws or a Governmental Entity. Notwithstanding

the foregoing, the Company may further extend the time of the Company Meeting in the event that any auditor consent (or similar instrument)

is required with respect to the Additional Financing Disclosure and such consent (or similar instrument) is not available at the scheduled

time of printing the Company Circular – such extended period of time to be agreed to by the Company and the Parent, each acting

reasonably.”

| 3. | Section 5.03(e) of the Arrangement Agreement shall be deleted in its entirety and replaced with the following: |

“The Parent

shall use commercially reasonable efforts to complete the Financing on or prior to 5:00 p.m. (ET) on August 30, 2024 and reserve such

appropriate amount of proceeds of the Financing to fulfil its obligations contemplated herein.”

| 4. | Section 8.02(d) of the Arrangement Agreement shall be deleted in its entirety and replaced with the following: |

“the Financing

is not completed on or before 5:00 p.m. (ET) on August 30, 2024 or such later date as the Parties may in writing agree.”

| 5. | This Amending Agreement shall be binding upon and enure to the benefit of the Company, the Parent, the

Buyer and their respective successors and permitted assigns. |

| 6. | This Agreement shall be construed and interpreted in accordance with the laws of the Province of Ontario

and federal laws of Canada applicable therein. |

| 7. | This Amending Agreement may be executed by facsimile or other electronic signature and in counterparts,

each of which shall be deemed an original, and all of which together constitute one and the same instrument. |

| 8. | This Amending Agreement is supplementary to the Arrangement Agreement and is to be read with and construed

in accordance with the Arrangement Agreement as if this Amending Agreement and the Arrangement Agreement constitute one agreement. |

| 9. | Other than as provided in this Amending Agreement, all other terms and conditions of the Arrangement Agreement,

as amended, shall remain in full force and effect, unamended, and the Parties hereto hereby ratify and confirm the same. |

[remainder of this page

intentionally left blank]

IN WITNESS WHEREOF,

the Parties have executed this Amending Agreement as of the date first written above.

|

|

APPILI THERAPEUTICS INC. |

| |

By: |

/s/ Don Cilla |

| |

|

Name: Don Cilla |

| |

|

Title: President and Chief Executive Officer |

|

ADITXT, INC.

|

| |

By: |

/s/ Amro Albanna |

| |

|

Name: Amro Albanna |

| |

|

Title: Chief Executive Officer |

| |

ADIVIR, INC.

|

| |

By: |

/s/ Amro Albanna |

| |

|

Name: Amro Albanna |

| |

|

Title: Authorized Signatory |

v3.24.2

Cover

|

Jul. 01, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 01, 2024

|

| Entity File Number |

001-39336

|

| Entity Registrant Name |

Aditxt, Inc.

|

| Entity Central Index Key |

0001726711

|

| Entity Tax Identification Number |

82-3204328

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

2569 Wyandotte Street

|

| Entity Address, Address Line Two |

Suite 101

|

| Entity Address, City or Town |

Mountain View

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94043

|

| City Area Code |

(650)

|

| Local Phone Number |

870-1200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001

|

| Trading Symbol |

ADTX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

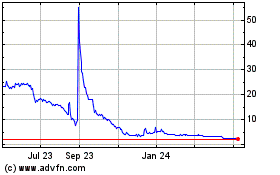

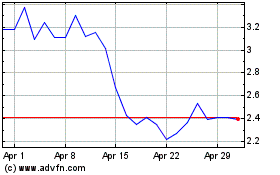

Aditxt (NASDAQ:ADTX)

Historical Stock Chart

From Oct 2024 to Nov 2024

Aditxt (NASDAQ:ADTX)

Historical Stock Chart

From Nov 2023 to Nov 2024