Advantage Solutions Inc. (NASDAQ: ADV), a leading business

solutions provider to consumer goods manufacturers and retailers,

today announced it has entered into an agreement to sell its

digital advertising platform Jun Group to Verve Group SE, a Swedish

digital advertising company formerly known as Media and Games

Invest SE.

Gross proceeds from the sale are expected to be approximately

$185 million, the majority of which will be received in cash at

closing. The transaction is expected to close in the third quarter,

subject to regulatory and other approvals.

As part of the agreement, Verve will pay Advantage approximately

$130 million in cash at close, plus two additional installments

paid 12 months and 18 months post-close to complete the deal.

Advantage plans to use the majority of initial proceeds to pay down

debt and reinvest in the business. The company remains committed to

reducing its net leverage ratio to less than 3.5 times.

Jun Group, which Advantage acquired in 2018, is a technology

company that powers digital media campaigns on digital platforms,

including smart phones, tablets and desktop computers.

While Jun Group provides some services to retailers and

consumer-packaged goods companies, many of its customers —

including publishers and health care companies — are distinct from

Advantage’s core customer base.

“The sale of Jun Group largely completes our business portfolio

transformation, which is sharpening Advantage’s focus squarely on

providing best-in-class services to our retailer and CPG clients,”

said Dave Peacock, CEO of Advantage Solutions. “Over the last year

and a half, we’ve simplified our portfolio around our core

capabilities, and we are building the foundation for growth.”

The transaction follows a series of divestitures over the last

year, including the recent sales of Strong Analytics, The Data

Council, Adlucent, Atlas Technology Group and Advantage’s

collection of foodservice businesses. Advantage will continue to

evaluate its portfolio and seek opportunities to further augment

its capabilities.

Global investment bank Canaccord Genuity and law firm Latham

& Watkins served as advisors to Advantage on the

transaction.

Financial update

Jun Group comprised less than 5% of Advantage 2023 consolidated

gross revenues and less than 10% of its 2023 consolidated Adjusted

EBITDA, including continuing and discontinued operations, per

Advantage estimates.

Advantage continues to expect low single-digit growth in both

full-year 2024 revenue and Adjusted EBITDA, including continuing

and discontinued operations, as compared with 2023, excluding the

announced divestitures and the deconsolidation of the Advantage

Smollan European JV in that year.

About Advantage Solutions

Advantage Solutions is a leading provider of outsourced sales,

experiential and marketing solutions uniquely positioned at the

intersection of brands and retailers. Our data- and

technology-driven services — which include headquarter sales,

retail merchandising, in-store and online sampling, digital

commerce, omnichannel marketing, retail media and others — help

brands and retailers of all sizes get products into the hands of

consumers, wherever they shop. As a trusted partner and problem

solver, we help our clients sell more while spending less.

Advantage has offices throughout North America and strategic

investments in select markets throughout Africa, Asia, Australia,

Latin America and Europe through which the company serves the

global needs of multinational, regional and local manufacturers.

For more information, please visit advantagesolutions.net.

Forward-Looking Statements

Certain statements in this press release may be considered

forward-looking statements within the meaning of the federal

securities laws, including statements regarding the closing of the

Jun Group divestiture, including the timing thereof, the use of

proceeds therefrom, and the anticipated benefits thereof, the

expected future performance of Advantage's business and projected

financial results. Forward-looking statements generally relate to

future events or Advantage’s future financial or operating

performance. These forward-looking statements generally are

identified by the words “may”, “should”, “expect”, “intend”,

“will”, “would”, “could”, “estimate”, “anticipate”, “believe”,

“plan”, “predict”, “confident”, “potential” or “continue”, or the

negatives of these terms or variations of them or similar

terminology. Such forward-looking statements are predictions,

projections and other statements about future events that are based

on current expectations and assumptions and, as a result, are

subject to risks, uncertainties and other factors which could cause

actual results to differ materially from those expressed or implied

by such forward looking statements.

These forward-looking statements are based upon estimates and

assumptions that, while considered reasonable by Advantage and its

management at the time of such statements, are inherently

uncertain. Factors that may cause actual results to differ

materially from current expectations include, but are not limited

to, the satisfaction of the conditions to closing related to the

Jun Group divestiture and the timing thereof, the ability to

realize the anticipated benefits from the Jun Group divestiture,

market-driven wage changes or changes to labor laws or wage or job

classification regulations, including minimum wage; the COVID-19

pandemic and other future potential pandemics or health epidemics;

Advantage’s ability to continue to generate significant operating

cash flow; client procurement strategies and consolidation of

Advantage’s clients’ industries creating pressure on the nature and

pricing of its services; consumer goods manufacturers and retailers

reviewing and changing their sales, retail, marketing and

technology programs and relationships; Advantage’s ability to

successfully develop and maintain relevant omni-channel services

for our clients in an evolving industry and to otherwise adapt to

significant technological change; Advantage’s ability to maintain

proper and effective internal control over financial reporting in

the future; potential and actual harms to Advantage’s business

arising from the Take 5 Matter; Advantage’s substantial

indebtedness and our ability to refinance at favorable rates; and

other risks and uncertainties set forth in the section titled “Risk

Factors” in the Annual Report on Form 10-K filed by the company

with the Securities and Exchange Commission (the “SEC”) on March 1,

2024, and in its other filings made from time to time with the SEC.

These filings identify and address other important risks and

uncertainties that could cause actual events and results to differ

materially from those contained in the forward-looking statements.

Forward-looking statements speak only as of the date they are made.

Readers are cautioned not to put undue reliance on forward-looking

statements, and Advantage assumes no obligation and does not intend

to update or revise these forward-looking statements, whether as a

result of new information, future events or otherwise, except as

required by law.

Non-GAAP Financial Measures and Related

Information

This press release includes a financial measure not presented in

accordance with generally accepted accounting principles (“GAAP”),

Adjusted EBITDA. This is not a measure of financial performance

calculated in accordance with GAAP and may exclude items that are

significant in understanding and assessing Advantage’s financial

results. Therefore, this measure is in addition to, and not a

substitute for or superior to, measures of financial performance

prepared in accordance with GAAP, and should not be considered in

isolation or as an alternative to net income, cash flows from

operations or other measures of profitability, liquidity or

performance under GAAP. You should be aware that Advantage’s

presentation of this measure may not be comparable to similarly

titled measures used by other companies.

Advantage believes that Adjusted EBITDA provides useful

information to management and investors regarding certain financial

and business trends relating to Advantage’s financial condition and

results of operations. Advantage believes that the use of Adjusted

EBITDA provides an additional tool for investors to use in

evaluating ongoing operating results and trends and in comparing

Advantage’s financial measures with other similar companies, many

of which present similar non-GAAP financial measures to investors.

Non-GAAP financial measures are subject to inherent limitations as

they reflect the exercise of judgments by management about which

expense and income are excluded or included in determining these

non-GAAP financial measures. Additionally, other companies may

calculate non-GAAP measures differently, or may use other measures

to calculate their financial performance, and therefore Advantage’s

non-GAAP measures may not be directly comparable to similarly

titled measures of other companies.

Adjusted EBITDA, inclusive of continuing and discontinuing

operations, means net (loss) income before (i) interest expense,

net, (ii) provision for (benefit from) income taxes, (iii)

depreciation, (iv) impairment of goodwill and indefinite-lived

assets, (v) amortization of intangible assets, (vi) gain on

deconsolidation of subsidiaries, (vii) (gain) loss on divestitures,

(viii) equity-based compensation of Karman Topco L.P., (ix) changes

in fair value of warrant liability, (x) stock based compensation

expense, (xi) fair value adjustments of contingent consideration

related to acquisitions, (xii) acquisition and divestiture related

expenses, (xiii) costs associated with COVID-19, net of benefits

received, (xiv) EBITDA for economic interests in investments, (xv)

reorganization expenses, (xvi) litigation expenses, (xvii) costs

associated with (recovery from) the Take 5 Matter and (xviii) other

adjustments that management believes are helpful in evaluating our

operating performance.

Media:

Peter Frostpress@advantagesolutions.net

Investors:

Ruben Mellainvestorrelations@advantagesolutions.net

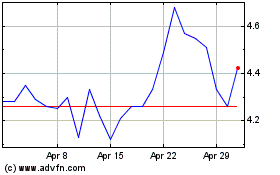

Advantage Solutions (NASDAQ:ADV)

Historical Stock Chart

From Oct 2024 to Nov 2024

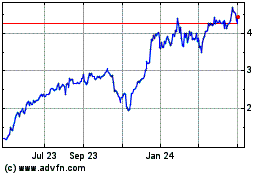

Advantage Solutions (NASDAQ:ADV)

Historical Stock Chart

From Nov 2023 to Nov 2024