Registration No. 333-278188

As filed with the Securities and Exchange Commission

on May 15, 2024

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

Post-effective

Amendment No. 1

To

FORM S-1

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Aethlon Medical,

Inc.

(Exact name of registrant as specified in its

charter)

| Nevada |

|

3826 |

|

13-3632859 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

11555 Sorrento Valley Road, Suite 203

San Diego, CA 92121

(619) 941-0360

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

James B. Frakes

Interim Chief Executive Officer

Aethlon Medical, Inc.

11555 Sorrento Valley Road, Suite 203

San Diego, CA 92121

(619) 941-0360

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

| |

|

|

|

Julie Robinson

Wade Andrews

Cooley LLP

10265 Science Center Drive

San Diego, CA 92121

(858) 550-6000 |

|

M. Ali Panjwani

Pryor Cashman LLP

7 Times Square

New York, NY 10036-6569

Telephone: (212) 326-0846

Fax: (212) 326-0806 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be

offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering

pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c)

under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration

statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d)

under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration

statement for the same offering. ☒ 333-278188

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging

growth company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

| |

|

|

|

| Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☒ |

| |

|

|

|

| |

|

|

|

Emerging growth company |

|

☐ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 7(a)(2)(B) of the Securities Act. ☐

The Registration Statement shall become effective upon filing in

accordance with Rule 462(d) promulgated under the Securities Act of 1933, as amended.

EXPLANATORY NOTE

This Post-Effective Amendment No. 1 (“Amendment

No. 1”) to the Registration Statement on Form S-1, as amended (File No. 333-278188), declared effective by the Securities

and Exchange Commission on May 15, 2024 (“Registration Statement”), is being filed solely for the purpose of replacing Exhibits

5.1 and 5.2 to the Registration Statement. This Amendment No. 1 does not modify any provision of Part I or Part II of the Registration

Statement other than Item 16(a) of Part II as set forth below.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

| Item 16. |

Exhibits and Financial Statement Schedules. |

(a) Exhibits

EXHIBIT INDEX

__________________

SIGNATURES

Pursuant to the requirements of the Securities Act, the Registrant

has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in San Diego, California,

on the 15th day of May, 2024.

| |

AETHLON MEDICAL, INC. |

|

|

| |

|

|

|

| |

By: |

/s/ JAMES B. FRAKES |

|

| |

|

James B. Frakes |

|

| |

|

Interim Chief Executive Officer |

|

| |

|

Chief Financial Officer |

|

| |

|

Chief Accounting Officer |

|

| |

|

|

|

|

Pursuant to the requirements of the Securities Act, this Registration

Statement has been signed by the following persons in the capacities and on the dates indicated.

| |

|

|

|

|

| Name |

|

Title |

|

Date |

| |

|

|

|

/s/ JAMES B. FRAKES

James B. Frakes |

|

Interim Chief Executive

Officer

Chief Financial Officer

Chief Accounting Officer

and Director |

|

May 15, 2024 |

| |

|

|

|

/s/ EDWARD G. BROENNIMAN*

Edward G. Broenniman |

|

Chairman and Director |

|

May 15, 2024 |

| |

|

|

|

/s/ NICOLAS GIKAKIS*

Nicolas Gikakis |

|

Director |

|

May 15, 2024 |

| |

|

|

|

/s/ ANGELA ROSSETTI*

Angela Rossetti |

|

Director |

|

May 15, 2024 |

| |

|

|

|

/s/ CHETAN S. SHAH*

Chetan S. Shah, M.D. |

|

Director |

|

May 15, 2024 |

| |

|

|

| * Pursuant to power of attorney |

|

|

| By: |

/s/ JAMES B. FRAKES |

|

| |

James B. Frakes |

|

| |

Attorney in fact |

|

Exhibit 5.1

|

Brownstein

Hyatt Farber Schreck, LLP

702.382.2101 main

100 North City Parkway, Suite 1600

Las Vegas, Nevada 89106

|

May 15, 2024

Aethlon Medical, Inc.

9635 Granite Ridge Drive, Suite 100

San Diego, California 92123

To the addressee set forth above:

We have acted as local Nevada counsel to Aethlon

Medical, Inc., a Nevada corporation (the “Company”), in connection with the filing by the Company of Post-Effective

Amendment No. 1 to the Registration Statement on Form S-1 (File No. 333-278188) (as so amended, and including the preliminary prospectus

contained therein, the “Registration Statement”) with the Securities and Exchange Commission (the “Commission”)

under the Securities Act of 1933, as amended (the “Act”), relating to the (i) offering and sale by the Company of (i)

up to 8,100,000 shares (the “Common Shares”) of the Company’s common stock, par value $0.001 per share (the “Common

Stock”); (ii) pre-funded warrants (the “Pre-Funded Warrants”) to purchase in the aggregate up to 8,100,000

shares of Common Stock (the “Pre-Funded Warrant Shares”); (iii) Class A Common Stock Purchase Warrants issued to the

Purchasers (the “Class A Purchaser Common Warrants”) to purchase in the aggregate up to 8,100,000 shares of Common

Stock (the “Class A Purchaser Common Warrant Shares”); (iv) Class B Common Stock Purchase Warrants issued to the Purchasers

(together with the Class A Purchaser Common Warrants, the “Purchaser Common Warrants”) to purchase in the aggregate

up to 8,100,000 shares of Common Stock (together with the Class A Purchaser Common Warrant Shares, the “Purchaser Common Warrant

Shares”); and (v) a common stock purchase warrant issued to the Placement Agent (the “Placement Agent Warrant”

and together with the Purchaser Common Warrants and the Pre-Funded Warrants, the “Warrants”) to purchase up to 324,000

shares of Common Stock (the “Placement Agent Warrant Shares” and together with the Pre-Funded Warrant Shares and Purchaser

Common Warrant Shares, the “Warrant Shares”), all pursuant to one or more securities purchase agreements (each, a “Purchase

Agreement”) to be entered into by and between the Company and each of the purchasers identified on the signature pages thereto

(collectively, the “Purchasers”), and a placement agent agreement to be entered into by and between Maxim Group LLC,

as the exclusive placement agent thereunder (in such capacity, the “Placement Agent”), and the Company. The Common

Shares and the Warrant Shares are hereinafter collectively referred to as the “Shares” and the Shares and the Warrants

are hereinafter collectively referred to as the “Securities”. This opinion letter is being delivered at your request

pursuant to the requirements of Item 601(b)(5) of Regulation S-K under the Act.

In our capacity as such counsel, we are familiar

with the proceedings taken and proposed to be taken by the Company in connection with the authorization, issuance and sale of the Securities

as contemplated by the Transaction Documents (as defined below) and as described in the Registration Statement. For purposes of this opinion

letter, and except to the extent set forth in the opinions below, we have assumed that all such proceedings have been or will be timely

completed in the manner presently proposed in the Transaction Documents and the Registration Statement (including, without limitation,

with respect to the assumed combined public offering price of the Securities as stated in the Registration Statement).

Aethlon Medical, Inc.

Page 2

For purposes of issuing this opinion letter, we

have made such legal and factual examinations and inquiries, including an examination of originals or copies certified or otherwise identified

to our satisfaction as being true copies of (i) the Registration Statement, (ii) the forms of the Purchase Agreement and each of the Warrants

filed as exhibits to the Registration Statement (collectively, the “Transaction Documents”); (iii) the articles of

incorporation and bylaws of the Company; and (iv) such agreements, instruments, resolutions of the board of directors of the Company and

committees thereof and other corporate records, and such other documents as we have deemed necessary or appropriate for the purpose of

issuing this opinion letter, and we have obtained from officers and other representatives and agents of the Company and from public officials,

and have relied upon, such certificates, representations and assurances, and public filings, as we have deemed necessary or appropriate.

Without limiting the generality of the foregoing, in our examination,

we have, with your permission, assumed without independent verification: (i) the statements of fact and all representations and warranties

set forth in the documents we have examined are, and when any Securities are issued will be, true and correct as to factual matters; (ii)

each natural person executing a document has, or at the time of such execution will have, sufficient legal capacity to do so; (iii) all

documents submitted to us as originals are authentic, the signatures on all documents that we have examined are genuine and all documents

submitted to us as certified, conformed, photostatic, facsimile or electronic copies conform to the original document; (iv) all corporate

records made available to us by the Company, and all public records we have reviewed, are accurate and complete; (v) the obligations of

each party set forth in the documents we have examined are, and when any Securities are issued will be, its valid and binding obligations,

enforceable against such party in accordance with their respective terms; (vi) each of the Transaction Documents will be duly authorized,

executed and delivered by each party thereto in substantially the form thereof filed as an exhibit to the Registration Statement prior

to the issuance by the Company of any of any of the Securities to be delivered thereunder; and (vii) after any issuance of Shares, the

total number of issued and outstanding shares of Common Stock, together with the total number of shares of Common Stock then reserved

for issuance or obligated to be issued by the Company pursuant to any agreement or arrangement or otherwise, will not exceed the total number of shares of Common Stock then authorized under the

Company’s articles of incorporation.

We are qualified to practice law in the State of

Nevada. The opinions set forth herein are expressly limited to and based exclusively on the general corporate laws of the State of Nevada,

and we do not purport to be experts on, or to express any opinion with respect to the applicability or effect of, the laws of any other

jurisdiction. We express no opinion concerning, and we assume no responsibility as to laws or judicial decisions related to, or any orders,

consents or other authorizations or approvals as may be required by, any federal laws, rules or regulations, including, without limitation,

any federal securities laws, rules or regulations, or any state securities or “blue sky” laws, rules or regulations.

Aethlon Medical, Inc.

Page 3

Based upon the foregoing, and in reliance thereon,

and having regard to legal considerations and other information that we deem relevant, we are of the opinion that:

1. The Warrants have been duly authorized by the Company.

2. The Common Shares have been duly authorized by the Company, and if, when and to the extent any Common Shares are issued and sold in accordance

with all applicable terms and conditions set forth in, and in the manner contemplated by, the relevant Transaction Documents, and as described

in the Registration Statement (including payment in full of any and all consideration required for such Common Shares), such Common Shares

will be validly issued, fully paid and nonassessable.

3. The Warrant Shares have been duly authorized by the Company, and if, when and to the extent any Warrant Shares are issued in accordance

with all applicable terms and conditions of, and in the manner contemplated by, the relevant Transaction Documents, and as described in

the Registration Statement (including due and proper exercise of the relevant Warrant(s) in accordance therewith and payment in full of

any and all consideration for such Warrant Shares as required thereunder), such Warrant Shares will be validly issued, fully paid and

nonassessable.

The opinions expressed herein are based upon the

applicable laws of the State of Nevada and the facts in existence on the date of this opinion letter. In delivering this opinion letter

to you, we disclaim any obligation to update or supplement the opinions set forth herein or to apprise you of any changes in any laws

or facts after such time as the Registration Statement is declared effective. No opinion is offered or implied as to any matter, and no

inference may be drawn, beyond the strict scope of the specific issues expressly addressed by the opinions set forth herein.

We hereby consent to the filing of this opinion

letter as an exhibit to Post-Effective Amendment No. 1 to the Registration Statement filed pursuant to Rule 462(d) under the Act and to

the reference to our firm in the Registration Statement under the heading “Legal Matters”. In giving this consent, we do not

admit that we are within the category of persons whose consent is required under Section 7 of the Act or the rules and regulations of

the Commission promulgated thereunder.

Very truly yours,

/s/ Brownstein Hyatt Farber Schreck, LLP

Exhibit 5.2

Julie M. Robinson

T: +1 858 550 6092

robinsonjm@cooley.com

May 15, 2024

Aethlon Medical, Inc.

1555 Sorrento Valley Road, Suite 203

San Diego, CA 92121

Ladies and Gentlemen:

We have acted as counsel to Aethlon Medical,

Inc., a Nevada corporation (the “Company”), in connection with the sale by the Company of (i) up to

8,100,000 shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”),

(ii) pre-funded warrants (the “Pre-Funded Warrants”) to purchase up to 8,100,000 shares of Common

Stock, (iii) Class A warrants to purchase up to 8,100,000 shares of Common Stock (the “Class A Purchase

Warrants”), (iv) Class B warrants to purchase up to 8,100,000 shares of Common Stock (the “Class B

Purchase Warrants”, and together with the Class A Purchase Warrants, the “Purchase

Warrants”), and (v) warrants (the “Placement Agent Warrants”) to purchase up to 324,000

shares of Common Stock, all pursuant to the Registration Statement on Form S-1 (File No. 333-278188) (the “Registration

Statement”) filed with the Securities and Exchange Commission (the “Commission”) under the

Securities Act of 1933, as amended (the “Securities Act”), the prospectus included in the Registration

Statement (the “Base Prospectus”) and the prospectus supplement relating to the Shares, the Warrants and

the Warrant Shares filed with the Commission pursuant to Rule 424(b) under the Securities Act (together with the Base Prospectus,

the “Prospectus”). The Pre-Funded Warrants, the Purchase Warrants, and the Placement Agent Warrants

are collectively referred to herein as the “Warrants”.

In connection with this opinion, we have examined

and relied upon the Registration Statement and the Prospectus, the forms of the Warrants, and such other records, documents, opinions,

certificates, memoranda and other instruments as in our judgment are necessary or appropriate to enable us to render the opinion expressed

below.

We have assumed the genuineness of all signatures,

the authenticity of all documents submitted to us as originals, the conformity to originals of all documents submitted to us as copies,

the accuracy, completeness and authenticity of the certificates of public officials and the due authorization, execution and delivery

of all documents by all persons, including the Company, where due authorization, execution and delivery are prerequisites to the effectiveness

thereof. As to certain factual matters, we have relied upon a certificate of an officer of the Company and have not independently verified

such matters.

Our opinion is expressed solely with respect to

the laws of the State of New York. Our opinion is based on these laws as in effect on the date hereof. We express no opinion to the extent

that any other laws are applicable to the subject matter hereof and no opinion and provide no assurance as to compliance with any federal

or state securities law, rule or regulation. We note that the Company is incorporated under the laws of the State of Nevada and that our

opinion is limited to the laws identified in the first sentence of this paragraph. We have assumed all matters determinable under the

laws of the State of Nevada, including the valid existence of the Company, the corporate power of the Company to execute, deliver and

perform its obligations under the Warrants and the due authorization of the Warrants by the Company. We have also assumed that the laws

of the State of Nevada would not impose any requirements or have any consequences relevant to our understanding of the matters addressed

in this opinion that would impact our conclusions with respect thereto.

May 15, 2024

Page Two

With regard to our opinion concerning the Warrants

constituting binding obligations of the Company:

(i) Our

opinion is subject to, and may be limited by, (a) applicable bankruptcy, reorganization, insolvency, moratorium, fraudulent conveyance,

debtor and creditor, and similar laws which relate to or affect creditors’ rights generally, and (b) general principles of

equity (including, without limitation, concepts of materiality, reasonableness, good faith and fair dealing) regardless of whether considered

in a proceeding in equity or at law.

(ii) Our

opinion is subject to the qualification that the availability of specific performance, an injunction or other equitable remedies is subject

to the discretion of the court before which the request is brought.

(iii) We

express no opinion as to any provision of the Warrants that: (a) provides for liquidated damages, buy-in damages, monetary penalties,

prepayment or make-whole payments or other economic remedies to the extent such provisions may constitute unlawful penalties, (b) relates

to advance waivers of claims, defenses, rights granted by law, or notice, opportunity for hearing, evidentiary requirements, statutes

of limitations, trial by jury, or procedural rights, (c) restricts non-written modifications and waivers, (d) provides for the

payment of legal and other professional fees where such payment is contrary to law or public policy, (e) relates to exclusivity,

election or accumulation of rights or remedies, (f) authorizes or validates conclusive or discretionary determinations, or (g) provides

that provisions of the Warrants are severable to the extent an essential part of the agreed exchange is determined to be invalid and unenforceable.

(iv) We

express no opinion as to whether a state court outside of the State of New York or a federal court of the United States would give effect

to the choice of New York law provided for in the Warrants.

On the basis of the foregoing, and in reliance

thereon, we are of the opinion that the Warrants, when duly executed and delivered against payment therefor as provided in the Registration

Statement and the Prospectus, will constitute binding obligations of the Company.

This opinion is limited to the matters expressly

set forth in this letter, and no opinion has been or should be implied, or may be inferred, beyond the matters expressly stated. This

opinion speaks only as to law and facts in effect or existing as of the date hereof and we have no obligation or responsibility to update

or supplement this letter to reflect any facts or circumstances that may hereafter come to our attention or any changes in law that may

hereafter occur.

We consent to the reference to our firm under

the heading “Legal Matters” in the Prospectus and to the filing of this opinion with the Commission as an exhibit to amendment

to the Registration Statement filed pursuant to Rule 462(d) under the Securities Act of 1933, as amended. In giving such consent, we do

not thereby admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act or the rules

and regulations of the Commission thereunder.

Very truly yours,

Cooley LLP

By: /s/ Julie M. Robinson

Julie M. Robinson

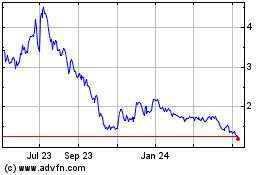

Aethlon Medical (NASDAQ:AEMD)

Historical Stock Chart

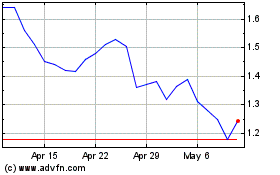

From Nov 2024 to Dec 2024

Aethlon Medical (NASDAQ:AEMD)

Historical Stock Chart

From Dec 2023 to Dec 2024